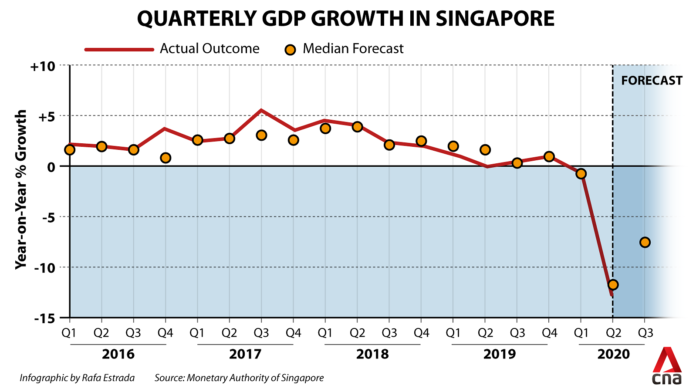

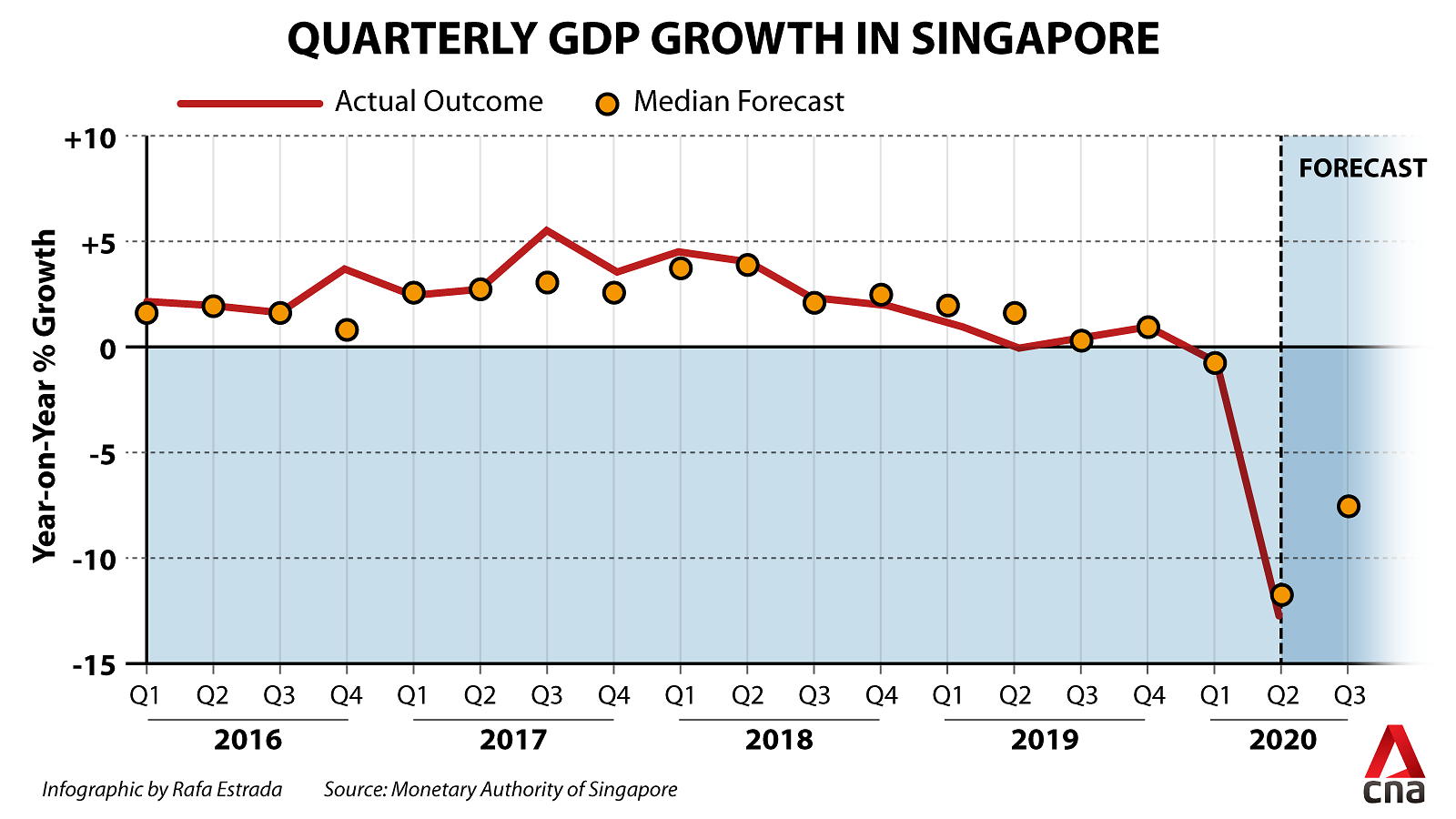

SINGAPORE: Private-sector economists are expecting the Singapore economy to contract 6 per cent this year, a slight downgrade from their earlier forecast of a 5.8 per cent decline following a worse-than-expected slump in the second quarter.

This was according to the latest quarterly survey from the Monetary Authority of Singapore (MAS) released on Monday (Sep 7), which polled 26 economists and analysts.

Watchers of the local economy had earlier predicted a 11.8 per cent year-on-year decline in the April to June quarter, but official quarterly gross domestic product (GDP) showed a 13.2 per cent plunge amid muted external demand and a domestic “circuit breaker” period that saw widespread business closures.

The second quarter GDP marked Singapore’s worst-ever quarterly performance, but that could be the trough for the economy as those surveyed by the MAS expect a smaller contraction of 7.6 per cent in the third quarter, the survey showed.

READ: Singapore narrows 2020 GDP forecast range as economy sees record quarterly slump in Q2

Across the key macroeconomic indicators, the outlook for the year was a mixed bag.

Expectations improved for industries such as manufacturing – with a median forecast of 2.3 per cent growth, a slight pick-up from 2.2 per cent in the last survey – and for finance and insurance with a growth forecast of 4.9 per cent compared with an earlier 3.1 per cent.

Wholesale and retail trade is expected to shrink by 6.4 per cent, halving an earlier estimated 12.8 per cent fall, while respondents foresee non-oil domestic exports to grow 4.5 per cent this year, as opposed to the flat growth earlier predicted.

But forecasts for other indicators were gloomier, particularly for the hard-hit construction sector, where a 23 per cent contraction is now expected, much worse than the previously-predicted 11.4 per cent decline.

Accommodation and food services is expected to see a full-year contraction of 29.1 per cent, worsening from the 26 per cent decline forecast in the earlier survey. Private consumption is seen falling 11.8 per cent this year, down from the last forecast of a 5.2 per cent fall.

Turning to the labour market, respondents expect the unemployment rate to be 3.5 per cent by the year-end, down slightly from 3.6 per cent in the previous survey.

A further deterioration in the current COVID-19 outbreak continued to top the respondents’ list of downside risks to the economy, followed by an escalation in US-China trade tensions and a slower-than-expected global economic recovery.

Conversely, the top upside risk was a containment of COVID-19 due to reasons such as the successful global deployment of a vaccine. Other possible upsides include a stronger-than-expected manufacturing sector performance – led by electronics and pharmaceuticals production – and an easing in global trade tensions.

Looking forward to 2021, economists are expecting a recovery given how they have pencilled in growth of 5.5 per cent. This is a more optimistic forecast compared with the 4.8 per cent growth in the previous survey.

BOOKMARK THIS: Our comprehensive coverage of the coronavirus outbreak and its developments

Download our app or subscribe to our Telegram channel for the latest updates on the coronavirus outbreak: https://cna.asia/telegram