SINGAPORE: Sales of new private homes in Singapore plunged in the first quarter of the year along with a dip in prices, amid disruption from the COVID-19 pandemic, data showed on Friday (Apr 24).

Expectations are that the private property market will deteriorate even further, as the “circuit breaker” measures take hold.

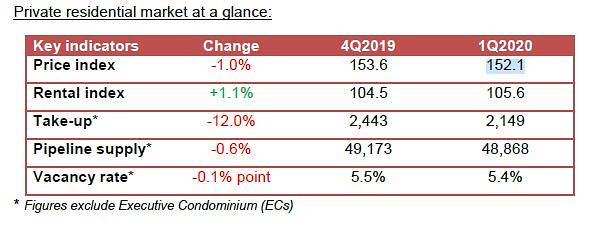

Developers sold 2,149 homes (excluding executive condominiums) in the first three months of the year, down 12 per cent from 2,443 units in the fourth quarter of last year, according to the data from the Urban Redevelopment Authority (URA).

This came on the back of fewer launches: Developers released 2,093 homes for sale in the January to March period, compared with 2,226 units in the previous three months.

Along with the fall in take-up, private home prices declined 1 per cent, slightly better than the -1.2 per cent flagged in the flash estimates released earlier this month. This compares with the 0.5 per cent increase in the previous quarter.

The sentiment was similar in the public housing market, where resale transactions fell 7 per cent in the first quarter.

(Image: URA)

“Ever since COVID-19 reached Singapore shores and worsened, property buyers have turned opportunistic, prudent and highly price-sensitive,” said property analyst Ong Kah Seng.

“Times will be even harsher from Q2 2020, as COVID-19 conditions further worsen,” he added.

Singapore has put in place a circuit breaker period to stem the spread of the virus, closing most non-essential workplaces and schools. The one-month period was originally scheduled to end on May 4, but has since been extended to Jun 1.

With stricter safe distancing measures and travel restrictions installed by governments around the world, potential buyers from foreign countries have all but disappeared while show flats have been closed and house viewings postponed.

“Singapore’s property market recovery came to an abrupt halt amid the global pandemic and growing macroeconomic uncertainties,” said Ms Christine Sun, head of research and consultancy at OrangeTee & Tie.

She said that prices of private homes for the entire year could decline up to 4 per cent if the pandemic continues to drag on, although pent-up demand could see a rise in buying activity when the COVID-19 measures are eased.

“Although the long-term effects of the coronavirus pandemic remain uncertain, the bright side is that Singapore’s property market has always recovered after every economic crisis. Buying activities could pick up faster than other downturns given the pent-up demand from many weeks of home isolation,” said Ms Sun.

READ: Private property prices rise 2.7% last year, led by landed homes

HOME PRICES

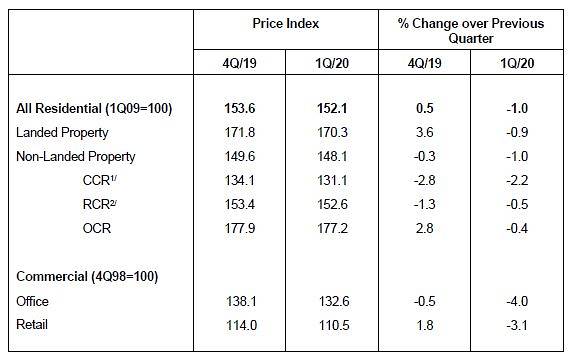

Prices of landed properties fell by 0.9 per cent in the first quarter, reversing a 3.6 per cent increase in the previous quarter, said URA.

In the non-landed market, prices declined 1 per cent as homes in the Core Central Region (CCR) lagged, extending the 0.3 per cent decrease in the previous quarter.

By region, prices of non-landed properties in CCR fell the most by 2.2 per cent in the first quarter, followed by the Rest of Central Region (RCR) at -0.5 per cent and Outside Central Region (OCR) at -0.4 per cent.

(Image: URA)

RENTAL MARKET

Compared to the sales market, rentals of private homes performed relatively well, rising 1.1 per cent in the first quarter, a rebound from the 1 per cent fall in the previous quarter.

This was boosted by rentals of non-landed properties, which rose 1.3 per cent, compared with rentals of landed properties, which fell 0.9 per cent.

By geography, rentals of non-landed homes in the OCR performed the best (+1.9 per cent), followed by CCR (+1.4 per cent) and RCR (+0.6 per cent).

SUPPLY IN THE PIPELINE

As of end-March, there was a total supply of 48,868 uncompleted private residential units (excluding ECs) in the pipeline with planning approvals, compared with the 49,173 units in the previous quarter.

Of these, 29,149 units remained unsold at the end of the first quarter, compared with the 30,162 units in the previous quarter.

In the EC market, there is an upcoming supply of 3,613 homes in the pipeline with planning approvals, with 1,950 units unsold.

Based on the expected completion dates reported by developers, 5,134 units (including ECs) will be completed in the remaining three quarters of this year. An additional 10,816 units (including ECs) will be completed in 2021.