As modern as Singapore and Singaporeans are, there are still a number of traditions that many hold close to their hearts.

One of which is the Chinese tradition of Li Chun (Farmers’ Day), the date that marks the beginning of spring and is believed to be an auspicious day on the Chinese calendar.

Over the years, Chinese Singaporeans have cultivated the practice of depositing money on that day, believing that it’s good luck, and will also help their wealth grow in the new year.

In fact, it has become such a significant event here that local bank DBS (which has over 10,000 staff) even specifically credited their employees’ salaries into their bank accounts during Li Chun in 2016.

This year, Li Chun falls on 4 February 2018.

While snaking queues are fully expected at various ATMs machines around Singapore, there are clever Singaporeans who are getting around that time-consuming tradition with tech.

Getting around (mostly inconvenient) traditions with tech

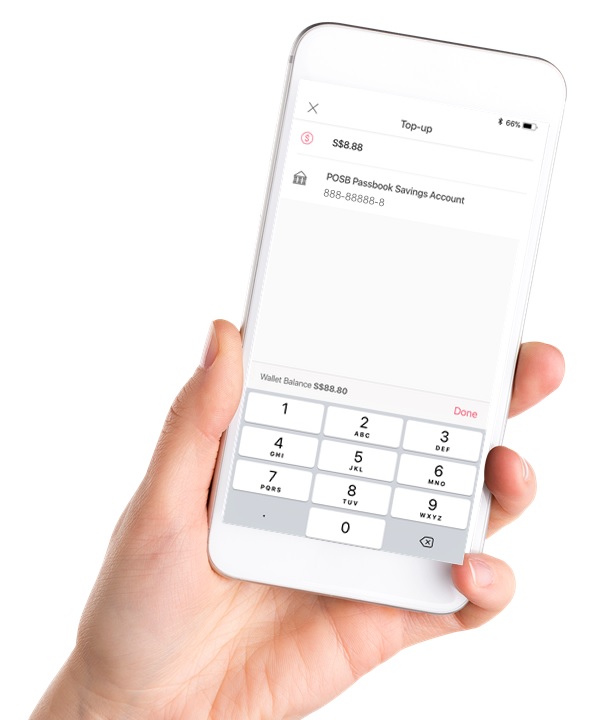

As compared to braving it out in the long queues, some resourceful Singaporeans have taken to depositing money into their e-wallets, like DBS PayLah!, instead.

Given that on top of the auspicious date, there are also ‘lucky timings’ for those born under the various zodiac animals to adhere to, using a more convenient option that can be accessed at any point of time also makes sense.

PayLah! users who deposit money on Li Chun (4 Feb) also stand a chance to win $88 – so, why not?

Here’s a fun fact:

During Li Chun 2017, an average of $35 was deposited per DBS PayLah! transaction.

e-Ang baos are also an a rise

It’s not just for Li Chun that Singaporeans are making use of tech – according to DBS, the number of eAng Baos sent last year was 5 times higher than what was sent in 2016!

And here’s another fun fact:

In 2017, the average amount of every eAng Bao sent was $26!

But of course, for those who still prefer to keep to the tradition of giving physical ang baos, 36 new-notes ATMs have been rolled out at 27 community clubs islandwide.

More than 110,000 customers made use of these pop-up ATMs in 2017.

Starting from today (29 Jan), customers will be able to withdraw new notes in sums of $100 ($2 x 50), $300 ($10 x 30) and $500 ($50 x 10).

For the first time, sums of $200 ($2 x 100), $300 ($2 x 50 + $10 x 20) and $500 ($10 x 20 + $50 x 6) will also be made available.

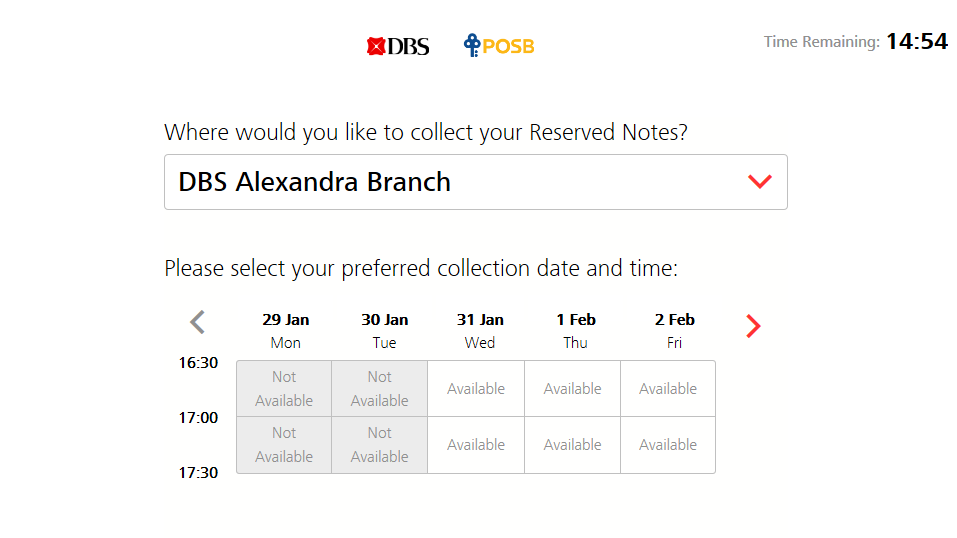

For those who don’t want to queue or head to the pop-up ATMs, online reservations can also be made for the new notes, and be collected at all full-service branches.

Special priority queues will also be available for the elderly and those with special needs, and customers will be able to use an SMS ‘Q’ notification service option to request for a queue number and get notified about note availability before heading down to the various bank branches.

Other banks, like OCBC and UOB, also have pushed out similar services in the festive rush for new notes.

UOB customers will be able to reserve new notes online, while OCBC customers can use the bank’s mobile app to see in real time which branches have stock of new notes.

A virtual queue number can also be taken with the OCBC app.

Go forth and huat ah!

With so many convenient solutions available for even the most superstitious among us, there’s no reason to take MC (or leave) to queue at ATMs anymore.

For those already planning for 4 Feb, below is a chart stating the ‘best’ time to deposit money for your zodiac sign:

More about

Chinese New Year E-banking POSB DBS