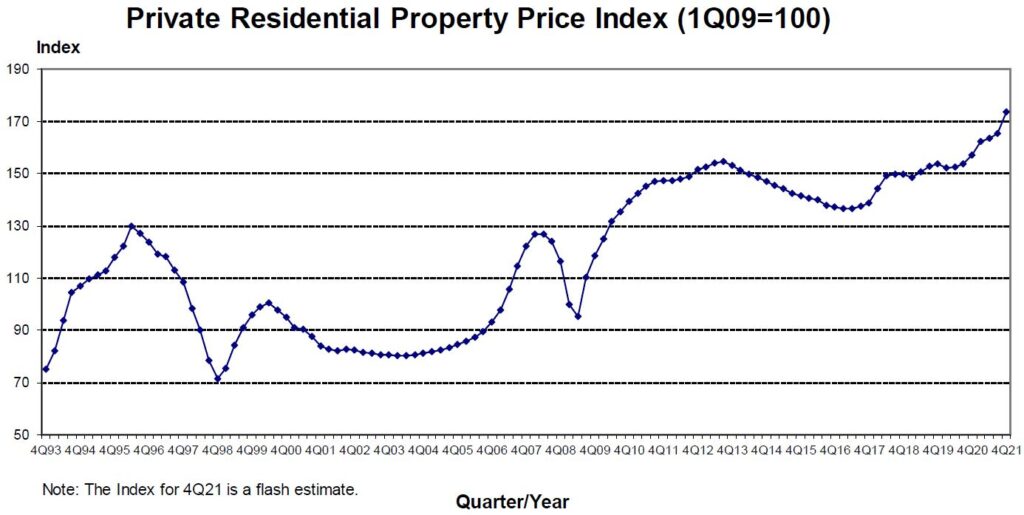

Singapore: According to preliminary estimates from the Urban Redevelopment Authority (URA) on Monday (January 3), private residential prices in Singapore rose by 10.6% in 2021, up from 2.2% in the previous year.

Ms. Christine Sun, senior vice president of research and analysis at OrangeTee and Tie, said that this was the highest annual growth rate since 2010, when private residential prices rose by 17.6%.

Overall, the private residential property index for the fourth quarter of 2021 rose by 8.3 points from the third quarter to 173.6 points.

The URA stated: “Compared with 1.1% in the previous quarter, this means an increase of 5%.”

Ms. Sun said that this was also the highest quarterly increase since the second quarter of 2010, when prices rose by 5.3%.

Private non-landed housing in the rest of the central region (RCR) drove the rise, with prices rising by 7.3% in the fourth quarter, compared with 2.6% in the previous quarter.

The price of non-landed private homes in the Core Central Region (CCR) rose by 2.5%, reversing the 0.5% decline in the previous quarter.

In the Outer Central Region (OCR), prices in the fourth quarter rose by 5.4%, while prices fell by 0.1% in the third quarter.

In 2021, the prices of CCR, RCR, and OCR will increase by 3.7%, 16.9% and 8.4% respectively.

Singapore launched a package of measures on December 16 last year to cool the real estate market. They include a higher additional buyer’s stamp duty (ABSD) rate and a stricter total debt service ratio (TDSR).

Lee Sze Teck, senior research director at Huttons Asia, said that its impact “may not be felt” in the 2021 full-year data.

Partly because of the holidays, the market may be calmer in the last two weeks of December, and also because first-time home buyers account for about 80% of current market transactions.

Mr. Li said that the reduction in the number of new homes launched in 2022 will lead to a decrease in sales of new homes by approximately 8,000 to 9,000 units, and the price may increase by 3% due to rising construction costs.

Ohmyhome research and content analyst Mohan Sandrasegeran said that the number of houses sold in the fourth quarter decreased, but the value of transactions increased, driving up prices in various sales departments.

He said that as developers may reconsider the launch date and readjust the pricing, the demand for new sales in the first half of 2022 may be weakened.

He expects that the overall growth of private residential prices will slow down, hovering around 1% to 2% in the first half of the year.

Eugene Lim, the chief executive officer of ERA, said that with the real estate cooling measures, the private real estate market will become a “real home buyer’s market.”

“For motivated sellers, it makes sense to pursue this group with realistic pricing,” he added.

Ms. Sun said that after the implementation of cooling measures, the price of private housing may stabilize, and compared with the previous year, the rate of increase may be much slower, between 0% and 3%.

The preliminary estimate is based on the transaction price given in the submitted contract for payment of stamp duty and the data on the units sold by the developer as of mid-December. The URA stated that this is before the implementation of the latest round of cooling measures.

The statistics will be updated on January 28, when the URA will release a full set of real estate data for the fourth quarter of 2021.

“Past data indicates that when the changes are small, the difference between the quarterly price changes shown by the flash estimates and the actual price changes may be large. The public is advised to interpret flash estimates with caution,” the authorities said.