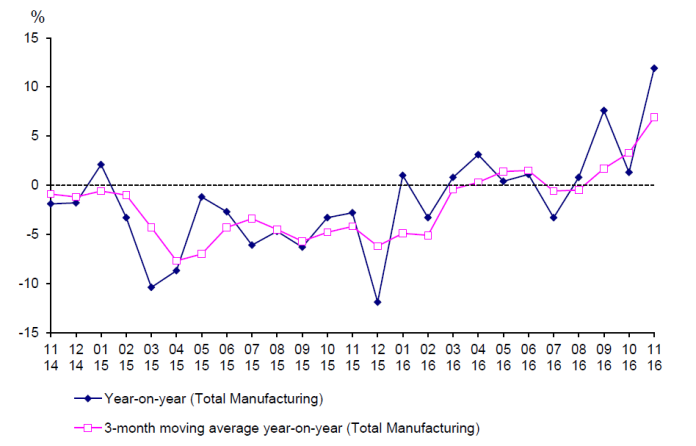

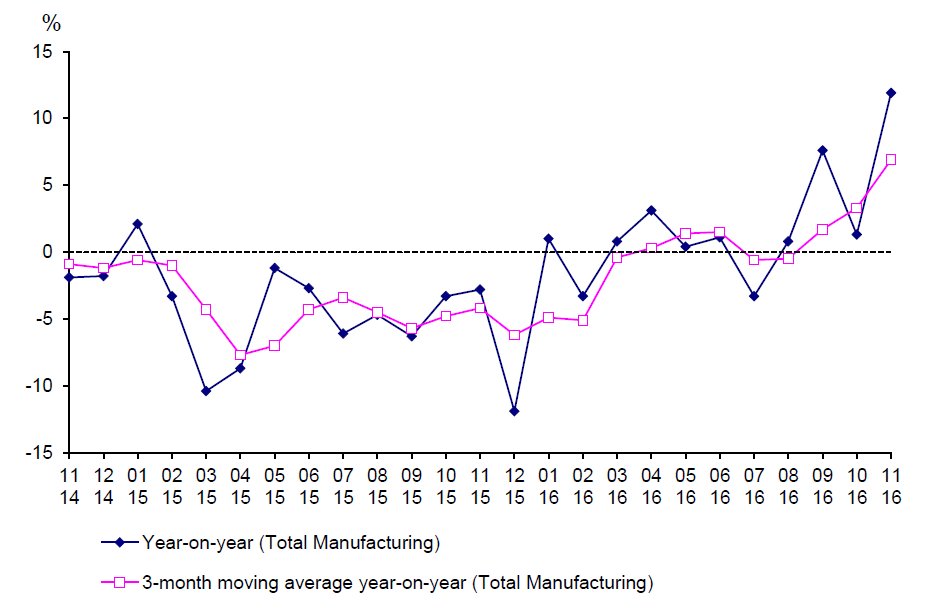

SINGAPORE: Industrial production in Singapore in November expanded at its fastest annual pace since March 2014, buoyed by strong electronics and pharmaceuticals output, data showed on Friday (Dec 23).

Manufacturing output in November jumped 11.9 per cent from a year earlier, data from the Singapore Economic Development Board (EDB) showed. The median forecast in a Reuters survey predicted a 1.6 per cent expansion.

Excluding biomedical manufacturing, output grew 6.4 per cent.

On a month-on-month and seasonally-adjusted basis, industrial production rose 6.1 per cent in November, its strongest since January this year. The median forecast was for a contraction of 2.0 per cent. Excluding biomedical manufacturing, output grew 5.1 per cent month-on-month.

STRONG ELECTRONICS AND PHARMACEUTICALS OUTPUT

Output of the biomedical manufacturing cluster grew 34.8 per cent in November, compared to the same month last year, while the pharmaceuticals segment expanded 36.1 per cent. The growth was mainly due to a different mix of active pharmaceutical ingredients and biological products produced, said EDB. The medical technology segment also posted a growth of 30.8 per cent, with high export demand for medical instruments, it added.

Meanwhile, the electronics cluster’s output increased 24.2 per cent in November on a year-on-year basis. According to EDB, growth in the cluster was largely attributed to the semiconductors segment, which grew 49.6 per cent.

Output of the precision engineering cluster grew 7.6 per cent, compared to a year ago. The machinery and systems segment grew 10 per cent as export demand for semiconductor-related equipment increased, while the precision modules and components segment recorded higher output of industrial rubber and dies, moulds, tools, jigs and fixtures.

The chemicals cluster’s output rose 3.5 per cent, led by the petroleum segment which grew 22 per cent due to the low base effect last year as some plants shut down for maintenance, EDB said.

General manufacturing industries’ output declined 0.9 per cent year-on-year, mainly attributed to the miscellaneous industries and printing segments which contracted 4.5 per cent and 16.2 per cent respectively.

The transport engineer cluster’s output shrank the most, contracting 14.8 per cent compared to the same month last year. The land transport segment grew 12.2 per cent, but this was offset by declines in the aerospace and marine and offshore engineering segments. Meanwhile, the marine and offshore engineering segment remained weak as the low oil price environment continued to affect rig building activities and demand for oilfield and gasfield equipment.