Working mums could do with more help from the Government as they juggle their responsibilities at home and in the office, said MPs.

While they welcomed the measures in this year’s Budget to support young parents and families, 10 of the 25 MPs who spoke in Parliament yesterday had a slew of suggestions on ways to give them a boost.

Some want more childcare spaces for infants and a directory to match parents and nannies, while others want greater promotion of flexible work arrangements.

“Some working mothers, who are professionals, managers or executives in multinational companies, tell me that whenever a woman becomes pregnant, her career progression or promotion can be held back for one year,” said Ms Tin Pei Ling (MacPherson).

Added Nominated MP (NMP) and veteran unionist K Thanaletchimi: “Women should not be fearful of sacrificing their careers for a family.”

More infantcare facilities could be opened or expanded to give parents peace of mind that their babies would be looked after whenever they work late, said several MPs.

With a directory of nannies, parents could also leave the children in their care, suggested Ms Tin and Mr Gan Thiam Poh (Ang Mo Kio GRC).

Ms Tin said the Government could create an official directory online for parents to find potential caregivers in the neighbourhood.

Mr Gan said nannies’ hours tend to be more flexible, which would be helpful for parents who work shifts or long hours.

For mothers of newborns returning to work after maternity leave, more flexible work arrangements would help, said MPs.

Mr Christopher de Souza (Holland-Bukit Timah GRC) suggested that the Government come up with a law that gives working mums another eight weeks of either flexible work or no-pay leave, after the end of their 16 weeks of maternity leave.

“This way, more mothers can return to the workforce and increase their family income without compromising on their family life,” he said, adding that it could mean working from home or shorter work weeks.

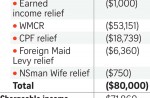

High-earning mums had four MPs championing their cause, following the introduction of a personal income tax relief cap of $80,000 in the Budget. They wanted to know the reason for the cap, which they said would hit these mums the hardest.

Ms Joan Pereira (Tanjong Pagar GRC) asked for it to be lifted for widowed or divorced mothers, as they tend to face more challenges like raising their children themselves.

Ms Tin, Mr Louis Ng (Nee Soon GRC) and Ms Lee Bee Wah (Nee Soon GRC) said working mums were upset at what the move signifies. “They feel singled out as their male contemporaries are generally unaffected,” said Ms Tin.

“Some wonder if this signals that senior job roles are not for mothers or that mothers should not have higher career aspirations.”

Ms Lee added that while the cap is expected to add $100 million a year in revenue, this should not come at the cost of driving high-income mothers out of the workforce, or reducing the number of children they add to the future workforce.

NMP Kuik Shiao-Yin, however, was critical of mothers who held such a view. She called for a change in this mindset “among some mums in the 1 per cent when they discovered they cannot claim tax relief above $80,000 anymore”.

The additional revenue, she noted, would support greater social spending.

Children of unwed parents should be included in upcoming schemes to give kids from less well-off families a leg up, argued four MPs as they called for the qualifying criteria of two schemes to be clarified.

These were the KidStart programme for young children who need support, and the Child Development Account First Step grant in which parents can receive $3,000 from the Government to use for their children’s healthcare and childcare, without first having to deposit $3,000.

Children of unwed parents have the same needs as their peers whose parents are married, said Mr Faisal Manap (Aljunied GRC) and Non-Constituency MP Dennis Tan.

“They should not be treated differently because of something their parents did,” said Mr Faisal.

charyong@sph.com.sg

This article was first published on April 6, 2016.

Get a copy of The Straits Times or go to straitstimes.com for more stories.