Investors sold down shares of Singtel, StarHub and M1 yesterday after the nation’s fourth telco operator was announced.

All three incumbents took a hit as investors fretted over their earnings outlook given the arrival of the new kid on the block.

TPG Telecom was named late on Wednesday as the winner of the spectrum rights bid, ending months of speculation.

The rights will start on April 1 next year, and TPG Telecom – an Australian firm – is required to roll out nationwide 4G coverage in the 18 months after that.

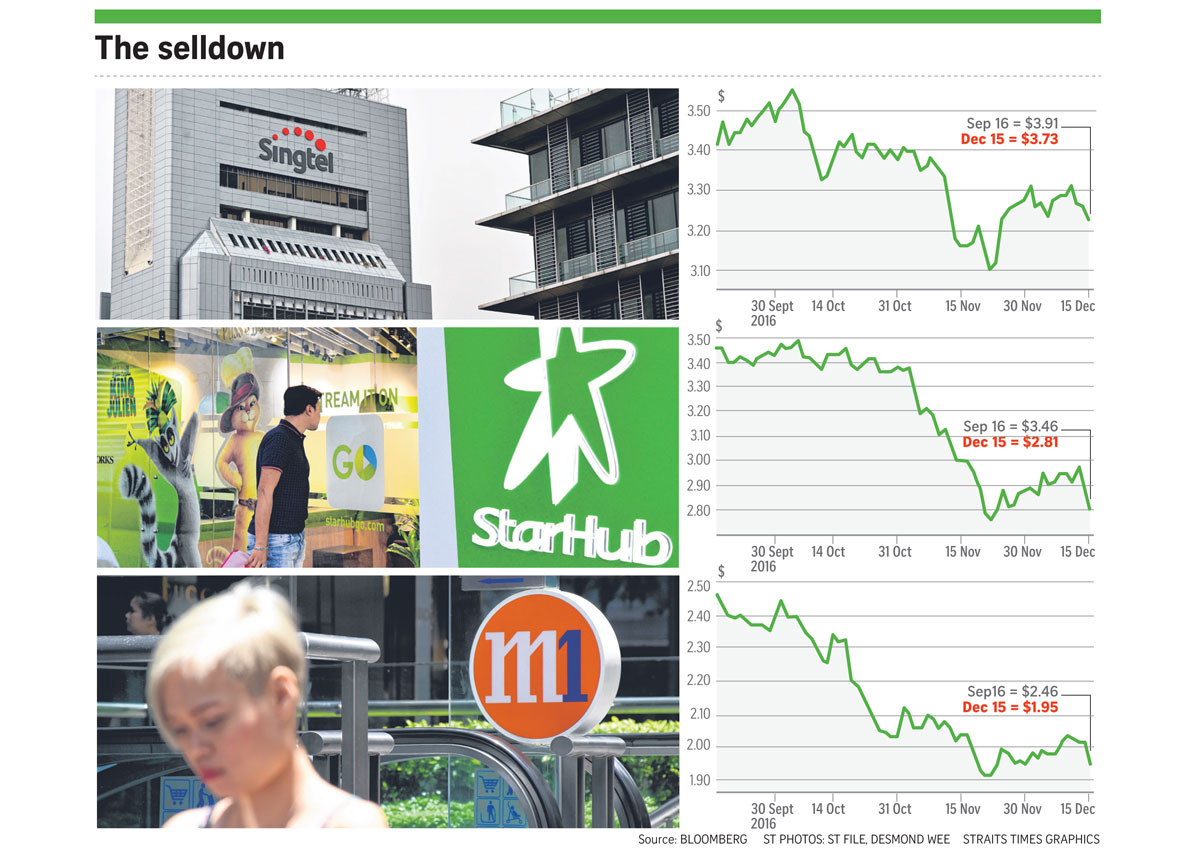

The market clearly did not like the news. Singtel shares were least affected, paring 0.8 per cent to $3.73 but StarHub slid 3.1 per cent to $2.81 and M1 sank 3.47 per cent to $1.95.

These reactions reflected concerns around earnings weakness and loss of market share among the incumbent players, in a market that already has a mobile penetration rate of around 150 per cent.

DBS analyst Sachin Mittal expects TPG Telecom to gain some 8.5 per cent of mobile revenue share by 2022, while overall revenue share can hit as high as 10 per cent of the market over the same period.

“We project StarHub’s earnings to contract by 25 per cent and M1 by 41 per cent in financial year 2022 versus 2015, due to higher revenue share loss,” Mr Mittal said in a note yesterday.

As a result, DBS believes StarHub and M1 shares are fully valued – its target price is $2.65 for StarHub and $1.78 for M1.

Singtel will also be vulnerable, but market watchers believe the industry leader is best placed to weather the challenges from the new entrant.

“We expect Singtel’s earnings to stay resilient due to limited Singapore mobile business exposure and dominant position with enough scale to help mitigate new entrant impact,” OCBC analyst Eugene Chua said in a report last week.

Only around a quarter of Singtel’s earnings before interest, tax, depreciation and amortisation was from Singapore, compared with the 100 per cent exposure to Singapore that StarHub and M1 have.

These factors are important as investors need to adopt a more selective approach to the telco stocks, long seen as stable yield plays around which a portfolio is built.

“In the past, given the defensive business of telcos, we would recommend investors to pick up telco stocks during such pullbacks. That, however, has changed. With the impending fourth telco entry, those with high Singapore exposure are no longer as defensive as they used to be,” Mr Chua noted.

OCBC has thus given Singtel a fair value of $4.27 with a buy call. StarHub has a fair value of $3.05 while M1’s is at $2.08 – both with a hold rating.

whwong@sph.com.sg

TPG founder a ‘reclusive billionaire’

A reclusive billionaire. That is how most people tend to regard telecommunications tycoon David Teoh, the man behind Singapore’s newly assigned fourth telco TPG Telecom.

According to Forbes, Mr Teoh, TPG chairman and chief executive, has a net worth of US$1.58 billion (S$2.27 billion).

He is ranked 854th on Forbes’ 2016 billionaires list and ninth on its Australia’s 50 Richest list.

Born in Malaysia, he moved to Australia in 1986, and is an Australian citizen living in Sydney.

Mr Teoh, 60, is TPG’s largest shareholder, with a 34.37 per cent stake. His Taiwan-born wife Vicky Teoh, with whom he has four children, helped start the company but is no longer involved.

Little else is known about the low-profile businessman, who avoided having his photo taken by outsiders until a photographer staked out his Sydney home for three days last year, said Forbes.

But partners in the industry have praised him as a self-made and successful businessman.

Mr Kevin Russell, a former chief executive at Singtel’s Australian unit Optus, told The Australian Financial Review in a report last year: “David Teoh deserves more respect than anyone in the telco sector because he built the business.

“He hasn’t been appointed into a CEO role of a well-established company. He has built an organisation and created massive value for his shareholders in the process through smart business dealings.”

TPG was founded in 1986 as Total Peripherals Group, a company that sold computers.

Following a reverse takeover by SP Telemedia in 2008, the combined entity was renamed TPG Telecom. The company is listed in Australia.

The firm has since embarked on a series of aggressive acquisitions, with the latest being the A$1.56 billion (S$1.66 billion) takeover of iiNet, an Australian Internet service provider.

TPG had 1.87 million broadband subscribers in Australia as at July 31 – ahead of Optus’ 1.11 million broadband subscribers as at the end of September.

The firm’s market capitalisation stands at A$6.02 billion, going by Bloomberg data.

Mr Russell, who resigned from his role at Optus in 2014, went on in the report to describe Mr Teoh as “very hands-on and very strategic”.

“I personally don’t think there’s another executive in the sector who can claim to have done what he has built and delivered as (an) individual.”

TPG has more than 6,000 staff across its operations globally, including Australia, South Africa, New Zealand and the Philippines.

tsjwoo@sph.com.sg

This article was first published on Dec 16, 2016.

Get a copy of The Straits Times or go to straitstimes.com for more stories.