SINGAPORE: All retail investors who subscribed to Temasek Holdings’ first public bond offer will get all or a proportion of the bonds they applied for, the Singapore state investment firm announced on Wednesday (Oct 24).

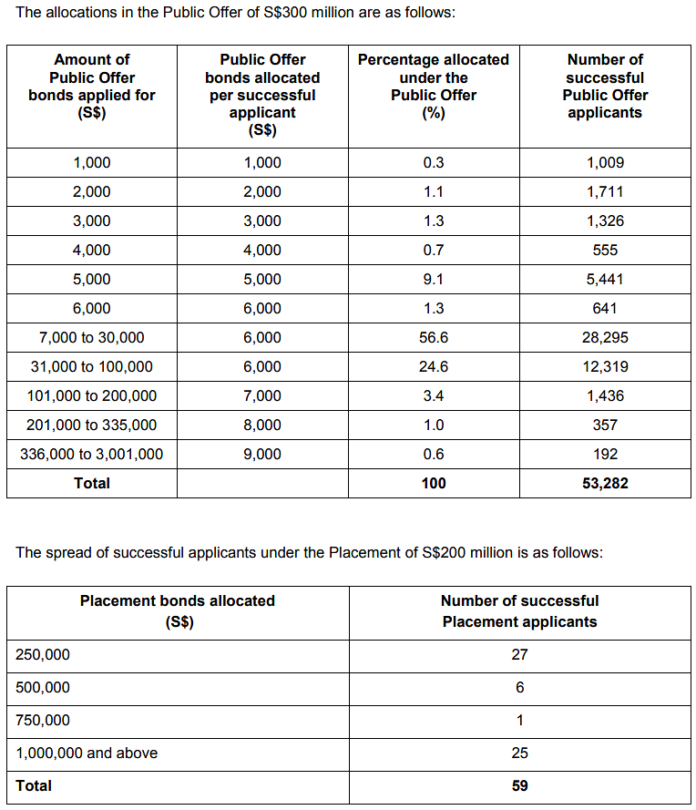

Those who applied for up to S$6,000 of bonds stand to receive their full application, while those who applied for amounts above S$6,000 will get between S$6,000 and S$9,000.

More than 80 per cent of the issued bonds will go to investors who applied for between S$7,000 to S$100,000 of bonds. They will each be allocated S$6,000.

(Source: Temasek Holdings)

Due to strong demand that saw retail investors submitting valid applications of around S$1.68 billion for S$200 million worth of bonds, Temasek exercised the option to upsize the issue size to S$300 million, an increase of S$100 million.

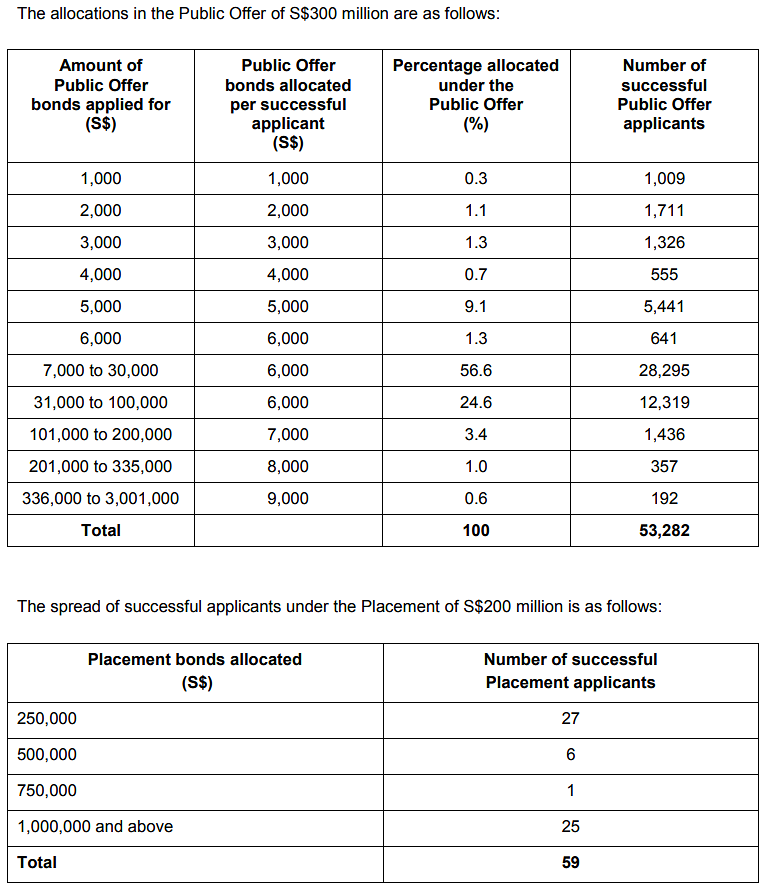

Interest among institutional investors was similarly robust, with more than seven times the offered amount or about S$1.4 billion in bids received.

READ: Temasek’s first public bond offer more than 8 times subscribed

The five-year notes, which will mature on Oct 25, 2023, offer a guaranteed fixed interest rate of 2.7 per cent. The interest will be paid at the end of every six months.

Chief financial officer Leong Wai Leng thanked all applicants for their support for the bond issue, saying: “We appreciate the confidence they have all shown in us. The demand for both the public offer and the placement was robust, amounting in aggregate to about S$3 billion.”

READ: Temasek launches first retail bonds with 2.7% interest rate

Temasek welcomed, in particular, members of the public who applied for its inaugural public offer, Ms Leong said.

“We very much welcome our first retail investors as a new set of stakeholders for Temasek.”

READ: What are some of the least risky investments? Here’s a guide

Issued under the firm’s wholly owned subsidiary Temasek Financial (IV), the T2023-S$ Temasek Bond is expected to trade on the Singapore Exchange on Friday.

Invalid applications and those who did not receive the full allocation for their applied amount will have their application amounts or the balance refunded without interest, credited to their bank account, Temasek said in its statement.