THE ACCUMULATION of private wealth has rocketed in China in the decade following the global financial crisis, thanks to a strengthening economy and successful stimulus programmes.

Between 2016 and 2017, China added 106 billionaires to its ultra-high net worth population to hit a total 373 billionaires – a growth rate of two billionaires per week. In 2006, the country only had 16 billionaires.

Flush with cash, this group of nouveau riche are not only travelling more (nearly 80 million Chinese nationals made outbound trips in the first half of 2018 – 16.4 percent more than last year) and choosing to send their children to schools abroad, they are also constantly on the lookout for investment opportunities outside of China.

And because culturally, home ownership is a key marriage criterion among the Chinese (over 70 percent of Chinese millennials are already proud homeowners), buying up overseas real estate is a naturally attractive prospect.

SEE ALSO: What China’s ‘consumption downgrade’ means

So where are the Chinese investing?

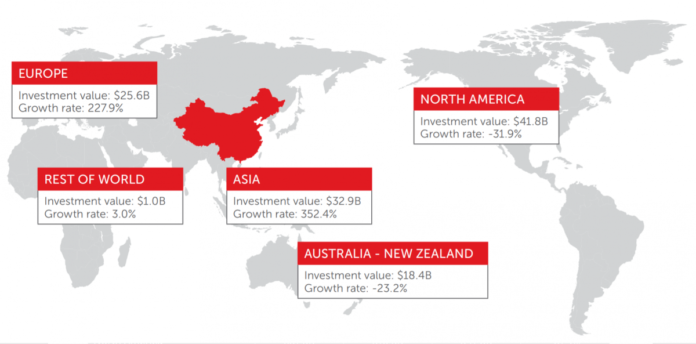

Chinese outbound real estate investment in 2017. Source: Juwai.com

Reports say the answer lies in Asia.

Compared to traditional favourites like the US, Canada, Australia and New Zealand, it is in Asia where Chinese interest has been picking up the most steam. And fuelled by an increasingly tough domestic investment climate, the Chinese are keener than ever on investment opportunities in Asia’s developing markets.

Last year, Chinese investment in Asia increased by a staggering 352.4 percent to hit a total value of US$32.9 billion in both commercial and residential properties, according to online Chinese real estate data platform Juwai.com in its October 2018 report.

Europe emerged the second most popular region for Chinese investors, with investments growing 227.9 percent to reach US$25.6 billion in total value, whilst investments in Australia, New Zealand and the US declined.

Within Asia, Juwai CEO and director Carrier Law says countries in Southeast Asia have been gaining Chinese buyer market share at unprecedented rates.

In Thailand, for example, the number of inquiries from Chinese buyers looking to buy homes increased by 91 percent between January 2017 and January 2018. When compared to the same period in 2016, that increase goes up even further – to a staggering 313 percent.

Aerial view of Bangkok’s skyline. Source: Shutterstock

An Asia Times article quoting China Real Estate News said one likely contributing factor is that although foreigners are only allowed to buy high-rise properties in Thailand, they enjoy permanent property rights without property tax and inheritance tax.

Data from Bangkok-based developer Risland shows that since 2015, Chinese buyers pumped in US$10 billion into condo purchases in Thailand, which is the equivalent of the combined investment from Japanese and Singaporean investors. In fact, the developer estimates that one out of every five condos built in Thailand is owned by mainlanders or buyers from Hong Kong.

Other Southeast Asian economies drawing Chinese investors include Malaysia, Vietnam, Singapore and the Philippines.

Speaking to NST Property, Law added in a recent report: “Even smaller countries like Cambodia are seeing rapid growth in Chinese buying, although from a much smaller base.”

These investments are largely due to low prices and cultural commonalities between the Chinese mainlanders and these Southeast Asian markets but one other key factor, Law said, is their involvement in China’s “One Belt One Road” initiative.

SEE ALSO: Malaysia: Public protests force Chinese builder to live up to its eco-friendly tag

Capital controls no hindrance

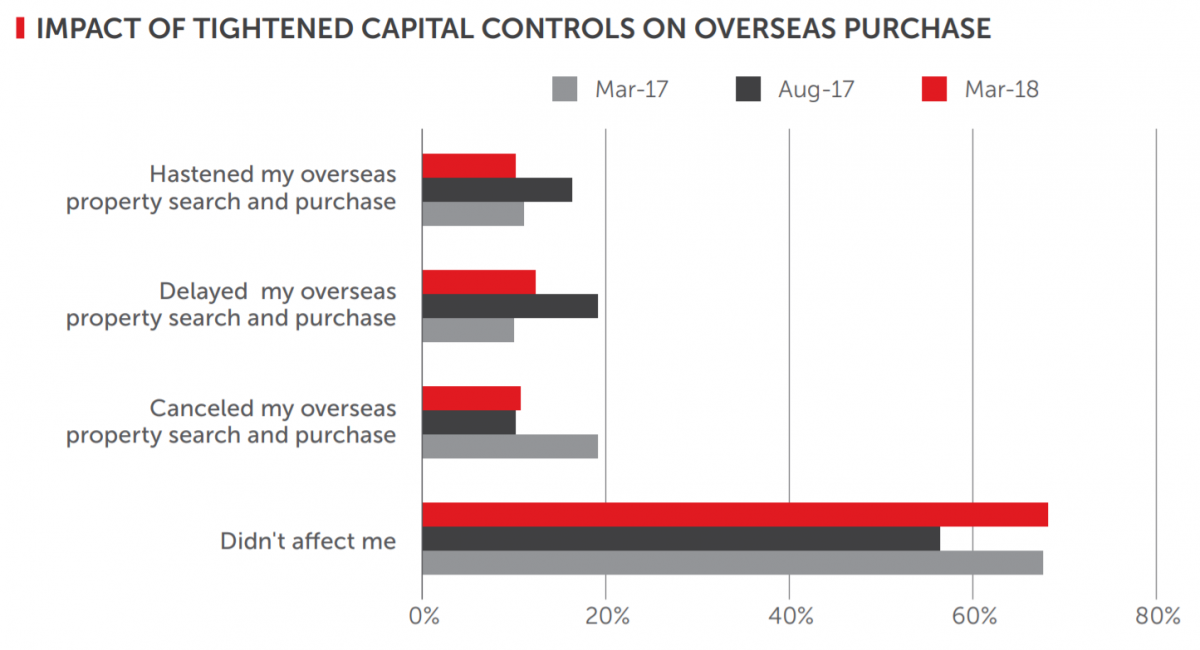

Source: Responses compiled for UBS Evidence Lab survey. Chart from Juwai.com report.

In total, Chinese mainlanders spent US$119.7 billion to buy properties abroad in 2017.

This is an 18.1 percent increase from the US$101.4 billion they spent in 2016, an impressive growth figure, given it comes at a time of capital controls and growing political resistance to the spread of Chinese money abroad.

At home, Chinese citizens are bound by an annual purchase limit of US$50,000 worth of foreign currency per person whilst abroad, their overseas withdrawals using Chinese bank cards are limited to RMB100,000 (US$14,400) per person.

Additionally, according to South China Morning Post, the State Administration of Foreign Exchange (SAFE) has also “dramatically increased its policing” of illegal outflows, even resorting to naming and shaming those who dared to challenge Beijing’s capital control regime. The report said SAFE disclosed 23 such cases in August, five of which involved Chinese citizens trying to buy properties abroad.

But interestingly, despite Beijing’s best efforts to tighten controls over domestic capital outflows, Chinese interest and demand for properties abroad remain robust, reports say.

Juwai’s study says the impact of capital controls may have been blown out of proportion or “overstated”. Two-thirds of Chinese investors even told a survey by the UBS Evidence Lab (see image) that the capital controls, “didn’t affect me”.

As it stands, Juwai expects Chinese overseas real estate investments to continue unabated, with a projected growth of 3 to 8 percent this year. This would bring the total investment value up to between US$123.3 billion and US$129.3 billion.