SINGAPORE: The S$50,000 issue limit for Singapore Savings Bonds (SSB) will be removed from Mar 1 this year, the Monetary Authority of Singapore (MAS) said in a media release on Thursday (Mar 1).

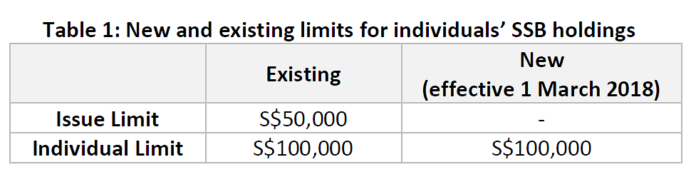

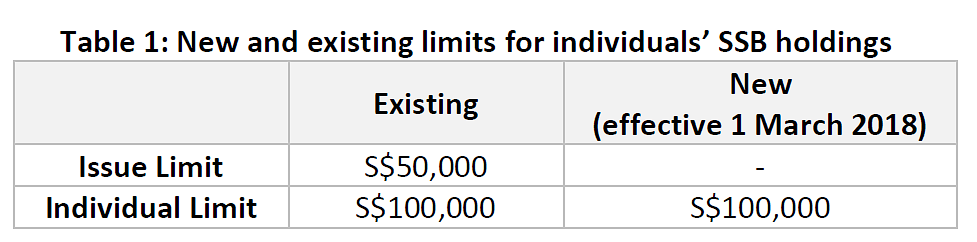

Investors in SSB are currently subject to two limits – the issue limit, which limits the maximum amount of each issue that an individual can hold at S$50,000, and the individual limit, which limits each individual’s total SSB holdings at S$100,000.

“The removal of the issue limit will simplify the SSB programme, allowing investors to apply for a larger amount of a particular SSB issue,” said MAS. The individual limit will remain at S$100,000, the authority added.

“The SSB allocation mechanism will continue to ensure that the bond is distributed as evenly as possible amongst investors,” MAS added. It said that smaller applications would be filled first in the event of an oversubscription.

About S$362 million of SSB have been issued so far this year, said the authority. It said it would offer about S$2 billion of SSB in 2018 and continue to “monitor the subscription levels closely” in determining the monthly issue size.

Since the launch of the SSB programme in October 2015, more than S$1.9 billion of SSB has been issued to about 57,000 investors, according to MAS.

More than half of all applications were for amounts less than S$10,000 and more than half of SSB investors are aged 41 and above.

Details of the next SSB issue will be announced at 4.30pm on Thursday and will be open for applications from 6pm Thursday to 9pm on Mar 26 this year.