SINGAPORE – It may be a while before the newly introduced NFC (Near-Field Communication)-enabled SIM cards become widely used in Singapore, but this is unlikely to impact the three telcos, DBS Group Research said in a note on Wednesday.

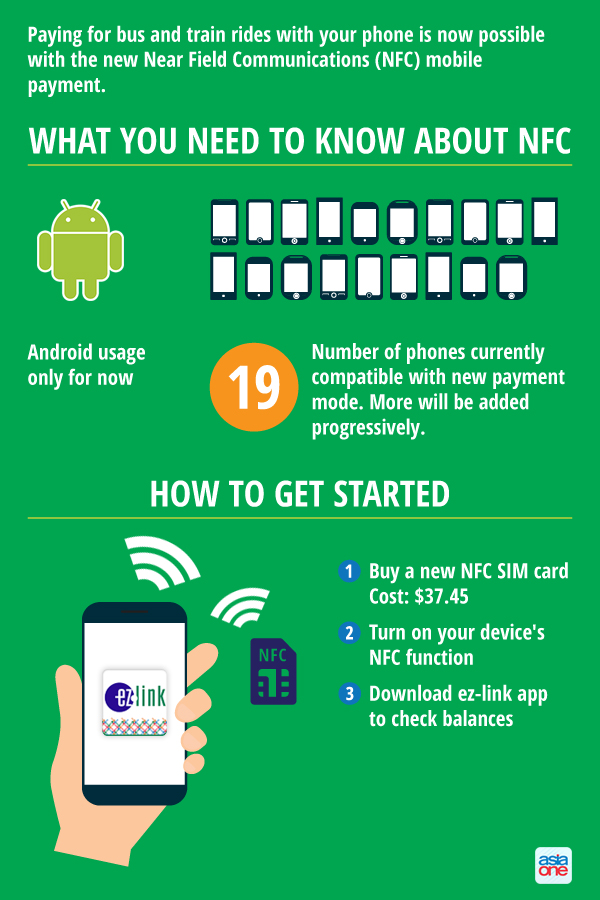

Reacting to Tuesday’s unveiling of these SIM cards, which let users pay for bus or train rides and shopping by tapping their NFC-enabled smartphones at over 30,000 EZ-Link acceptance points, DBS analyst Sachin Mittal said one reason the cards will not take off for now is that they are incompatible with the iPhone – which commands more than a third of the smartphone market in Singapore. The SIM cards can be used in 19 smartphone models, including those of LG, Samsung and Sony.

NFC comprises a set of communication protocols that enable two electronic devices – one of which is usually a portable device such as a smartphone – to establish communications by setting them near each other.

The iPhone supports only Apple Pay, a mobile payment and digital wallet service by Apple. iPhone users will thus see no reason to fork out nearly S$40 for each of these SIM cards.

Apple Pay has been “quite successful” in the US for its user-friendliness and security features, said Mr Mittal, who pointed out that Apple Pay makes contactless payments secure with “Touch ID” authentication. “Even if an iPhone is lost, it cannot be misused by anyone; a lost Visa payWave card, on the other hand, can be used by anyone.”

He added that NFC-enabled payments do not add any security feature to the user’s EZ-Link card; Apple Pay, on the other hand, offers security to credit-card transactions, “so we do not see that the NFC-enabled SIM-based payments will be widely used”.

Telcos may not get “much” commission from the transactions, given that the bulk could go to EZ-Link for the large customer base using NFC to pay for bus and train rides, Mr Mittal said.

“Most negatives are priced in for M1, which is trading at 14x FY16F PE (price earnings) and represents a 12 per cent discount to StarHub’s 16x. A potential upside will emerge only if there is no new entrant in the mobile sector.”

However, pending the possible entry of a new player, the identity of which he said would be clear only in Q3 2016, he maintains a “fully valued” rating on StarHub (with a target price of S$3.30) and a “hold” rating on M1 (S$2.60).

M1, the first to offer the cards, has priced them at S$37.45 each; StarHub’s cards, to debut on Saturday, will cost S$37.45 for new cards and S$26.75 for replacements for existing subscribers. Singtel customers will be able to buy the cards in late April at prevailing SIM rates, with no additional costs.

On Wednesday, M1 shares closed three Singapore cents higher at S$2.62; Singtel ended six Singapore cents higher at S$3.85. StarHub was unchanged at S$3.31.

This article was first published on March 31, 2016.

Get The Business Times for more stories.