SINGAPORE: A single QR code that is compatible with multiple e-payment solutions has been rolled out on Monday (Sep 17), marking the latest step in Singapore’s push towards cashless payments.

Dubbed the first of its kind globally, the Singapore Quick Response Code (SGQR) is an “infrastructure-light technology” that will help to simplify QR e-payments in Singapore for both consumers and merchants, said the Monetary Authority of Singapore (MAS) and Infocomm Media Development Authority (IMDA) in a joint media release.

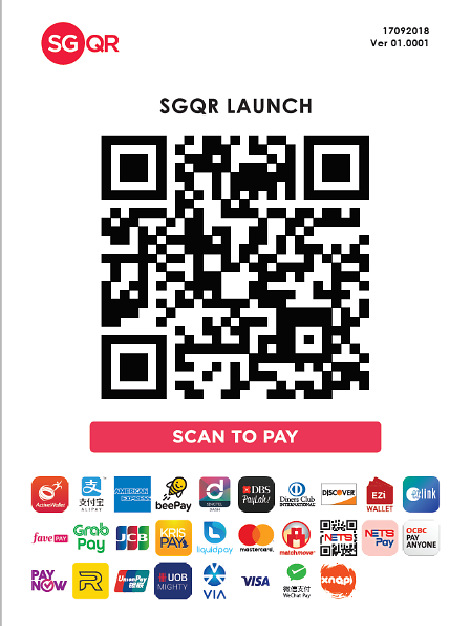

The SGQR will be used in 27 payment schemes, including PayNow, NETS, GrabPay, DBS PayLah and Singtel DASH.

Currently, multiple QR code stickers may be displayed at one store to support various e-payment schemes, which can be confusing for consumers. With the roll-out of the SGQR, there will only be one QR code sticker that shows all QR payment options that the merchant accepts.

“Consumers will be able to quickly and easily see if their preferred QR payment option appears on the merchant’s SGQR label,” said MAS and IMDA in their press release.

To make payment, customers will have to log in to the apps of their preferred payment schemes, scan the SGQR code and key in the payment amount.

A symbolic SGQR label with various QR payment options. (Photo: MAS/IMDA)

Describing SGQR payments as “simple, swift and safe”, MAS and IMDA said: “Simplicity and speed of e-payments were identified by MAS as one of the critical challenges impeding adoption of e-payment options in Singapore. As QR payments could be an e-wallet or funded by a credit or debit cards, consumers retain the flexibility in choosing how to fund their QR payments.”

For merchants, the display of one QR code sticker will mean “less clutter” and “quicker payments by consumers”, the joint statement said.

The SGQR will be deployed over the next six months, with the first phase set to include more than 1,000 merchants in the Central Business District.

About 19,000 QR codes will be replaced with the SGQR labels from end-September. The replacement exercise is expected to complete by the end of this year.

The SGQR comes after the set-up of an industry task force last August to look at developing a common QR code for the fragmented e-payment landscape in Singapore. Co-led by the MAS and the IMDA, the task force consists of members from payment schemes, issuers, acquirers, banks and relevant government agencies.

NOT DONE BUILDING THE E-PAYMENT INFRASTRUCTURE

Speaking at the launch, Education Minister Ong Ye Kung, who is also a MAS board member, also touched on other initiatives that he described “as the last few jigsaw pieces” to complete the national e-payment infrastructure.

For one thing, regulations for payments have to be “transparent, easily understood and give sufficient peace of mind to all parties”, he said.

“We have taken some time to build up an open, accessible and inter-operable e-payments infrastructure which fosters competition, innovation and enhances consumer experience,” said the minister.

“SGQR is our latest feature, and we are developing the next piece in the national e-payments infrastructure through broader access to e-wallet players.

“But consumers will only use e-payments when they feel safe,” Mr Ong added.

One of the initiatives is a set of user protection guidelines, to be released at the end of this month. The guidelines, among other things, will aim to apportion liability for unauthorised transactions between financial institutions and users.

For instance, where the unauthorised transaction is caused by the financial institution, it will bear the entire loss.

For unauthorised transactions caused by a third party and below S$1,000, financial institutions will similarly bear the loss.

Where the transaction is above S$1,000, the financial institution will have to investigate the case further and decide on a case-by-case basis.

“This is because transactions above S$1,000 require additional authentication and it is very unlikely that the user will be unaware of it, unless he did not take due care of his account,” said Mr Ong.

Mr Ong also announced plans to form a DIRECT FAST industry working group to help develop business and technical requirements for non-banks to connect directly to FAST, a transfer service launched in 2014 which enables customers of several banks here to transfer funds almost instantly.

Apart from the operator of FAST, banks and MAS, other players like Grab, Liquid Group, MatchMove and Razer and TransferWise have also signed up for the working group.

“If we want the e-payment system in Singapore to be truly open, accessible and competitive, we will have to open up FAST to other non-bank e-wallet payment solutions so that they can interoperate with bank accounts,” said Mr Ong, while adding that this is already underway in the UK and India where non-banks have been allowed access to central payment infrastructure to encourage competition.

Similar initiatives are also in the pipeline in Hong Kong and Malaysia, he added

The Government will also seek expressions of interest to build and operate a FAST aggregator. This will help lower costs by aggregating the technical requirements across a number of players, said Mr Ong.