SINGAPORE: Almost 350 pages long, the latest Household Expenditure Survey was chock-a-block with mind-numbing statistics.

One set of data, however, caught the eye: On average, the bottom 20 per cent of households are each spending S$2,570 a month while having a monthly income of S$2,235, which include regular government transfers such as Workfare. This means a shortfall of S$335 on average each month.

This was the only income group whose income was lower than their expenditure, according to the survey conducted by the Department of Statistics (SINGSTAT) from October 2017 to September last year. Nevertheless, such a situation has persisted for at least the past decade.

The average monthly shortfall for this group was S$266 in 2012/2013, and S$321 in 2007/2008, based on Singstat’s data.

To help these households cope, government transfers including ad hoc ones, as well as rebates or subsidies, are disbursed to the families and individuals.

In response to queries, the Ministry of Social and Family Development (MSF) noted that a number of households in the bottom 20 per cent “may be semi-retired households who are able to tap on other sources of income” – for example, savings, allowances from children, and Central Provident Fund payouts – for their household expenses.

The Ministry added that in its Household Income Trends report last year, SINGSTAT noted that about 45 per cent of resident employed households in the bottom decile were headed by persons aged 60 years and above, while some owned a car, employed a maid, or lived in private property.

Be that as it may, Members of Parliament (MPs), sociologists as well as social service agencies stressed the need to pay attention to the situation – notwithstanding the fact that an array of assistance schemes are provided by the Government and the community.

Expenditures of lower-income households outpacing their incomes is a sign that their well-being is being compromised, said Associate Professor Teo You Yenn, head of sociology at the Nanyang Technological University.

“People generally adjust spending to expected income, meaning that people with lower income already forgo spending that higher-income people consider basic needs, including educational needs such as tuition, nutritious food, healthcare, and leisure and social activities important for overall well-being,” said Assoc Prof Teo.

Observers and experts noted that it remains a challenge for the Government and the community to reach out to low-income households who may be unaware of the available schemes or unwilling to seek help. There is also scope to help these individuals and families manage their limited finances, they added.

READ: Commentary: Want to fight inequality? How about paying higher taxes first?

A one-room rental flat of a low-income family in Singapore. (Photo: TODAY / Ooi Boon Keong)

Interviews with several low-income households found that their main expenses vary according to individual and family circumstances. For example, those with young children find themselves spending a chunk of their income on basic necessities such as diapers and formula milk.

Couples who are childless or who are receiving no financial support from their children find themselves having to cope with medical bills, for instance. These may not necessarily be one-off large expenditures for a medical procedure for example, but the little things add up: Every trip to the polyclinic or general practitioner for relatively minor ailments means money spent on transport and medicine, and a loss of income for the next few days if they are too ill to work.

Then, there are also the indulgences which households with better means hardly think twice about spending money on: For some, it could be simply buying a fish – a luxury for some of these families – to cook at home, as one 72-year-old retiree said. For others, it could be buying cigarettes or beer.

Apart from turning to government handouts, some resort to borrowing from friends and relatives – and end up in a spiral of debt.

Jurong Group Representation Constituency (GRC) MP Rahayu Mahzam noted the difficulties faced by individuals mired in long-standing debts. Help in this area is limited for now since Social Service Offices (SSOs) – run by the MSF – cannot help to repay loans, said Ms Rahayu, who is also the deputy chairperson of the Government Parliamentary Committee (GPC) for Social and Family Development.

While there is no immediate solution, the Government will look into these problems to see how they can be better addressed, she added.

READ: Commentary: A wake-up call, when a disadvantaged child gets 8 out of 100 for an exam

FINANCES OF LOW-INCOME HOUSEHOLDS

Among those interviewed was Madam Rosmah (not her real name), 63.

She and her husband have children from previous marriages, but they do not get financial support from them.

After a heart bypass in late June forced her husband to stop work as a cleaner for half a year, Mdm Rosmah, who works as a cleaner as well, has become the sole breadwinner.

She takes home S$700 a month, but this is easily outstripped by the couple’s monthly spending of about S$1,000. The bulk of their money is spent on groceries (about S$420), with the rest going to electricity and conservancy charges (about S$120), medical expenses (about S$100), transport (about S$100), rent (S$33), and prepaid phone cards (S$18).

She also uses part of her salary to repay money owed to some friends and neighbours – while continuing to borrow from others. Sometimes, when their finances run dry towards the end of the month, the couple would cook less or eat with their neighbours.

Unable to keep up with their bills, the couple had water supply to their one-room rental flat in Jalan Kukoh cut more than three years ago.

“Little water runs through the taps (now). We have to put pails and bottles under our taps to collect the water to shower and drink,” she said from the couple’s one-room rental flat in Bukit Merah estate.

Mdm Rosmah had approached MSF’s Social Service Office in June, and received one-time ComCare assistance to tide over the initial period where Mdm Rosmah had to stop working to look after her husband. It consisted of cash, as well as help with their rent, utilities and service and conservancy charges.

A medical social worker also helped with her husband’s medical expenses. The Islamic Religious Council of Singapore also provided cash assistance to the couple. The MSF said it is reviewing the couple’s situation to see if they require further help.

For low-income households which have young dependents, they have different concerns including setting aside enough money for their offspring.

Operations manager Nizam Ibrahim, 41, said he would sometimes eat instant noodles throughout the week, so he can provide for his wife and his one-month-old infant.

“We don’t go out at all: No holidays, no eating out. It has been this way for a year, since I got married,” he said.

To supplement his wage, he works part-time as a driver with ride-hailing firm Grab. In total, he takes home S$2,500 a month. But like the other families interviewed, Mr Nizam said his income is not enough to cover his expenses which come up to about S$2,650 each month. Part of the reason is that he is servicing a S$40,000 loan, which he took out to refurbish his house from a previous marriage. He pays off S$1,000 in debts every month.

To stretch his dollar, he travels across the Causeway every week to stock up on supplies, which are cheaper in Johor Bahru. “Diapers cost S$15 a pack and milk costs S$20 in Malaysia, which are so much cheaper than in Singapore,” he said.

Asked if he had tried seeking financial assistance, he said that he can still manage for the time being. His neighbours had suggested to him to go to speak with his MP, but he said: “I don’t intend to do that, not now. Now still okay.”

Likewise, Mdm V M, who declined to give her full name, is finding it a challenge to make ends meet.

The 48-year-old divorcee works as a hospital attendant. Her take-home pay is S$1,120 a month, and she has two more mouths to feed apart from herself: Her daughter – a single mother who is looking for work – and her granddaughter.

She said her monthly expenses total about S$1,200 a month. She spends about S$500 on groceries (including more than S$330 on diapers and formula milk), S$200 on transport and S$150 on water bills.

She also pays rent for her one-room Jalan Kukoh flat (S$111), and medical (S$100) and electricity expenses (S$100). Her granddaughter’s nursery programme is subsidised and she pays just S$10 a month for it.

The monthly financial assistance from ComCare has helped alleviate her situation by providing cash and help with rent, utilities and service and conservancy charges. She also receives Medifund assistance for her medical bills.

Still, her household is months behind on conservancy and rental bills, she said. To try and save money, she is training her granddaughter to use a potty, which will obviate the need for diapers.

On its part, the Government has sought to ease the general expenses for families with young children, apart from targeted schemes to help low-income familiies, said the MPs who were interviewed.

Nee Soon GRC MP Louis Ng reiterated that it has become more affordable for families to raise children over the years.

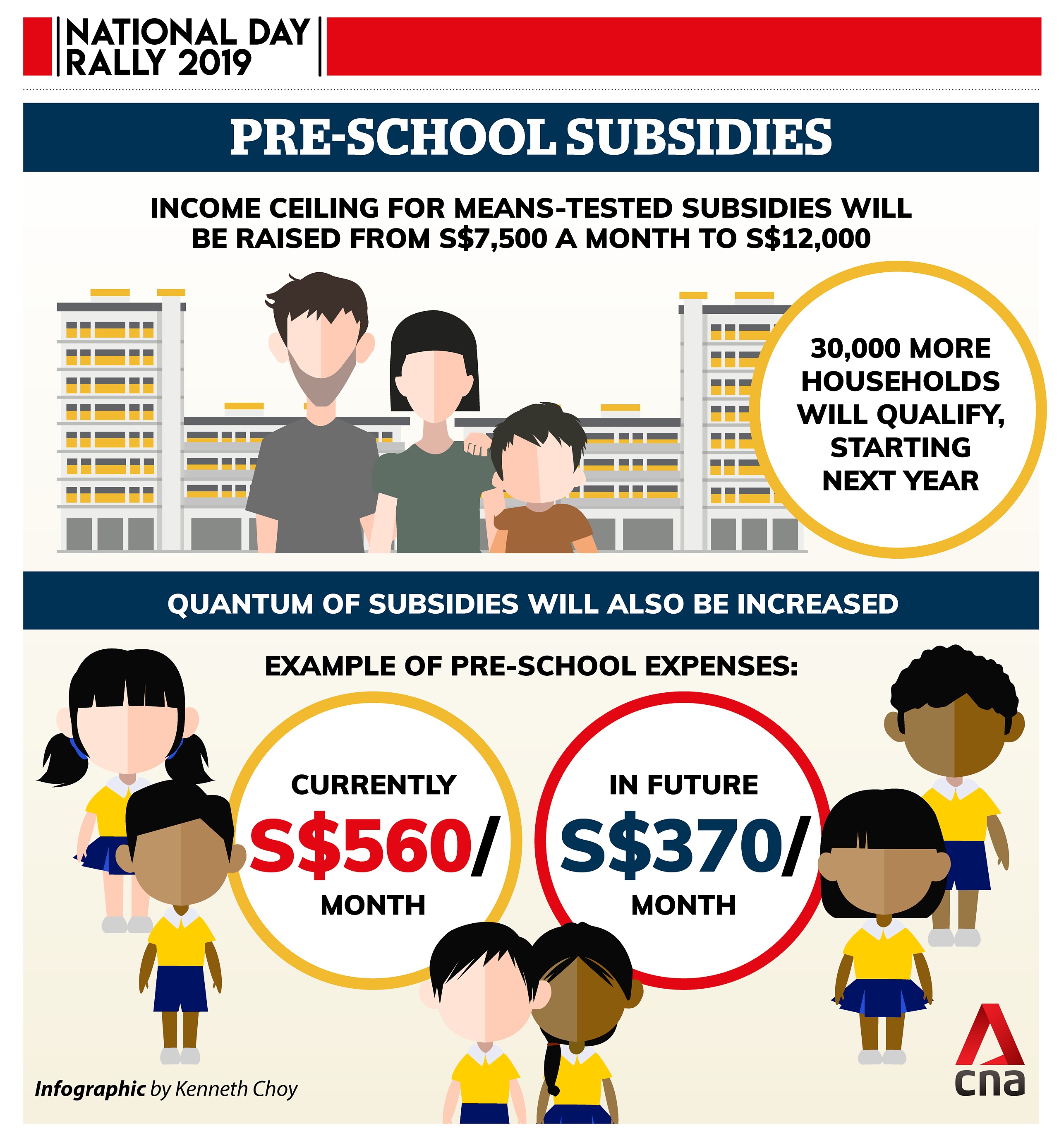

He cited Prime Minister Lee Hsien Loong’s announcement at the recent National Day Rally that the Government would beef up subsidies to soothe concerns over the cost of preschool education.

READ: NDR 2019: From retirement age to climate change, here are 9 things you need to know

READ: NDR 2019: More pre-school subsidies as Singapore set to spend more on early childhood education

These include doubling spending on early-childhood education, from about S$1 billion today, and raising the income ceiling for households to qualify for extra subsidies.

“I always feel that the financial side of things are resolved – those who really need it will get it. That’s my experience on the ground,” Mr Ng said.

Agreeing, Marine Parade GRC MP Seah Kian Peng cited the example of milk powder, which has also become more affordable. Today, a can of milk powder can cost under S$30 and there is a wider range of options compared with two years ago, he said.

But he acknowledged that making the financially prudent choice is not always easy as parents want to be able to give their children “little luxuries”.

Parents need to be better educated on how to make informed purchases so that they can stretch their dollar, he said.

Apart from providing for their children, healthcare cost is a major concern for some low-income households, especially for singles and couples who do not have children or whose children are not able to support them financially.

While the array of government schemes help families defray their medical expenses, the attendant costs such as paying for transport to see the doctor and the loss of income are also considerable.

In the case of Mdm Rosmah, her husband’s surgery was covered by government subsidies . For the first few weeks after he was discharged from hospital, she was absent from work on some days because she had to look after him. She lost about S$40 in wages each day she missed her shift.

“It was very hard on me,” she said. She added that she resorted to borrowing small sums from friends and neighbours to get by. Her husband’s condition improved early last month and she has since returned to work fully.

On healthcare costs, Jalan Besar GRC MP Lily Neo, deputy chairperson of the GPC for health, pointed out that there are many Government schemes to help families cover these expenses, but families needing help must step forward.

“Affordability-wise, I think Singapore is pretty good in terms of healthcare. The 3M system – Medisave, MediShield and MediFund – is pretty comprehensive to ensure that no one is deprived of healthcare due to a lack of means,” she said.

But Dr Neo acknowledged that some families may be unaware of the schemes. “For families who face this problem, the best is for them to visit the SSO or their grassroots advisers. Sometimes, we do not know that they are facing certain issues, and if they come forward, we can explain the schemes to them,” she added.

Apart from the day-to-day expenses, some low-income individuals or families invariably find themselves spending money on guilty pleasures or even vices.

Freelance dishwasher Rajasheker Narayanasamy, 58, said he spends almost S$1,500 on alcohol and cigarettes each month. This is two-thirds of his S$2,000 wage, which fluctuates because a problematic knee cap leaves him unable to work at times.

“I drink so that I can go to sleep at night. Otherwise, the pains in my body will cause me to lose sleep,” said Mr Narayanasamy, who received ComCare assistance in 2015 when he was looking for a job. According to the MSF, the SSO recently reached out to him to review his case and see if he requires help.

GOVT & COMMUNITY HELP AVAILABLE

Among other things, the Household Expenditure Survey also found that the proportions of low-income households and those living in one- and two-room public flats who have creature comforts – namely air-conditioners and Internet subscriptions – have increased significantly compared with five years ago.

For example, among households living in one- and two-room public flats, 45 per cent of them have access to the Internet in 2017/18, compared with 22 per cent in 2012/13. And 25 per cent of this group now have air-conditioners, compared with 14 per cent five years ago. And this reflects a higher standard of living and lifestyle changes, among other things, said Singstat.

Among the nine low-income households interviewed, one has an air-conditioner at home but the individual said he rarely turns it on as his electricity bill was already too high. None of them had broadband Internet subscriptions at home, and few subscribed to a mobile data plan.

In response to queries, an MSF spokesperson said the Government reviews schemes for low-income families regularly to ensure that their coverage and criteria are responsive to the needs of beneficiaries.

For instance, the ministry regularly reviews ComCare, which provides aid to low-income families, taking into account changes in the prices of essential items and the changing lifestyles of Singaporean families.

“For example, telecommunications items such as broadband access and mobile subscriptions are recognised as essential needs and are factored into the ComCare assistance provided,” the spokesperson added.

The MSF recently improved its ComCare Long-Term Assistance scheme, which offers help to individuals who are permanently out of work and require support for their daily expenses.

From Jul 1, the monthly cash assistance for single-person households rose from S$500 to S$600. The cash-assistance rates are higher for larger households, the ministry said.

The MSF also has a ComCare Short-to-Medium Term Assistance scheme, which provides financial support to those who are temporarily out of work, between jobs or receive low wages.

While there are income caps to qualify for support, MSF noted that the SSOs are allowed flexibility if they find that a household who earns above the cap needs help.

For example, the SSOs may refer those who are looking for jobs or earning low wages to government agency Workforce Singapore or the labour movement’s Employment and Employability Institute for help, MSF said.

The MSF, which has a network of 24 SSOs in every Housing and Development Board estate, also partners other agencies and organisations to bolster support for low-income families.

While government assistance can help families stay afloat, it is also up to the community to step in to fill the gaps. Community resources, MSF said, are an added layer of support for low-income households. These include organisations that provide low-income families with meals and food vouchers, courses to upgrade their skills, and medical and mental-health services.

The public, too, can play its part. Those who come across individuals or families who need help should approach the nearest social service office or call the ComCare hotline, the ministry added.

Ms Rahayu reiterated that many constituencies have schemes to help their residents. “Very often, local communities can help to deal with specific issues, such as families not being able to afford food, diapers and milk powder,” she said.

Mr Ong Ai Wah, 56, for example, has turned to a host of agencies – including the SSO and non-governmental organisations – for money, canned food and other necessities, such as clean mattresses.

Since 2017, he has been receiving monthly ComCare assistance in the form of cash, and help with rent, and service and conservancy charges. He also receives Medifund assistance for his medical bills.

He said that he receives about S$500 a month from the SSO, and also borrows money from friends to make ends meet.

Mr Ong is unemployed and lives in a one-room rental flat at Jalan Kukoh. The divorcee has three children aged 17 to 24 . He gives his youngest son about S$20 as pocket money each month. In total, he spends an average of S$600 a month on groceries, food and transport.

His oldest son sells insurance part-time, while his daughter is estranged. He said that his children occasionally live with him but they do not support him financially.

Mr Ong Ai Wah, who is unemployed, said landing a job is impossible because of his failing health. (Photo: TODAY / Kimberly Lim)

Mr Ong added that he has been unable to find a job because of his failing health. Living with mental illness and lung cancer, and having suffered a heart attack this year, the former part-time plumber and electrical technician makes regular trips to the hospital.

Meanwhile, charities and self-help groups said they have also stepped up support or widen their services to cater to shifting needs.

For example, the Chinese Development Assistance Council (CDAC) will relax its income-eligibility criteria to allow more people to benefit from its programmes.

With effect from January, it will raise its monthly household-income cap from S$1,900 to S$2,400, and its per-capita income ceiling from S$650 to S$800.

Similarly, the Singapore Indian Development Association (SINDA) also said that it launched a slew of initiatives and revised subsidy-eligibility criteria across all its programmes last year.

Its initiatives include educational programmes, parenting workshops and counselling services. Under the revised criteria, participants from families with a per-capita income of S$1,000 and below will have their fees waived. Those from families with a per-capita income of $1,001 and above will pay a one-off “commitment fee” of S$10 for every programme.

For those who do not qualify for its help schemes, SINDA has the Beacon Fund which offers emergency and interim assistance – such as with funeral expenses for an unexpected death in the family – as well as help with household, mobility and information-technology matters.

GETTING OUT OF THE POVERTY TRAP

While helping families to alleviate their daily struggles was important, Ms Rahayu said the goal should be to help them rise above their situation.

“We can help them for a while with their immediate needs, but they also have to review what they spend on and try to upskill, so that they can get a better income,” she said.

A spokesperson from North West Community Development Council (CDC) said that they work with various partners to provide students from low-income families with financial literacy skills and knowledge through various programmes.

An example of this is the POSB Matched Savings Programme which is open to primary school students who either receive financial assistance from the Ministry of Education or who are beneficiaries of the School Pocket Money Fund.

The programme supports the students and their parents in learning the importance of cultivating good saving habits and equips them with money management skills.

Mr Seah noted that financial literacy could go a long way towards helping low-income families manage their finances better.

“Every dollar saved means a lot more to someone from a lower-income family than a middle-income family. We have to find ways to help them save where the money is there for the taking,” he added.

However, for some families, the barrier between making the first step towards being more financially capable is not a lack of desire but a lack of information.

Ms Tan Ying Jie, who oversees capacity and partnerships at charity organisation Daughters of Tomorrow (DOT) said that in her experience, women from low-income households are already making use of what is available to them to best provide for their families. However, they struggle because they lack the information and resources to make better financial choices.

In October last year, DOT partnered with women’s charity organisation Aidha to run a financial literacy programme for low-income women. The programme was offered to existing beneficiaries who have employment or a source of income in addition to receiving financial assistance from the Government.

Over the course of six months, nine women, who were aged 20 to 45, were introduced to different strategies on how they can better manage their finances. As part of the curriculum, participants were also given a notebook where they were asked to track their expenses.

At the end of the programme, the women were able to collectively save about S$4,000. This meant that each participant had saved about S$30 to S$100 dollars a month, Ms Tan said.

During the feedback session, the participants also reflected that the programme has helped them to be more aware of their spending habits and they will work towards being more cautious in the future.

READ: Commentary: The unequal, unnoticed life of a female worker

Some of them were also interested in what they can do to further grow their money now that they have achieved some financial stability, and so an expansion of the curriculum is currently being explored, she said.

Aidha chief executive officer Jacqueline Loh said that the programme will run again in September and plans are afoot to conduct another session in November.

However, not all low-income individuals or families see the benefits of such programmes.

Mr Ong, who has attended budgeting classes suggested by his social worker, said he did not find them helpful. He said: “Whenever I fall sick and I have to travel to see the doctor, I have to spend money. These things are out of my control. How do I save the money when there’s already not enough to spend?”

“SERIOUS IMPLICATIONS”

While providing holistic support for low-income households requires massive efforts and resources from the Government and the community, experts said there are serious implications if this group of Singaporeans perpetually struggle to make ends meet on their own.

Assoc Prof Teo said that this trend would imply that these families are unable to save, and this has negative long-term effects in old age. It also puts stable households at risk of a crisis when there is illness, accident, job loss or a child with special needs, she said.

Dr Mathew Mathews, a senior research fellow at the Institute of Policy Studies, said that while low-income households can avail themselves of subsidies, family circumstances may render these ineffective.

“While (government subsidies) are substantial measures, the cost of living in Singapore is high,” he said.

He added: “Some families will have greater challenges, depending on the types of issues they have to deal with, such as chronic illnesses. While there might be subsidies for healthcare, there might be many out-of-pocket expenses that can be rather substantial.”

Sociologist Tan Ern Ser of the National University of Singapore cautioned that if left unchecked, the situation could likely result in these families being entrenched in poverty.

These households should be supported in finding employment, and the Government and charity sector have a part to play, he said. “It’s not just about money, but about finding employment and helping the children in terms of educational support,” he added.