For most of us, the Central Provident Fund (CPF) scheme is an essential component of our financial planning for our golden years.

Over the years, enhancements have been made to the scheme to enable us to boost our retirement savings as well as improve the flexibility of withdrawals and the timing of payouts.

Efforts have also been made to encourage CPF members to make top-ups – with cash and/or CPF savings – to their CPF accounts and those of their loved ones to boost their retirement savings.

Top-ups provide a means to enjoy some tax relief while enabling these CPF members or their loved ones to benefit from the compounding effect of the CPF’s interest rates so as to grow their nest eggs.

It is heartening to note that this practice is on an uptrend.

In terms of the number of top-ups – excluding self top-ups from OA to SA – they have risen 15 per cent from 2014 and have nearly doubled from the 2012 figure.

Self top-ups from OA to SA are also trending north with 26,300 top-ups worth $289.1 million last year compared with 23,400 top-ups ($257.7 million) in 2014 and 17,100 top-ups ($156 million) in 2012.

RETIREMENT SUM TOPPING-UP SCHEME

This scheme allows you to build your retirement savings by topping up your own CPF accounts or those of anyone including your loved ones. You can opt to top up your own or your loved ones’ Special Accounts (below age 55) or Retirement Accounts (RA) for those aged 55 and above.

Top up your own or loved ones’ account

You can make a cash top-up to anyone.

In total, you may enjoy tax relief of up to $14,000 per calendar year if you make top-ups for:• •Your parents, parents-in-law, grandparents, grandparents- in-law, spouse or siblings, if their income does not exceed $4,000 in the year preceding the year of top-up or if they are handicapped. • •Yourself (or your employer makes a cash top-up for you).

However, you can enjoy tax relief for cash top-ups to your own or your recipient’s RA only up to the current Full Retirement Sum (FRS) which is $161,000 for those who turned 55 from July 1 last year. Cash top-ups beyond the current FRS will not be eligible for tax relief.

Your employer will receive an equal amount of tax deduction.

Enhanced Retirement Sum (ERS)

On Jan 1, several enhancements kicked in, including an additional retirement sum option – ERS of $241,500 – aimed at boosting our nest egg so we can enjoy more retirement income in our golden years.

Recipients aged 55 and above can receive cash top-ups or CPF transfers to their RA up to the current ERS, which is three times the Basic Retirement Sum (BRS) of $80,500.

Mr Johnny Chua, 57, was among those who topped up their RA to get higher payouts in the future. In January, CPF members made 1,700 top-ups worth $80 million to their RAs to boost their retirement savings beyond the FRS.

During that month, Mr Chua made a one-time cash top-up of about $90,000 beyond his FRS for his cohort to make up the amount to the ERS. “The lower level of payouts would not be enough based on my needs. So it is great that the CPF Board introduced the ERS which allows me to receive higher payouts later,” he said. Mr Chua plans to supplement his retirement income with rent from his investment property.

Previously, the maximum amount members could set aside was the FRS, allowing estimated monthly payouts of $1,220 to $1,320 from the age of 65.

The current ERS of $241,500 translates to estimated monthly payouts of $1,770 to $1,920 from 65.

However, do note that tax relief will be given for cash top-ups to your own or recipient’s RA only up to the current FRS. This means that cash top-ups beyond your own or recipient’s current FRS will not be eligible for tax relief.

And depending on your financial situation, you may wish to defer your payouts from your eligibility age up to 70 years old and enjoy 6 per cent to 7 per cent more in monthly payouts for each year deferred.

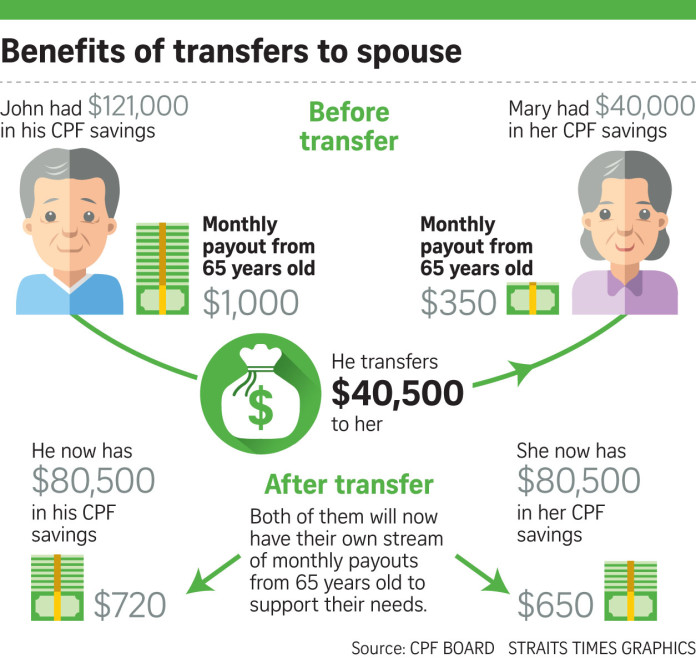

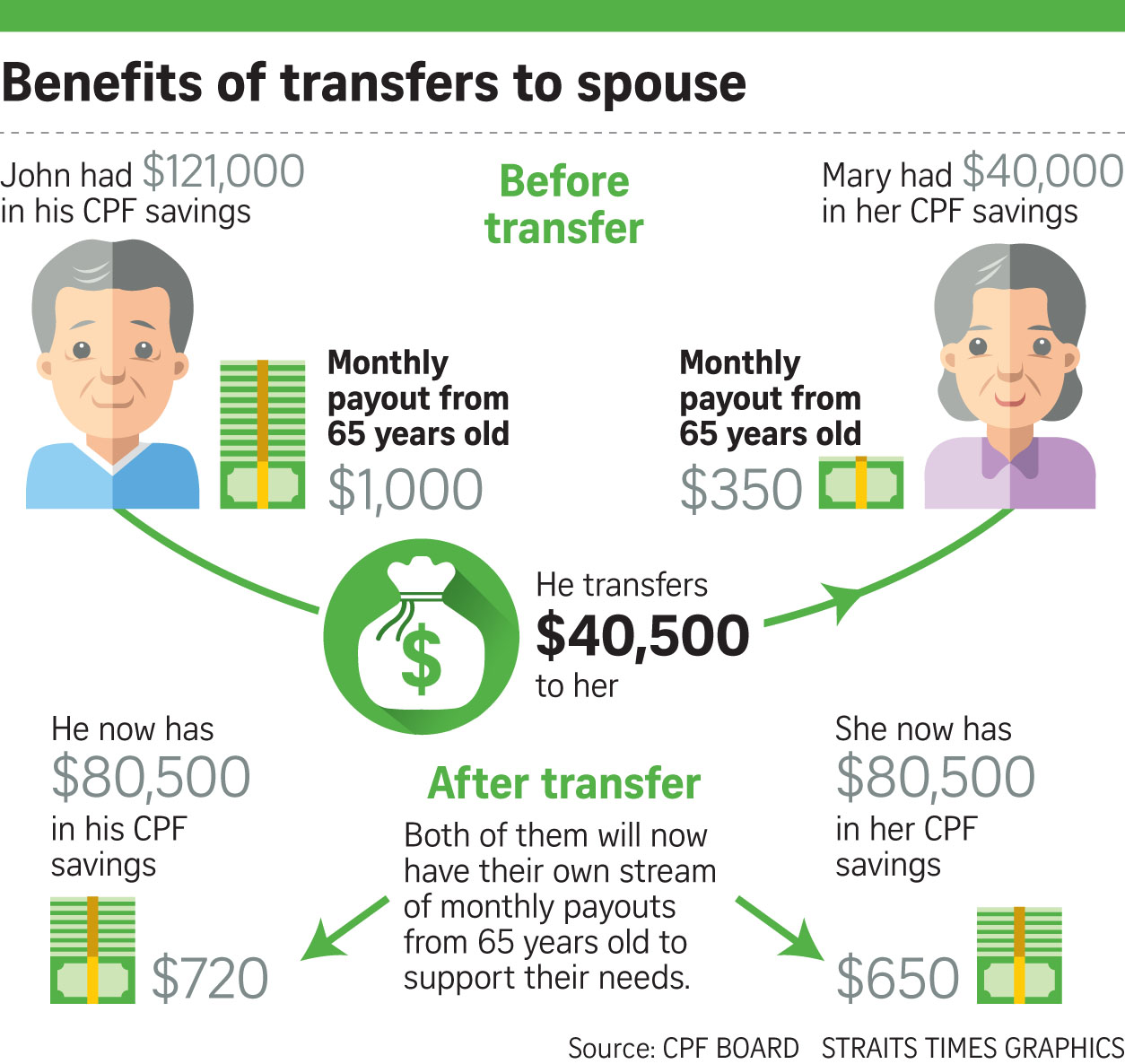

Top up your spouse’s account using CPF or cash

This will benefit non-working spouses who have made sacrifices to stop work for their families, and have low CPF balances.

Before the changes on Jan 1, only CPF savings above your FRS could be transferred to your spouse.

There is now a lower threshold so members can transfer their net CPF money after setting aside the BRS in their own CPF accounts to top up their spouse’s CPF account up to the ERS.

Both will benefit from the extra interest that will be paid in the respective accounts and there is peace of mind as the spouse will have her or his own source of retirement payouts.

For cash top-ups, you can top up any amount up to the ERS.

According to the CPF Board, there were more than 400 transfers of CPF savings to spouses in January, around 21/2 times that of the corresponding month last year. About 20 of the spousal transfers were made possible only after the scheme was changed.

For housewife Margaret Tan, 59, having her RA topped up every year by her hubby Richard Tan, 53, gives her peace of mind. The couple have two sons, aged 26 and 24, and she had left the workforce after her first child was born.

Mr Tan, in the police force, started the annual cash top-ups of $7,000 for his wife two years ago on their 25th wedding anniversary. He also tops up her RA on an ad hoc basis when he has surplus cash.

Mrs Tan has about $80,000 in her RA and her hubby wants her CPF to eventually reach an amount of about $161,000 when she is 65.

“It’s my anniversary present every year now. He used to give me roses and chocolates. Richard said we should plan ahead…We must think of our old age and have our own money. Then the two of us can go for holidays, sit on the beach and sip coconut juice while listening to music,” said Mrs Tan.

She can look forward to receiving $808 to $857 monthly from the CPF when she hits 65 and starts receiving the payouts.

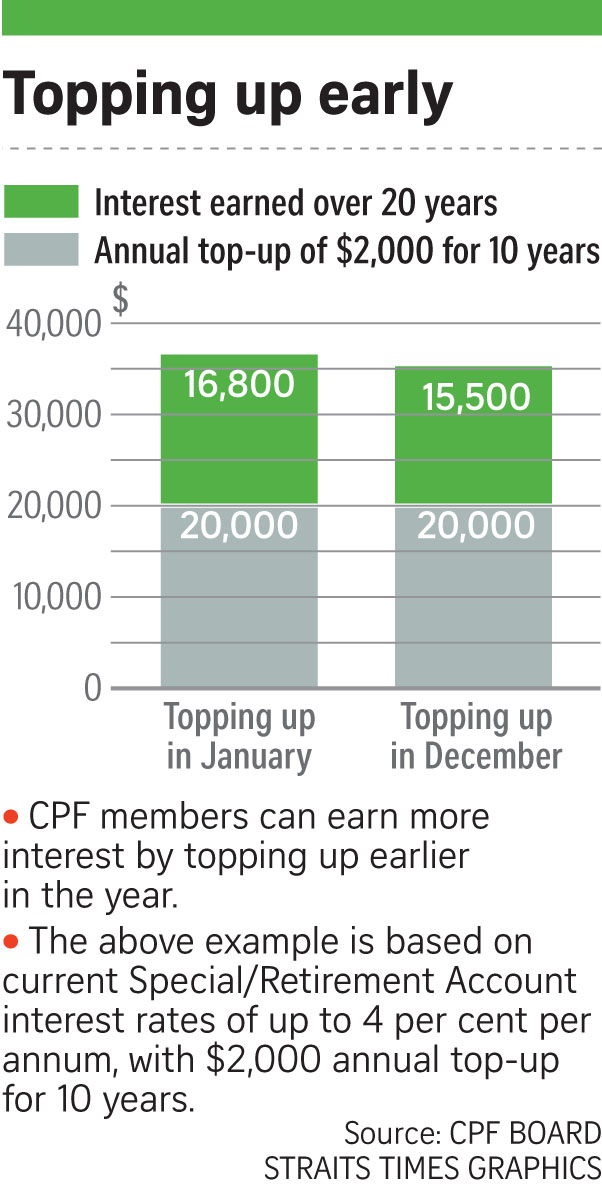

TOPPING UP EARLY CPF

members can earn more interest by topping up earlier in the year. So don’t procrastinate and wait till the end of the year to do a top-up.

From Jan 1, you stand to earn more interest on your CPF savings, depending on your age.

Members over age 55 are getting an additional 1 per cent interest on the first $30,000 of their CPF savings, making a significant 6 per cent interest a year.

This is on top of the 1 per cent extra interest on the first $60,000 in CPF combined balances – of which $20,000 comes from your Ordinary Account – which everyone enjoys. CPF savings in the SA and RA currently earn guaranteed interest rates of 4 per cent a year.

GIRO TOP-UP

are encouraged to make regular monthly and/or yearly top-ups to your own or loved ones’ CPF accounts through Giro, which can be monthly and/or yearly arrangements.

This makes it convenient for members to do top-ups on a regular basis to benefit from the Retirement Sum Topping-Up Scheme, without the hassle of having to complete forms or make cheque payments.

INVESTING CPF MONIES

Mr Justin Chua, senior vice-president of investment products at DBS Bank, advised that while CPF monies can be invested in certain instruments to make them work harder, the individual needs to consider the risk-return trade-off.

This is because investing in higher-risk investments requires a longer timeframe to exhibit long-term growth and these returns are not guaranteed. In addition, the CPF member may potentially suffer capital losses in adverse market situations such as during the global financial crisis from 2008 to 2009.

Subject to specific limits, CPF monies can be invested in financial instruments like shares, unit trusts, government and statutory board bonds, endowment and investment-linked insurance policies, exchange-traded funds and gold.

“The individual will need to consider his risk tolerance, investment time horizon and current financial situation before deciding on an appropriate investment tool. Diversification into various asset classes and markets would be an appropriate strategy to potentially assist the individual in achieving an overall targeted return,” said Mr Chua.

Some financial experts advise that for CPF accounts that earn at least a risk-free interest rate of 4 per cent a year, it is better to leave them alone.

Still, CPF members who want higher returns can also look forward to a low-cost, simple-to-understand alternative investment scheme for their retirement savings, which should be announced in the first half of this year.

This article was first published on March 13, 2016.

Get a copy of The Straits Times or go to straitstimes.com for more stories.