Lorna Tan Nothing is certain but death and taxes, as the saying goes, but some of us still have difficulty getting those taxes, particularly stamp duty payments, right.

Ignorance is not bliss; the penalties for committing mistakes can be costly. Documents that are not stamped or those with an insufficient stamp duty can attract penalties of up to four times the undercharged amount.

Stamp duty is paid on documents or agreements relating to immovable property such as tenancy or lease agreements, acceptance of options to purchase, and sale and purchase agreements. Duty is also payable on share transactions.

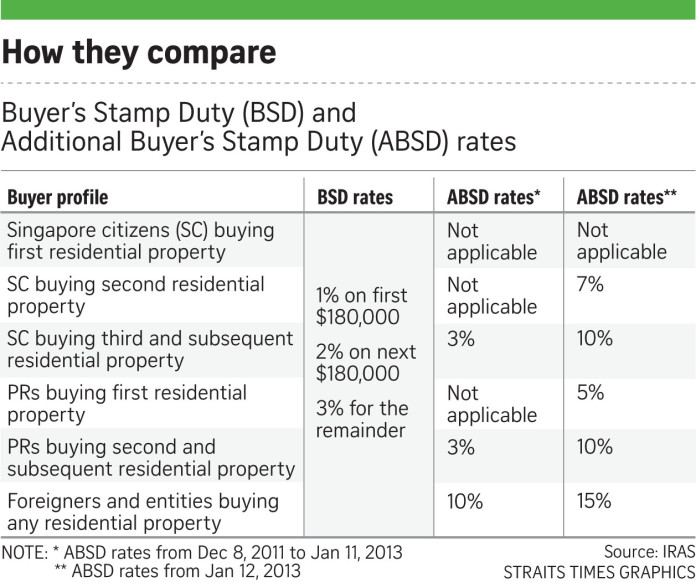

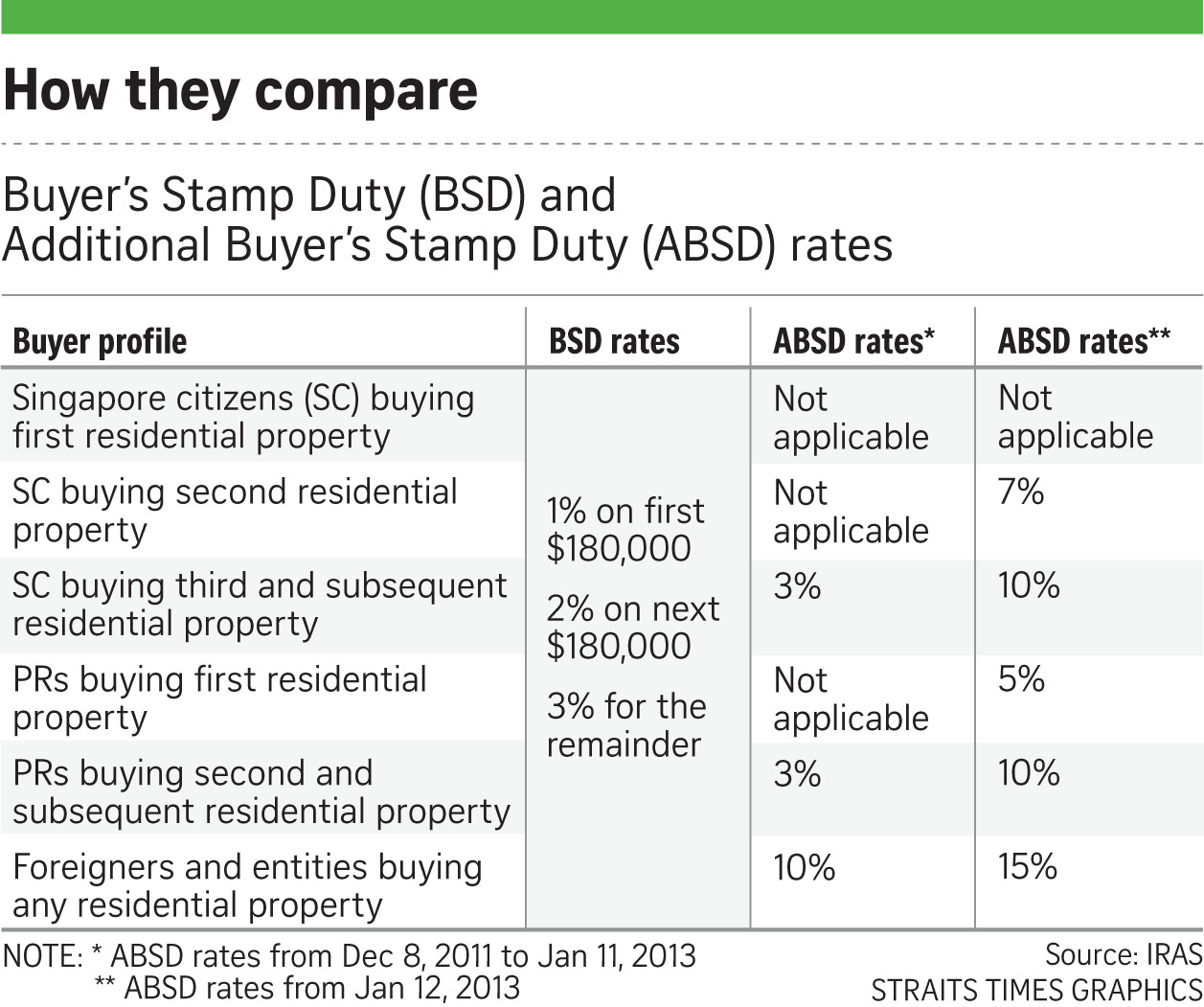

One of the most high-profile levies is the Additional Buyer’s Stamp Duty (ABSD) introduced in December 2011 to help cool the property market. This levy is paid on top of the existing buyer’s stamp duty. The rate depends on whether the buyer is a Singapore citizen, a permanent resident, a foreigner or an entity like a trustee. The number of residential properties the buyer owns is also factored in.

An ABSD of 7 per cent to 10 per cent is imposed for Singaporeans buying their second or subsequent properties. Foreigners pay more.

Close to 40 out of 437 stamp duty audit cases uncovered in the three years to March 31 this year involved non-compliance of the ABSD, said the Inland Revenue Authority of Singapore (Iras).

To ensure you do not get tripped up by these levies, The Sunday Times highlights common mistakes that property owners and buyers should steer clear of when paying stamp duty. Fictitious names are used in the cases cited.

Stamp duty

The good news is that during that same period, more than 90 per cent of taxpayers complied with stamp duty requirements.

The taxman takes a strong stance against non-compliance and its auditing programmes have been successful in identifying non-compliant cases involving significant stamp duty amounts.

Iras recovered about $21 million in taxes and penalties from stamp duty audits in the three years to March 31.

“The minority who did not comply were mostly those who failed to stamp or were late in stamping their documents, or did not pay the correct amount of stamp duty due to incorrect computation,” said Iras. “For example, the stamp duty is computed based on purchase price which is far below the market value of the property.”

Non-compliance has also been uncovered in areas such as gift transfers and trust arrangements. The cases reflect taxpayers’ lack of understanding of stamp duty requirements. And some taxpayers were wrongly advised by their lawyers and agents.

Common scenarios of non-compliance

1. TRANSFER OF PROPERTY BY WAY OF GIFT – WRONG BASIS OF CALCULATING THE STAMP DUTY

Stamp duty should be based on the market value when a property is transferred by way of gift. Real-life case: Mr Allan Poh executed a document to transfer his property by way of gift to his son. Instead of stamping the document based on the market value, the document was wrongly stamped based on how much the father charged, which was $1 in this case. What you should do: As a recipient of a gift property, you are liable to pay stamp duty. Ensure that the document is adequately stamped based on the property’s reasonable market value.

2. MISCONCEPTION THAT STAMP DUTY IS NOT REQUIRED FOR RENTAL OF ROOMS, SUBLETTING AND LEASE RENEWALS

There have been cases where tenancy agreements were not stamped for rental of rooms, rental of whole units and renewal of leases.

Stamp duty is payable on signed documents for subletting and/or renewal of lease. Usually, tenants are responsible for paying the stamp duty unless otherwise stated in the tenancy or lease agreements.

What you should do: Tenants should ensure tenancy agreements for rental of rooms or whole units and lease renewals are stamped.

3. OWNERSHIP OF OTHER PROPERTIES AT TIME OF PURCHASE

Some taxpayers indicated ignorance, or did not inform their lawyers of other residential properties that they own. This resulted in the wrong ABSD rate being applied.

As the ABSD rate depends on the number of residential properties owned, buyers should consider all such properties in the property count, including those that are:

•Completed or under construction;

•Owned wholly by the buyer or jointly with others;

•Transferred to the buyer by way of gift or inheritance; and

•Held in trust where the buyer is the beneficiary stated in the trust instruments.

Real-life case: Mr Edward Tay did not pay the ABSD on the purchase of his third residential property. He claimed that he was unaware of his joint ownership in two other homes that were transferred to him from his late parents.

Real-life case: Mr Dominic Lee did not pay the ABSD on the purchase of his second residential property, claiming that he had already transferred ownership of his HDB flat to his son. However, HDB records reflected that the flat was still jointly owned by Mr Lee, his wife and their son.

Real-life case: When Ms Agnes Koh bought her second residential property, she thought the ABSD was not applicable as she had already discharged her loan for her first property, an HDB flat. However, the ABSD is not dependent on the number of loans outstanding but the number of residential properties owned.

Real-life case: Ms Vicky Tan did not pay the ABSD on the purchase of her second residential property, which was under construction. She thought the duty was payable at the point the development received its Temporary Occupation Permit.

In these cases, penalties of up to two times the amount of duty the buyer failed to pay were imposed.

What buyers should do: You can seek advice from your lawyers or Iras to determine your total property count.

4. MISCONCEPTIONS ON PROPERTY AND LAND USE

There were instances where buyers regarded mixed-used properties as commercial properties and so mistakenly thought the ABSD would not apply. In mixed-used properties such as HDB shops with living quarters, the ABSD applies to the portion deemed residential.

Real-life case: Singaporean Jimmy Low owned two residential properties and bought an HDB shop with living quarters on the second floor.

An Iras audit found he paid only the 3 per cent buyer’s stamp duty. He claimed that the HDB shop was a commercial property and would not attract the ABSD.

However,the duty applied to the living quarters on the second storey. Mr Low had to pay an additional stamp duty of 10 per cent and a penalty of two times the amount of the ABSD that he had failed to pay.

What buyers should do: You can verify your ABSD obligations with Iras or your lawyers for the purchase of mixed-use properties, buildings under construction and vacant land or entire building with land.

5. INACCURATE ADVICE GIVEN BY INTERMEDIARIES

Intermediaries such as property agents and lawyers have given inaccurate advice on the ABSD to their clients.

Real-life case: Singaporean Larry Lim bought his second residential property and signed the sale and purchase agreement on June 11, 2013. The ABSD was payable at 7 per cent but his lawyer had referred to outdated rules and failed to advise him that the duty was payable.

After an Iras audit, Mr Lim was asked to pay the ABSD of 7 per cent. His lawyer agreed to pay the penalty of two times the amount of ABSD undercharged due to his negligence.

Iras said: “Intermediaries who handle conveyance matters for their clients have to be familiar with prevailing stamp duty policies and rates.

“They are responsible for ensuring that they provide correct advice on ABSD liability based on the date of document, permitted use/ zoning, count of residential properties owned and the residency status of their clients.”

Iras encourages intermediaries to do a self-review of past cases to check if stamp duty obligations were fulfilled accurately.

What intermediaries should do: You should be familiar with the prevailing stamp duty policies and rates to correctly advise your clients.

What buyers should do: You have to be more careful when engaging intermediaries to handle your property transactions. You should conduct self-checks on ABSD rules on the Iras website.

6. STAMP DUTY FRAUD – FORGERY OF STAMP CERTIFICATES

It is a crime for any individual or business to deliberately forge stamp certificates and knowingly misrepresent counterfeit “certificates” as genuine. The maximum punishment is jail of up to three years or a fine of up to $10,000 or both.

Iras advises potential property buyers and tenants to check the authenticity of the stamp certificates in their possession by visiting the e-Stamping website at https://estamping.iras.gov.sg

An authentic certificate should bear the full details: the stamp duty payment, description of the document, address of the property, stamp duty amount and date of the document.

All these details, including the Stamp Certificate Reference Number, should match the information on the e-Stamping website.

Iras said: “Although stamp duty is usually paid by property buyers and tenants, sellers and landlords should also request copies of stamp certificates and verify them online to protect their own interests. For instance, in the event of legal disputes, the document must be duly stamped before it can be admitted as evidence in court.”

What you should do: Ensure that your stamp certificates are authentic by referring to the e-Stamping website.

Find out more about stamp duty

Information on stamp duty as well as the e-Tax Guide Additional Buyer’s Stamp Duty (ABSD) on Purchase of Residential Properties can be found on the Iras website. Contact Iras on 1800-460-4923 or e-mail estamp@iras.gov.sg for assistance on e-Stamping.

This article was first published on Nov 20, 2016.

Get a copy of The Straits Times or go to straitstimes.com for more stories.