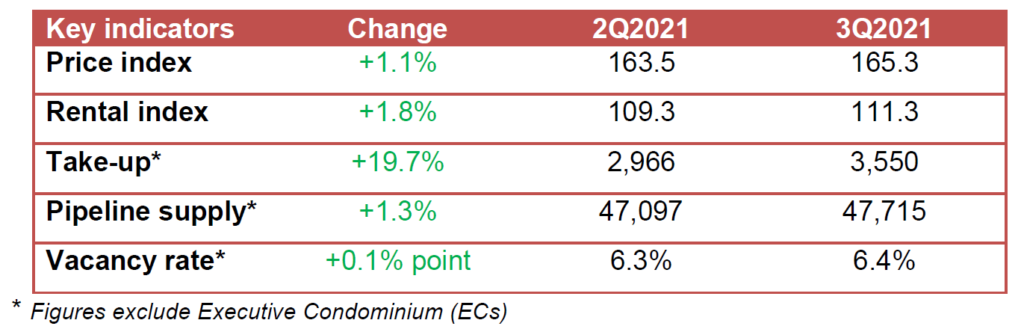

Singapore: Private residential prices in Singapore rose 1.1% in the third quarter, slightly higher than the preliminary estimate released earlier this month.

According to the real estate statistics released by the Urban Redevelopment Authority (URA) on Friday (October 22), the private residential property price index rose from 163.5 points in the second quarter to 165.3 points in the third quarter.

Landed housing prices rose by 2.6% between July and September, after falling by 0.3% in the previous quarter.

The price of non-landed properties rose 0.7%, lower than the 1.1% increase in the previous quarter.

Mr. Lam Chern Woon, Edmund Tie’s head of research and consulting, pointed out that overall private real estate prices have risen for the sixth consecutive quarter.

He said that most of the price increase during the pandemic can be attributed to the land market, with “new economic wealth and other booming industries” driving demand.

“We have also observed that due to capital improvement or reconstruction before the sale, the price of landed houses has risen sharply,” he said.

Resale Demand

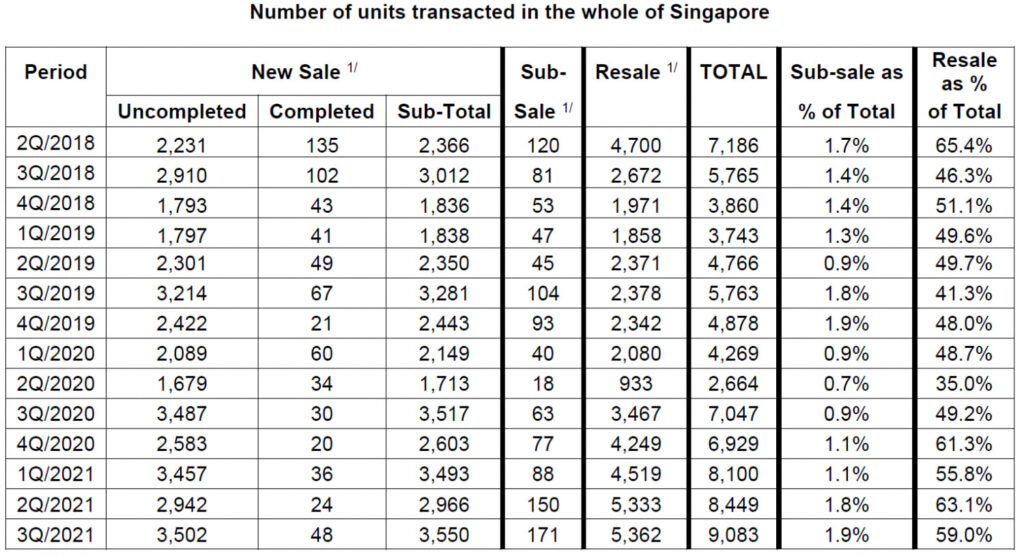

In the third quarter, there were 9,083 private residential property transactions in Singapore, of which resale houses accounted for 5,362.

Ms. Christine Sun, senior vice president of research and analysis at OrangeTee & Tie, pointed out that this was the highest quarterly resale volume since the third quarter of 2009, when 5,809 such units changed hands.

“Demand in both the primary and secondary markets is increasing,” Ms. Sun said.

She said that due to increased demand for resale properties and rising prices of new homes, the number of resale transactions this year may increase from 10,729 units last year to around 19,500 to 20,500 units.

Ms. Sun said that this is also due to more and more HDB upgraders turning to the suburban resale market because of affordability and reduced supply of new homes.

In terms of new home sales, Ms. Sun pointed out that this year’s transaction volume may reach an eight-year high of approximately 12,000 to 12,500 transactions, compared with the previous high of 14,948 units in 2013.

She said: “Unless there are unforeseen circumstances, the overall price may rise by 6% to 7% this year, which is higher than 2.2% in 2020 and 2.7% in 2019.”

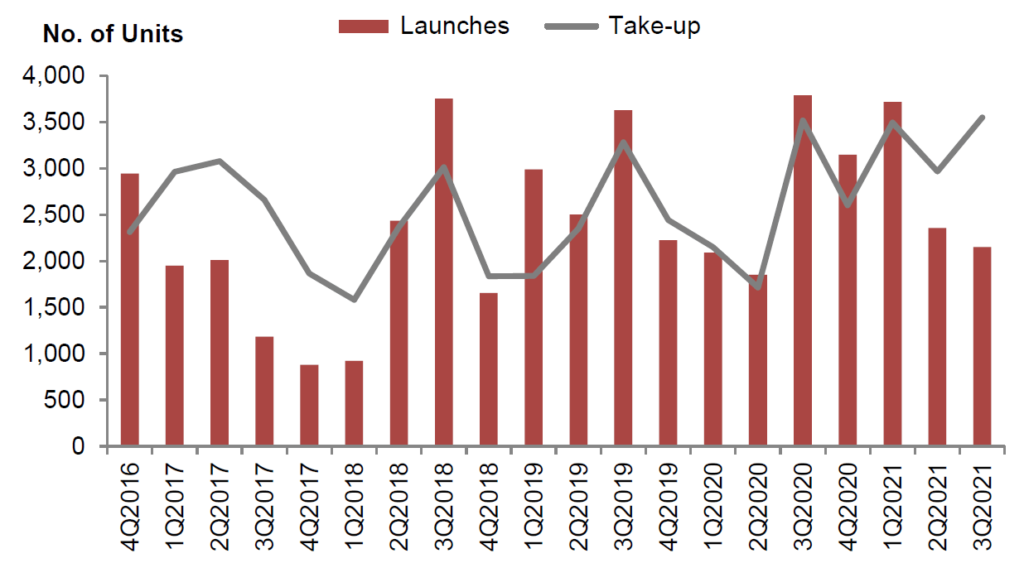

Overall, developers launched 2,149 unfinished private residences (excluding executive condominiums) in the third quarter, compared with 2,356 during the July-September period. They sold 3,550 units in the third quarter, compared with 2,966 units in the previous quarter.

In the area of executive apartments, developers launched 496 units in the third quarter, up from 413 units in the previous quarter. They sold 717 units, compared with 495 units in the July-September quarter.

Rental

Rent growth slowed in the third quarter of this year, rising 1.8%, lower than the 2.9% increase in the previous quarter.

This was driven by the landed property sector, with rents rising by 4.7% in the third quarter and 1.4% in the first quarter.

The rent of non-landed residential properties slowed to 0.7% from 3.1% in the previous quarter.

“As Singapore steps up its efforts to reopen its borders in an all-round way, the leasing market is expected to benefit when recruitment in the aviation, convention and exhibition, hotel and tourism industries increase,” Ms. Sun said.

“In addition, when more Singaporeans, permanent residents and foreign nationals return, and the company increases its recruitment of foreign nationals, rental demand may improve.”

Supply In The Pipeline

As of the end of the third quarter, a total of 47,715 unfinished private residential units and 4,718 EC units were under planning approval.

Among them, as of the end of September, 17,140 private residences and 1,581 EC units were unsold.

“The real estate market will end this year with a higher profile. As the global economy is expected to improve next year, market sentiment may improve further,” Ms. Sun said.

“The expansion of Singapore’s border reopening may stimulate employment growth and further boost the economy,” she said.