SINGAPORE: Sales of private homes by developers in Singapore fell 27 per cent in October from the previous month, official data released on Friday (Nov 15) showed.

Data compiled by the Urban Redevelopment Authority (URA) showed developers sold 928 units last month, compared with 1,270 units in September. Including executive condominiums, 955 units were sold.

Compared to the year ago period, the number of units sold represents an 84.9 per cent increase.

READ: New private home sales see best September sales in 7 years

READ: Singapore private home prices climb 0.9% in Q3

The number of new homes sold in the Core Central Region (CCR) in October tripled to 182 units from the month before, the highest since March 2016.

Singaporeans accounted for 133 of the 182 units bought in the CCR.

The improved performance was mainly driven by three new launches in the area – Neu at Novena, Midtown Bay Residences and Royalgreen, analysts noted.

The only other new launch this month was Midwood, located in the Outside of Central Region (OCR). The lack of major launches in the city fringe and mass-market segments like the OCR could have contributed to the sales decline, said OrangeTee and Tie head of research and consultancy Christine Sun.

“Sales volumes tend to be lower when more luxury projects are being launched in a particular month, owing to the higher price tags and lower affordability,” the analyst said.

In October, there were five non-landed new home sales worth above S$5 million, three of which were transacted at S$10 million and above. The three homes were all large-sized (above 250 sqm) units at luxury condo Boulevard 88.

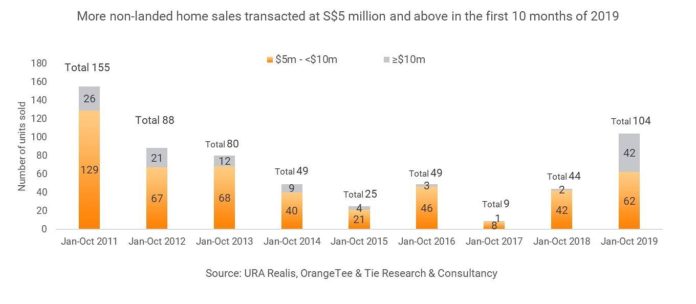

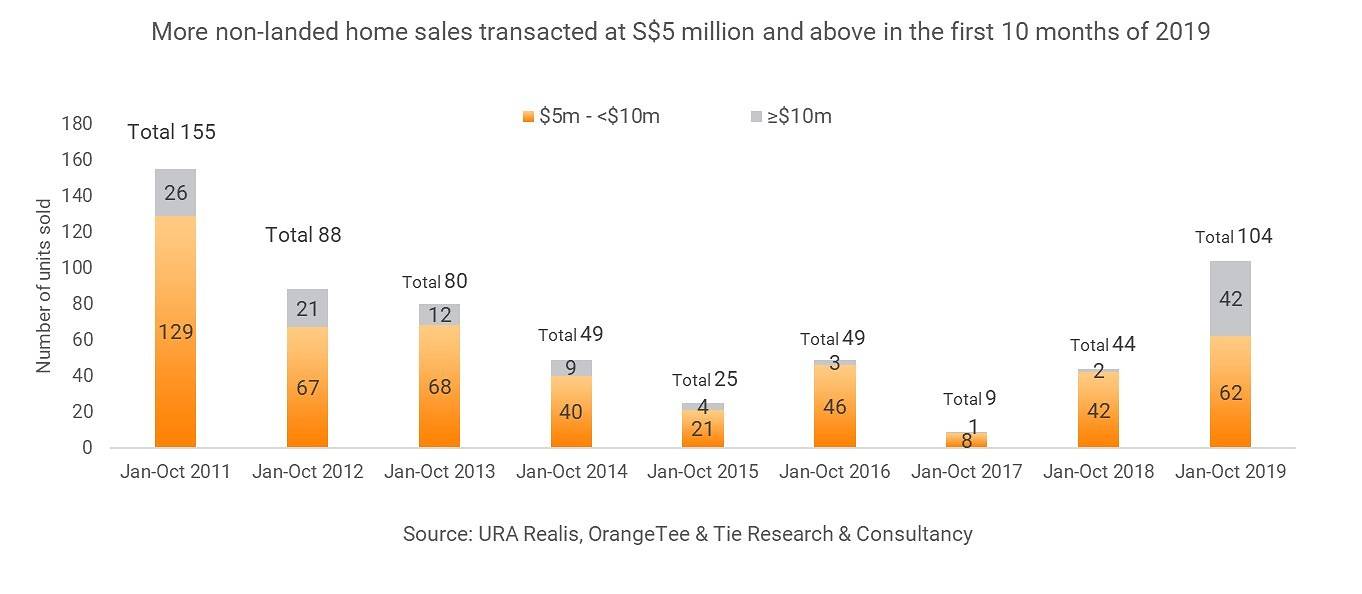

2019 has seen 104 non-landed new home sales at S$5 million and above so far, the highest tally since 155 units were sold in Jan-Oct 2011, Ms Sun said, citing URA Realis data.

High-profile transactions such as British billionaire James Dyson’s purchase of the most expensive apartment in Singapore contributed to “significant positive sentiments for developer sales,” said property analyst Ong Kah Seng.

More luxury homes are expected to be sold in 2020 with the launch of high-profile projects such as One Holland Village, The Avenir, The Atelier, Van Holland and a new project at Kampong Java Road.

“Despite the global trade and geopolitical uncertainties, we believe demand for Singapore private homes is still relatively stable given the tight labour market, favourable interest rate environment, and relatively healthy household balance sheet,” said Ms Tricia Song, head of research for Singapore, Colliers International.

Mr Ong predicted that Singaporean properties will become increasingly attractive for foreign buyers seeking stable investments.

“There’s increasing international attractiveness of Singapore residential properties as offering longer term stability to all profiles of buyers, including from foreigners who are eschewing investments in Hong Kong due to that city’s heightening social turbulence,” he said.