There will be more certificates of entitlement (COE) in the coming months and this is expected to drive vehicle prices down further.

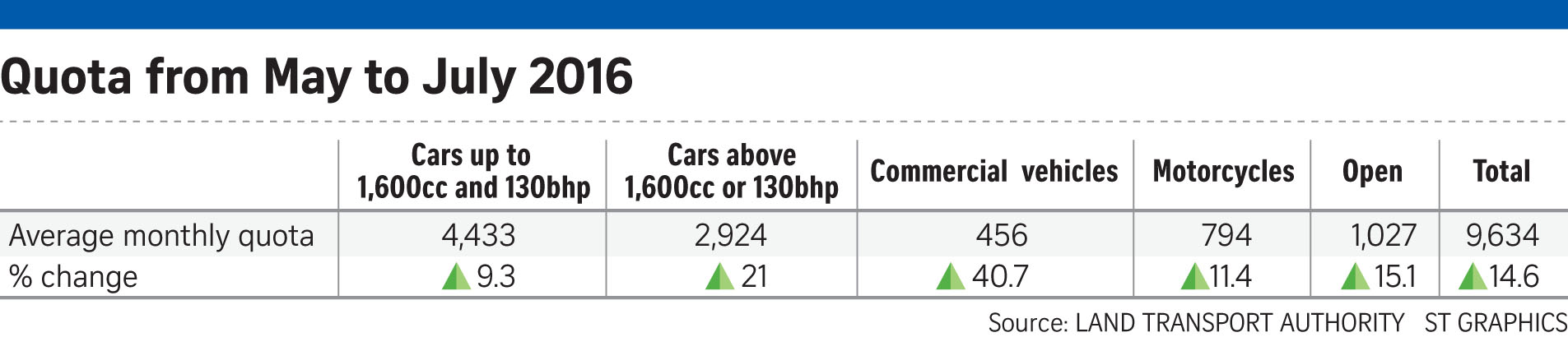

There will be 9,634 COEs a month, on average, from May to July. This is a 15 per cent increase from the previous three-month quota period.

Car COE numbers will rise by 14 per cent to 8,384 a month.

But the single biggest expansion will be in the commercial vehicle category, which goes up by 40.7 per cent to 456 a month.

The growth in COE supply, fuelled by the scrapping of old vehicles bought during the last supply bonanza about a decade ago, is expected to continue for another 18 months or so.

Bumper crop of COEs from May

There will be more certificates of entitlement (COEs) in the coming months which should, in turn, drive vehicle prices further south.

The Land Transport Authority (LTA) announced yesterday that there will be 9,634 COEs a month, on average, from May to July. This is a 15 per cent increase from the previous three-month quota period.

Car COE numbers will rise by 14 per cent to 8,384 a month. This includes the Open category COE, which is almost exclusively used to register bigger cars.

The big car COE supply will rise by 21 per cent, while the small car quota will go up by 9.3 per cent.

Overall, the single biggest expansion will be in the commercial vehicle category. It goes up by 40.7 per cent to 456 a month.

Motorcyclists will see an 11.4 per cent increase in supply, to 794 COEs a month.

That the COE supply would grow is no surprise. The trend, fuelled by the scrapping of old vehicles bought during the last supply bonanza about 10 years ago, is expected to continue for another 18 months or so.

But the quantum of the latest increase was somewhat of a surprise.

Mr Ron Lim, general manager of Nissan agent Tan Chong Motors, said: “The numbers look much higher than expected. March deregistrations must have been very high.”

Indeed, according to data just released by the LTA, 13,580 vehicles were scrapped last month – 46 per cent more than the average of the preceding two months.

The figure would have been even bigger if not for a small wave of COE extensions. About 10 per cent of expiring car COEs are extended, when owners pay the so-called prevailing quota premium – a moving average of COE prices over the previous three months.

Previously, extensions seldom amounted to more than 5 per cent of an expiring batch of COEs.

The current trend to extend COEs is driven by relatively high car prices – which have not fallen fully in tandem with COE prices – restrictions on car loans, and rental companies which are building up a fleet of private-hire vehicles in response to third-party taxi apps such as Uber and Grab.

Still, the COE supply ahead will be enough to soften premiums further.

Mr Neo Nam Heng, chairman of diversified motor group Prime, said: “This latest supply should make many consumers happy.”

Besides the increased supply, he said prices will be driven down by other factors, such as the weakening economic outlook, and the easing of monetary policies.

The latter, he added, would raise the cost of car imports and erode profit margins. That in turn, will suppress the ability of motor companies to bid for COEs, weakening premiums further.

This article was first published on April 16, 2016.

Get a copy of The Straits Times or go to straitstimes.com for more stories.