SINGAPORE: Some policyholders of Prudential have encountered erroneous deductions from their bank accounts, the Monetary Authority of Singapore (MAS) confirmed on Thursday (May 24).

“Customer accounts of multiple banks were affected. This was not a cyber attack but an operational lapse,” said MAS in a media release.

Multiple affected customers approached Channel NewsAsia and took to social media on Thursday to complain about “unauthorised fund transfers” and erroneous premium deductions from their bank accounts.

A Channel NewsAsia reader, who wanted to be known only as Ms Huang, said she was notified of an unauthorised fund transfer of more than S$50,000 from her HSBC bank account at about 3.45pm.

When she called the bank, they advised her that they had received numerous phone calls from customers reporting unauthorised transactions on their bank accounts.

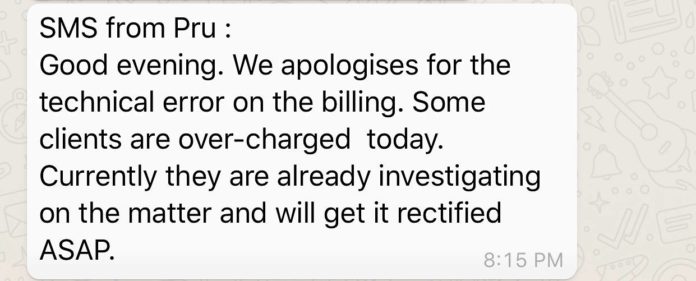

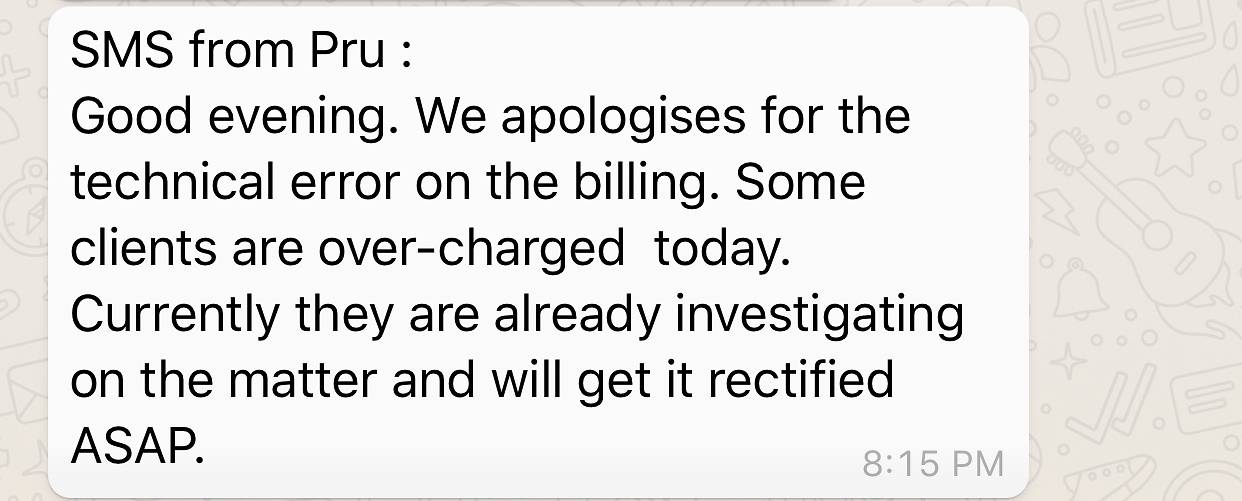

She added that her advisor sent her a message of apology from Prudential around 8pm.

The message read: “Good evening. We apologise for the technical error on the billing. Some clients are over-charged today. Currently they are already investigating on the matter and will get it rectified ASAP.”

A message of apology sent by Prudential to Ms Huang’s advisor, as provided by Ms Huang.

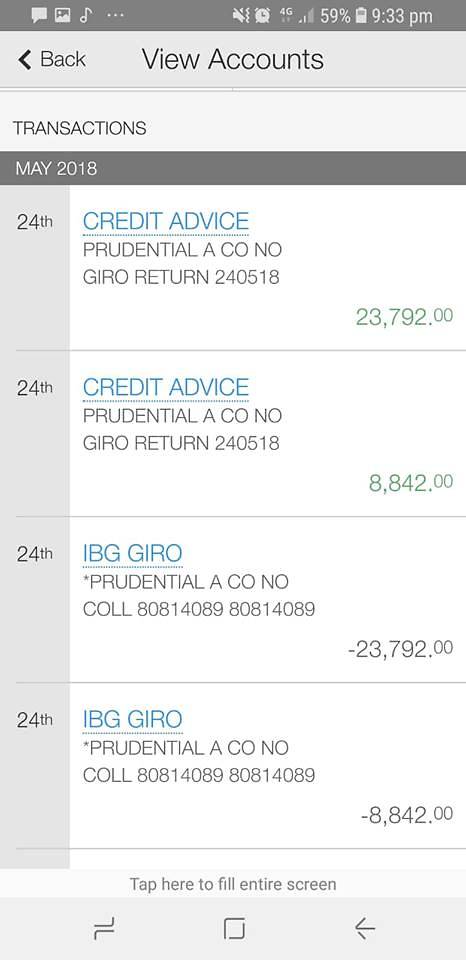

A Facebook user named Terence Tan said a total of S$32,634 was deducted from his wife’s bank account when it should have been S$326.34.

The 41-year-old operations executive told Channel NewsAsia that the money was later credited back into his wife’s account around 9.30pm. He added that no explanation has been offered to him or his wife so far.

Screenshot of the deductions made in the account of Terence Tan’s wife. The amount was subsequently credited back. (Photo: Terence Tan)

Another user, Angela Lee, said S$3,230 was deducted from her sister’s bank account, instead of S$32.30. When she called Prudential regarding the mistake, she was told it was an “IT glitch”.

An industry insider who requested anonymity said it seemed “like Prudential keyed in two more zeros by accident for the premium deductions.”

ERRONEOUS DEDUCTIONS A TECHNICAL ERROR: PRUDENTIAL

MAS said in its statement on Thursday that it has directed Prudential and its payment bank, Standard Chartered Bank Singapore to return the customer funds without delay, to keep customers updated, and to investigate the root cause of the incident.

“We take a serious view of such operational lapses and will take follow-up supervisory measures where appropriate.”

In an email to Channel NewsAsia, Prudential confirmed that “a number of our customers experienced a GIRO deduction in excess of their insurance premium or a failed GIRO deduction”.

“We have investigated the matter and found that this is due to a technical error,” said a Prudential spokesperson.

“This was not a cyberattack. We are very sorry for the inconvenience caused.”

The spokesperson added it was working with its bank partner to resolve the issue as quickly as possible” and to credit the relevant amount deducted back into customers’ accounts within the next 24 hours.

“Any interest lost will be refunded and any erroneous charges will be reversed as soon as possible,” the spokesperson added.

OCBC bank addressed its customers on Facebook saying that they have rectified the accounts of those affected “by an error in GIRO deduction requests by Prudential”.

“Customers who were affected should already see the erroneous transactions reversed in their bank accounts,” added the bank.

This story came from a reader tip-off. If you would like to send in photos or videos of something newsworthy, WhatsApp our Mediacorp news hotline at +65 8218 8281 or message us on Facebook.