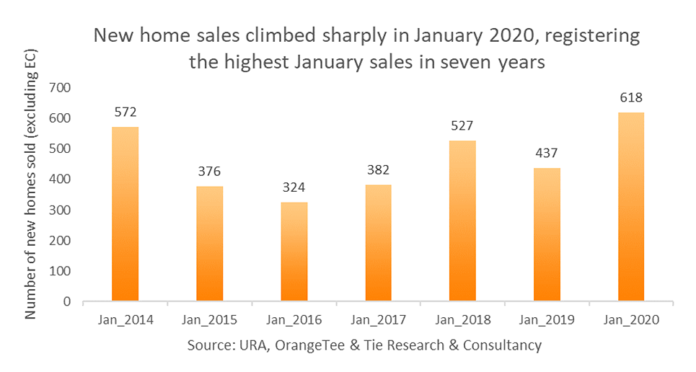

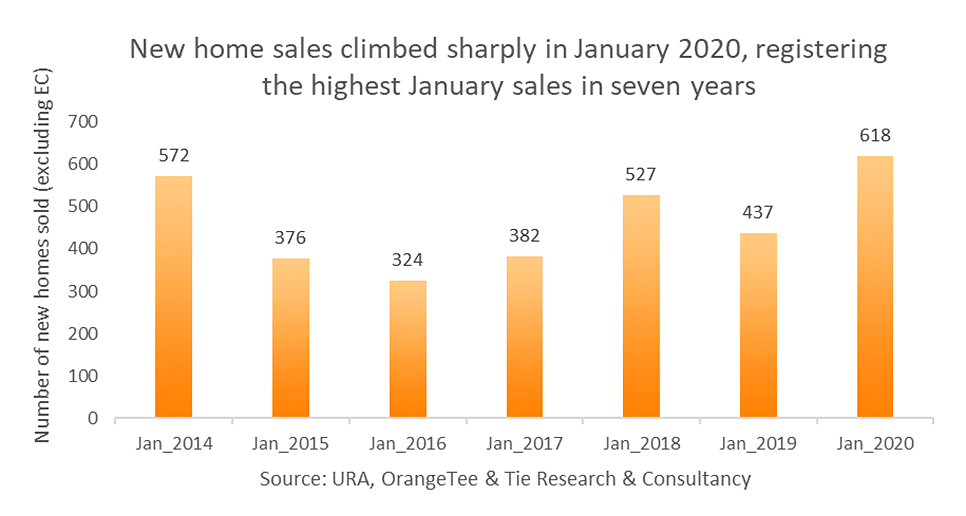

SINGAPORE: Sales of new private homes rebounded last month, marking the strongest January showing in seven years.

Developers sold 618 homes – excluding executive condominiums – last month, 14.9 per cent higher than the 538 units sold in the preceding month, data from the Urban Redevelopment Authority (URA) showed on Monday (Feb 17).

This was also 41.4 per cent more than the 437 units sold over the same period last year.

Last month registered the highest January new private home sales in seven years, according to an OrangeTee & Tie analyst.

Including executive condominiums, 638 units were sold, a 45.7 per cent increase over the 438 units sold in January 2019 and a 15.8 per cent increase on the 551 homes sold last December.

January’s sales take-up was led by projects in the city fringes or rest of central region (RCR), which accounted for 41.9 per cent (259 units) of total sales excluding executive condominiums, noted OrangeTee & Tie Head of Research and Consultancy Christine Sun.

This was followed by the surburban areas or outside central region (OCR), at 36.6 per cent (226 units).

The proportion of sales in the luxury segment or core central region (CCR) rose to its highest level since January 2019 at 21.5 per cent (133 units), said Ms Sun.

This could be attributed to more high-end projects launched in January, she said, including The Avenir, Leedon Green and Van Holland, which collectively sold 74 units last month.

NUMBER OF FOREIGN BUYERS STABLE IN CCR

Even within a “tumultuous” economic climate the number of foreign buyers entering the private property market in the CCR segment has remained stable, said PropNex Realty Chief Executive Officer Ismail Gafoor.

The segment saw a 32.3 per cent month-on-month increase of new private homes purchased by foreigners, he said, citing data from URA Realis.

On a month-on-month basis, the overall volume of CCR transactions increased by 60.2 per cent, he added.

ANALYSTS MIXED ON COVID-19 IMPACT

So far there seems to have been “no major impact” on the property market from the COVID-19 outbreak, said Ms Sun.

READ: Coronavirus cases in Singapore: Trends, clusters and key numbers to watch

The disease, which started in the Chinese city of Wuhan, has since spread to more than 25 countries.

In Singapore, 75 people have tested positive for the disease as of Sunday.

“There seems to be no major impact on the property market as of now, since it is not one of the sectors directly affected by the coronavirus unlike transport, retail, tourism and MICE (meetings, incentives, conferences and exhibitions),” said Ms Sun.

Many developers have also put in place precautionary measures at show flats to protect the health of customers, she added.

“Although it is not immediately clear how the epidemic will pan out, any impact could be temporary and may not cause a long-term adverse impact on the property market here,” she said, adding that Singapore has proven itself to be resilient amid crises such as the last Severe Acute Respiratory Syndrome (SARS) outbreak.

However, property analyst Ong Kah Seng said positive buying interest in January was set to change from February, as the novel coronavirus only reached Singapore shores in the last part of January.

As the disease spreads in Singapore, private residential sentiments “will be more cautious” with selective buying (but “not pessimistic sentiments”) setting in until the middle of the year, he predicted.

Property buyers will be “realistic, prudent and highly selective” as the disease dampens global economies, affecting job stability and “longer term mortagage servicing capabilities by Singaporeans with limited affordability”, he said.

“Only ‘contrarian mindset’ buyers with utmost confidence and strong affordability capacity will rush in to opportunistically grab a choice unit from developers, likely priced attractively at such challenging economic times and softened property market conditions following (the) COVID-19 coronavirus outbreak,” said Mr Ong.

PropNex’s Mr Ismail sounded an optimistic note, saying that historically most crises or downturns do not last long.

“When the storm calms, the tide of the market re-emerges with pent-up demand from buyers and investors,” he said.

“With the Government potentially announcing measures during the financial Budget to assist affected sectors and the resilient nature of the real estate market, we are likely expect(ing) new home sales volume to reach 9,000 to 10,000 units this year.”