Around 1.5 million policyholders can expect to face premium hikes for health insurance once the moratorium on freezing Integrated Shield Plan (IP) premiums ends on Oct 31.

The Straits Times understands that the average premium increase will be between 9 and 15 per cent but the hikes are expected to impact only certain IPs, particularly those covering private hospitals.

This is because the number and dollar amount of claims made at private hospitals have shot up compared with those at public hospitals.

About 2.5 million Singapore residents have IPs. An estimated 60 per cent of them have policies covering stays in private hospitals, while the rest have plans that cover class A and class B1 wards in public hospitals. So about 1.5 million Singapore residents may be affected by the premium hikes.

The Life Insurance Association (LIA) said the average IP claim incidence rate has been growing at approximately 9 per cent a year.

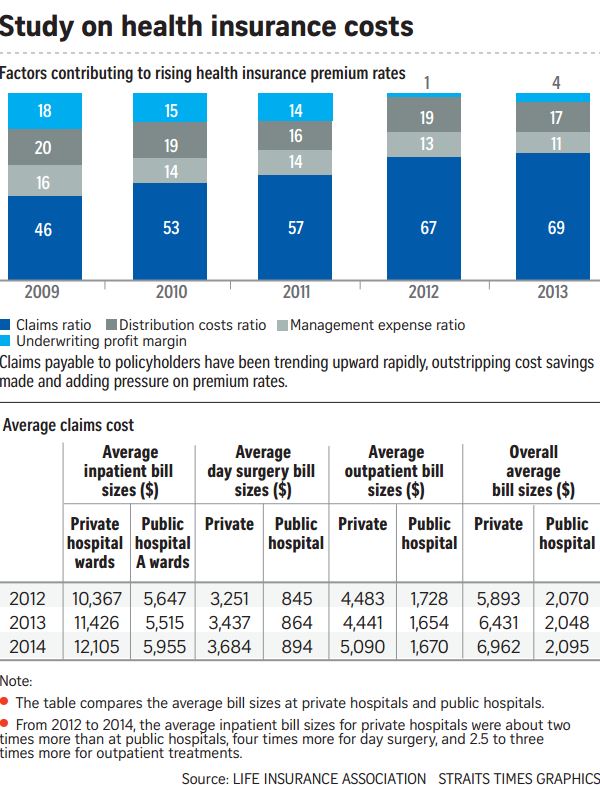

It noted that the overall average bill incurred by IP insurers increased by 8.7 per cent for private hospitals each year from 2012 to 2014 compared with just 0.6 per cent for public hospitals.

During the same period, the average inpatient bill for private hospitals was almost double that for public hospitals and four times more than recorded at day surgeries.

The LIA statistics also showed that IP insurers paid out claims amounting to $488 million in 2014 alone.

Healthcare is expected to be the biggest cost in retirement and many people have ranked this as their top concern.

The LIA told The Straits Times yesterday: “We recognise that the current rate of escalating claim costs in Singapore is not sustainable and that when it comes to IPs, premiums would need to correspondingly be increased to keep up with the claim amounts for IP insurers to continue offering these policies.”

It has been reported that two IP insurers have been making only marginal profits, with three racking up losses on such policies.

In May, French insurer AXA Life joined the IP market here as the sixth provider.

The LIA also noted while MediShield Life has led to some savings for IP insurers, these will be offset within one to two years by more – and costlier – claims being lodged.

The association released some recommendations yesterday, such as the pre-approval of medical treatment, to address the issue of escalating claim costs for IPs.

NTUC Income said it is reviewing its entire IncomeShield portfolio.

“At this point, we plan to increase the premiums of some plans in 2017. However, we are still working out the details, including the level of increase,” it said.

IP rider premiums are excluded from the one-year moratorium. So far, at least two insurers – Income and Prudential – have increased their IP rider premiums.

This article was first published on Oct 14, 2016.

Get a copy of The Straits Times or go to straitstimes.com for more stories.