SINGAPORE: The Inland Revenue Authority of Singapore (IRAS) collected S$53.5 billion in tax revenue in financial year (FY) 2019/20, up 2.1 per cent from the previous year.

The sum makes up 72 per cent of the Government’s operating revenue and 10.5 per cent of Singapore’s gross domestic product, said IRAS in its annual report released on Friday (Oct 16).

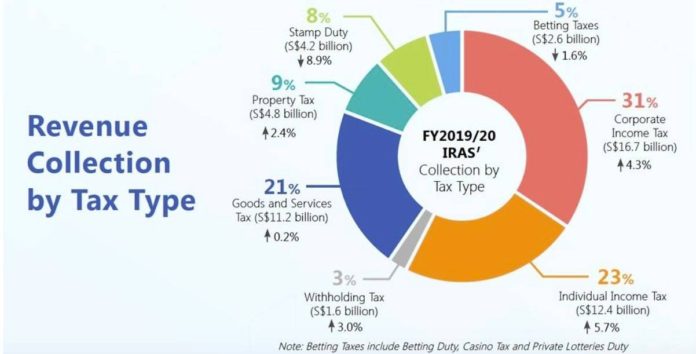

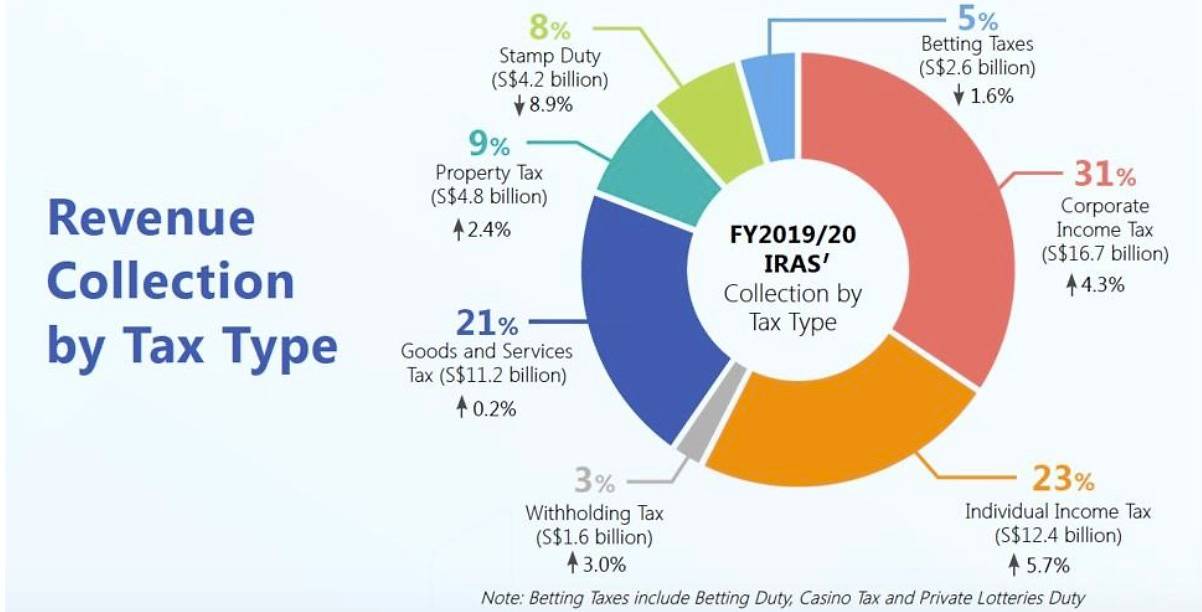

A breakdown of Singapore tax revenue for FY2019/20. (Graphic: IRAS)

Total income taxes – comprising corporate income tax, individual income tax and withholding tax – made up more than half (57 per cent) of the total collection. The S$30.8 billion collected in FY19/20 was 4.8 per cent more than total income taxes from the previous year.

Goods and Services Tax (GST) collection for FY2019/20 increased “marginally” by 0.2 per cent to S$11.2 billion. GST accounted for 21 per cent of total tax collection.

READ: Consumption taxes such as GST necessary to reduce burden on workers in ageing population: Indranee

While property tax collection went up, stamp duty collection fell almost 9 per cent. IRAS attributed this to a decrease in the number of property transactions.

“The cost of tax collection was kept low under one cent, at 0.78 cents for every dollar collected,” said IRAS.

“Tax arrears rate remained low at 0.79 per cent. Current year arrears for Income Tax, GST and Property Tax fell to S$357 million, from S$373 million in FY2018/19.”

SUPPORT DURING COVID-19 PANDEMIC

IRAS said it continues to support the Government in its administration of assistance schemes – the Wage Credit Scheme, Jobs Support Scheme, Government Cash Grant and Jobs Growth Incentive. Through these schemes, S$18 billion in grants have been disbursed so far this year.

These grants “help businesses and Singaporeans tide through this period of economic uncertainty caused by COVID-19,” said IRAS.

DIGITAL SERVICES

In its report, the tax authority also drew attention to an increasing use of digital services to “make taxpaying more seamless and hassle-free”.

IRAS said for last year’s tax assessment, around 1,600 taxi and private car hire drivers used a chat filing scheme involving Q&A forms with “conversational language”, as well as interactive chatbots.

“The conversational approach of chat filing helps to simplify e-Filing process for the less digitally-inclined taxpayers … (it) mimics the experience of having an officer guide them through their filing,” said IRAS.

“70 per cent of the sample users surveyed found tax filing with the chatbot more intuitive, and reported that they spent 60 per cent less time filing their returns.”

IRAS also highlighted several other initiatives to simplify tax filing: An interactive property tax bill (i-Bill), touted as an “upgrade” from the current e-Bill, as well as simpler tax filing process for companies, a result of an IRAS collaboration with the Accounting and Corporate Regulatory Authority and several accounting software providers.

Around 200,000 companies are expected to benefit from this initiative, said IRAS.

Moving forward, most paper notices and letters will be digitised by default, IRAS added. This will take place from May next year.

“IRAS is pursuing digital transformation with vigour, driven by our goals to provide taxpayers with excellent service and to improve tax compliance,” said Mr Ng Wai Choong, CEO and Commissioner of Inland Revenue.