SINGAPORE: More than S$50 billion in tax revenue was collected in the last financial year as revenue from stamp duties jumped by nearly 50 per cent, data released by the Inland Revenue Authority of Singapore (IRAS) on Wednesday (Sep 26) showed.

A total of S$50.2 billion was collected by IRAS in the 2017/2018 financial year, an increase of 6.8 per cent from the previous year.

The tax collected represents 66.2 per cent of the Government’s operating revenue and 11.1 per cent of Singapore’s GDP, the tax authority said in a news release.

The increase also came on the back of better-than-expected economic growth of 3.6 per cent in 2017, IRAS noted.

READ: After an outperforming year, how will Singapore’s economy fare in 2018?

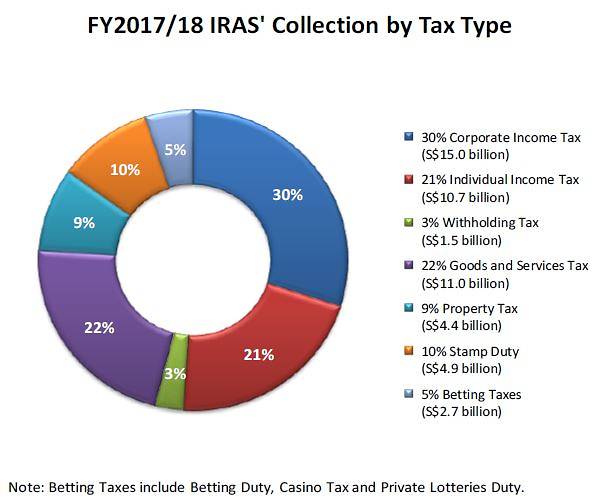

A breakdown of the tax revenue collected by the IRAS. (Infographic: IRAS)

Revenue from stamp duties surged by 49.6 per cent to S$4.9 billion due to an increase in property transactions. Property tax collection remained largely unchanged at S$4.4 billion, said IRAS.

Revenue from income tax, comprising corporate income tax, individual income tax and withholding tax, rose 6.3 per cent from the previous year to S$27.2 billion, and represented 54 per cent of total tax revenue, IRAS said.

READ: New property cooling measures announced – higher ABSD rates, tighter loan limits

Corporate income tax grew from S$13.6 billion to S$15 billion, while GST collection was S$11 billion, similar to the previous year.

Betting taxes collected in the last financial year was S$2.7 billion – similar to the previous year.

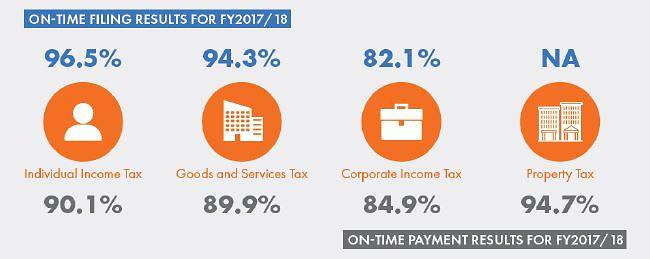

A total of 96.5 per cent of individual taxpayers filed their income tax on time and 90.1 per cent made their payments on time.

When it came to corporate income tax, 82.1 per cent filed it on time and 84.9 per cent paid their tax on time.

(Infographic: IRAS)

In total, 10,726 taxpayers were audited and investigated, and about S$384 million in taxes and penalties were recovered during the 2017/2018 financial year, IRAS added.

Starting Jan 1, 2020, GST will be imposed on imported digital services. About 850 businesses and associations have been consulted in the design of the GST measures, IRAS said.