Finding tenants for her four investment properties never used to be much of an issue for investor Jenny Yang, but those days of easy money are long gone.

Two of her units – a studio apartment in Novena and a two-bedroom unit near Lavender MRT station – remain vacant after the tenants, both foreigners, returned home in recent months.

“In the past, before one tenant moved out, I would get another offer, especially for the Lavender unit… now it’s slower. The offers are too low as well,” she told The Straits Times recently. She renewed leases for her two other properties – in the Bedok Reservoir area and Tampines – this year after lowering the rent by about 5 per cent.

Her plight is broadly in line with market trends, marked by falling rents and rising vacancies amid sluggish economic growth and a large supply of new units.

“With the economy slowing and the financial sector restructuring, the number of completions has outpaced the growth (in number) of foreigners, who account for about 60 per cent of the leasing activity,” said Dr Lee Nai Jia, head of South-east Asia research at property consultancy Edmund Tie & Co.

There were 30,310 vacant private homes and a vacancy rate of 8.9 per cent as of June 30, according to the Urban Redevelopment Authority.

International Property Advisor estimates the islandwide vacancy rate could hit 11.1 per cent by the end of the year. Its chief executive Ku Swee Yong noted: “The lack of leasing demand is not just due to the slowing economy, but recent statistics show that the top categories which contributed to population growth – including foreign domestic workers and dependants of pass holders – do not add demand for housing units.”

Second-quarter data shows that vacancies were the highest at 12.6 per cent in the north-east region, which includes Punggol and Sengkang, followed by a 9.1 per cent vacancy rate in the east region, which includes Tampines and Pasir Ris.

Condominium rents in the core central region rose 0.1 per cent in the second quarter over the first, while those in the city fringe dipped 0.6 per cent and those in the suburbs declined 1.2 per cent.

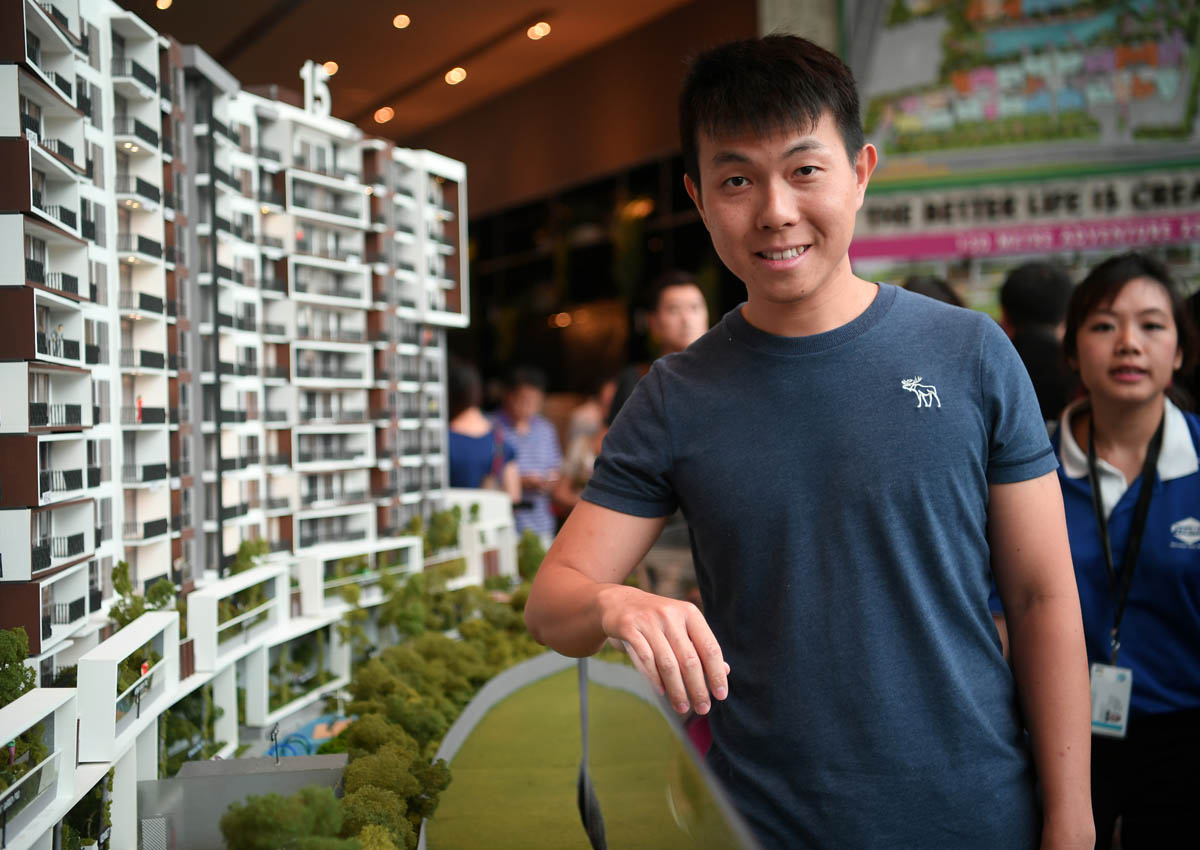

The lacklustre leasing market has not put off investors at recent launches. Small-business owner Andrew Yap, who bought a two-bedder at Forest Woods for $917,000 on Oct 8, said: “The market is dull now, but the project won’t be completed till a few more years… with future commercial development in Paya Lebar nearby, I think there’ll be tenants.”

Analysts expect the rental market to soften further, with suburban areas most vulnerable next year, when the bulk of units under construction are expected to be completed.

“Rental demand for some areas is still okay… such as for one- and two- bedroom units in the Central Business District, Marina Bay, Orchard Road, Buona Vista and River Valley,” said PropNex Realty senior associate director Anthea Yeo.

With rents moderating, Knight Frank noted that the average rent per lease signed fell 8.8 per cent in the suburbs in the first half of this year over the same period last year, while that of the core central region slipped 4.5 per cent and that for the city fringe was down 4 per cent.

Landlords like accountant Eunice Lim have been more flexible in view of the weaker demand. Ms Lim recently rented out a one-bedder in Balestier for $1,700 a month. “That’s a 30 per cent drop in rent… I was prepared to offer a discount. High rents in this market will not materialise. We have to be realistic,” she said.

Property agents say it will remain a tenant’s market in view of the wide choice of units available, but those near transport nodes and amenities will enjoy better demand.

This article was first published on October 17, 2016.

Get a copy of The Straits Times or go to straitstimes.com for more stories.