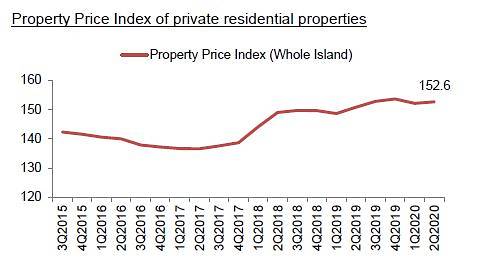

SINGAPORE: Private home prices in Singapore in the second quarter edged up 0.3 per cent from the previous quarter, according to updated data from the Urban Redevelopment Authority (URA) on Friday (Jul 24).

The private residential property price index increased to 152.6 points in the second quarter, up from 152.1 points in the first quarter.

The revised home prices for the second quarter reverses the 1.1 per cent decline flagged in the flash estimates released earlier this month.

It is also an increase from the 1 per cent drop seen in the first quarter.

(Graph: URA)

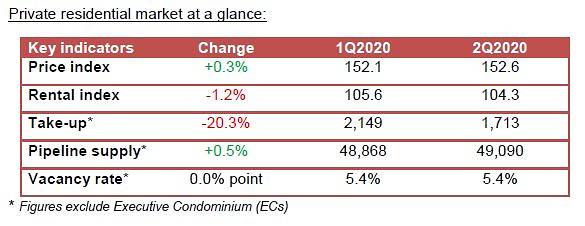

By property type, prices of landed homes remained unchanged in the second quarter, compared with the 0.9 per cent decrease in the previous quarter.

Prices of non-landed homes increased by 0.4 per cent, compared with the 1 per cent decrease in the first quarter. Those in the core central region jumped the most – by 2.7 per cent – followed by the outside central region, by 0.1 per cent. Homes in the rest of central region saw their prices fall by 1.7 per cent.

Rentals of private residential properties decreased by 1.2 per cent, compared with the 1.1 per cent increase in the previous quarter.

(Table: URA)

READ: Singapore new home sales jump 105% in June as showflats reopen after COVID-19 circuit breaker

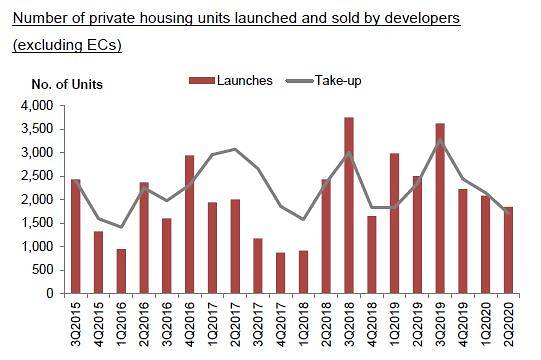

LAUNCHES AND TAKE-UP

In the second quarter, developers sold 1,713 private homes (excluding executive condominiums), down from the 2,149 units sold in the previous quarter. This represents the lowest number of homes transacted since the first quarter of 2018, when developers sold 1,581 units.

Between April and June, developers launched 1,852 uncompleted residential units, compared with 2,093 units in the first quarter.

No executive condominiums (ECs) were launched in the second quarter, while 71 such units were purchased.

(Graph: URA)

SUPPLY

As of end-June, there were a total supply of 49,090 uncompleted private homes (excluding ECs) in the pipeline with planning approvals. Of these, 27,977 units are unsold.

In the EC segment, there were a total supply of 3,613 units in the pipeline, of which 1,899 units are unsold.

Based on the expected completion dates reported by developers, 2,087 homes (including ECs) are expected be completed in the second half of the year.

Another 12,932 units (including ECs) are expected to be completed next year.

There is also a potential supply of around 5,400 units (including ECs) from Government Land Sales (GLS) sites that have not been granted planning approval.