SINGAPORE: Prudential Singapore has raised its Central Provident Fund (CPF) contribution rate for older workers above the age of 55 to match that of their younger colleagues, the insurance company announced on Wednesday (Aug 7).

It becomes the first financial institution to do so, after it scrapped the retirement age for employees in October last year.

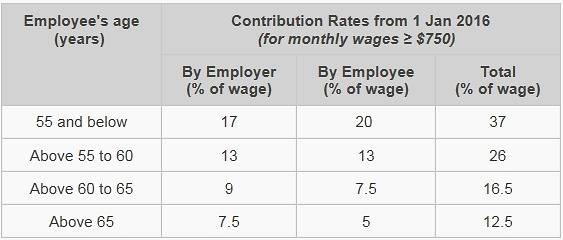

Currently, the government-mandated CPF contribution rate for workers below 55 is 17 per cent by employers and 20 per cent by employees, making up a total contribution rate of 37 per cent.

For older workers above 55, the total CPF contribution rate drops to between 12.5 per cent and 26 per cent, depending on their age bracket, with employers contributing between 7.5 per cent and 13 per cent and employees contributing between 5 per cent and 13 per cent.

Table of CPF contribution rates. (Graphic: CPF website)

But with Prudential’s new CPF scheme, the company will raise its contribution to 17 per cent if the employee chooses to raise their individual CPF contribution rates to 20 per cent.

“Prudential’s new CPF scheme for its older employees is an opt-in scheme as the insurer recognises that some individuals may prefer to have more disposable income to meet their current needs,” the insurance firm said in its media release.

According to Prudential’s calculations, a 61-year-old employee with a monthly salary of S$5,000 could save S$1,025 in CPF funds each month, equating to S$12,300 a year. There are currently 46 Prudential employees who stand to benefit from this scheme, the company said.

“It was a bonus when the company scrapped the retirement age as I can continue to work for as long as I am able to,” said Ms Sue Li, a 63-year-old customer service officer who has been working with Prudential for 24 years.

“Now, they are going a step further by contributing more money to my CPF funds. Although I must top up my CPF account as well, I am more than happy to do so. The additional savings would help finance my retirement years and potential healthcare expenses.”

Prudential Singapore CEO Wilf Blackburn said the new CPF scheme, introduced in close consultation with the Singapore Insurance Employees’ Union, aims to create a more “age-friendly workplace”.

“We believe in rewarding our people based on performance. It is with this in mind that we have decided to make equal our CPF contributions for all employees, regardless of age,” he added.

Prudential Singapore removed the retirement age in October last year to allow its older employees to continue working.

READ: PAP Seniors Group calls for more working opportunities for elderly

“Additionally, with rising lifespan and healthcare costs, we recognise that our employees will need to save more to fund their extended years,” Mr Blackburn added. “The additional CPF (money) could help them build a bigger retirement nest egg so they will be more financially ready for the future.”

According to a Prudential survey of 1,214 Singapore residents, about 50 per cent of respondents said they were not financially ready to live to 100 years old.

In February last year Member of Parliament Intan Azura Mokhtar called on the Government to review the CPF contribution rates for those above 55, saying it “does not make sense” that CPF rates are cut at 56 when the average life expectancy is at least 80 years old.