SINGAPORE: Private home prices in Singapore rose for the second consecutive quarter, with apartments in the central region proving most popular with buyers.

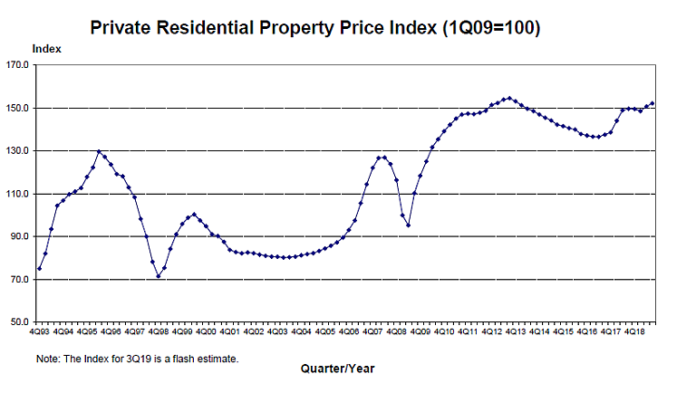

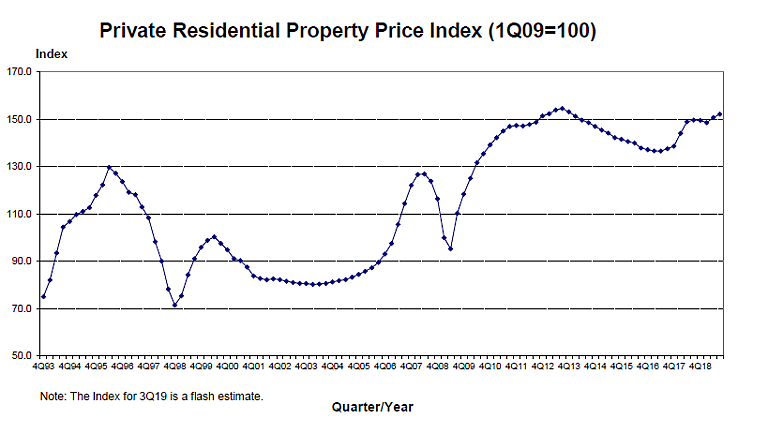

The private residential property index increased 0.9 per cent to 152.2 points in the third quarter, data from the Urban Redevelopment Authority (URA) showed on Tuesday (Oct 1).

READ: HDB resale prices increase slightly in Q3 after four quarters of decline

Private home prices had fallen 0.7 per cent in the first quarter and 0.1 per cent in the October to December period following cooling measures implemented by the Government in the middle of last year.

In the last quarter, prices rose 1.5 per cent.

In the landed property segment, prices fell by 2.2 per cent in the third quarter, compared with the 0.1 per cent decrease in the previous quarter.

Prices for private homes in the non-landed segment rose 1.7 per cent, compared with the 2 per cent increase in the previous quarter.

Those in the Core Central Region (CCR) rose the most at 2.9 per cent, followed by apartments in the Rest of Central Region (RCR) at 1.6 per cent and those in the Outside Central Region (OCR) at 0.7 per cent.

“The slower pace of price increase is within expectation possibly because most developers and sellers of resale homes have kept prices at attractive levels to clear their existing stock,” said Christine Sun, head of research and consultancy at OrangeTee & Tie.

“Lesser luxury homes (CCR) were also sold last quarter when compared to the prevailing quarter, whereas more mass-market (OCR) and city fringe private homes (RCR) were being transacted last quarter, which may have lowered the average pricing for the entire market as reflected by the slower pace of price growth in the third quarter.”

She added: “While the housing market may continue to be influenced by global forces in the wider economy, our robust population growth, rising household income, and positive employment numbers will remain key drivers for both home prices and demand over the long term.

“In view of the current economic uncertainties, Singapore will remain an attractive safe haven for foreign investors to park their funds here.

“We expect prices to remain relatively stable for the rest of the year as the underlying demand for private homes is still healthy despite the current macro-economic uncertainties.”