SINGAPORE: The incomes of resident households in Singapore have been rising faster than their spending compared to five years ago, according to a newly released government survey on Wednesday (Jul 31).

Conducted by the Singapore Department of Statistics (SingStat), the Household Expenditure Survey 2017/18 also found improvements in the standard of living here.

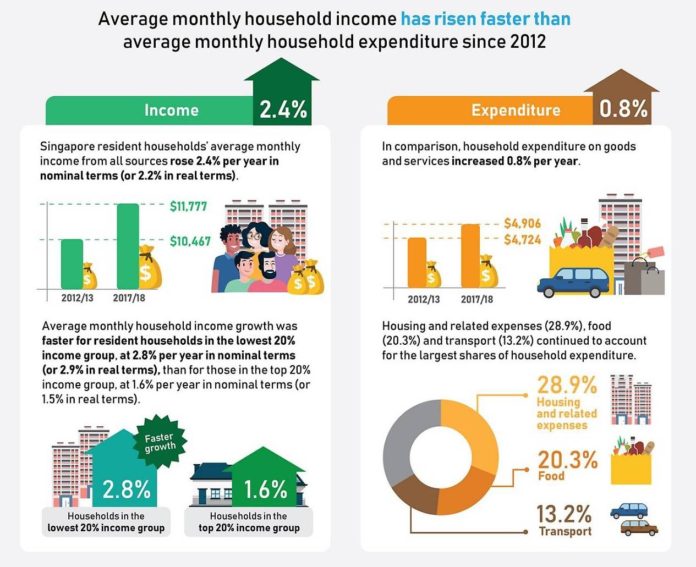

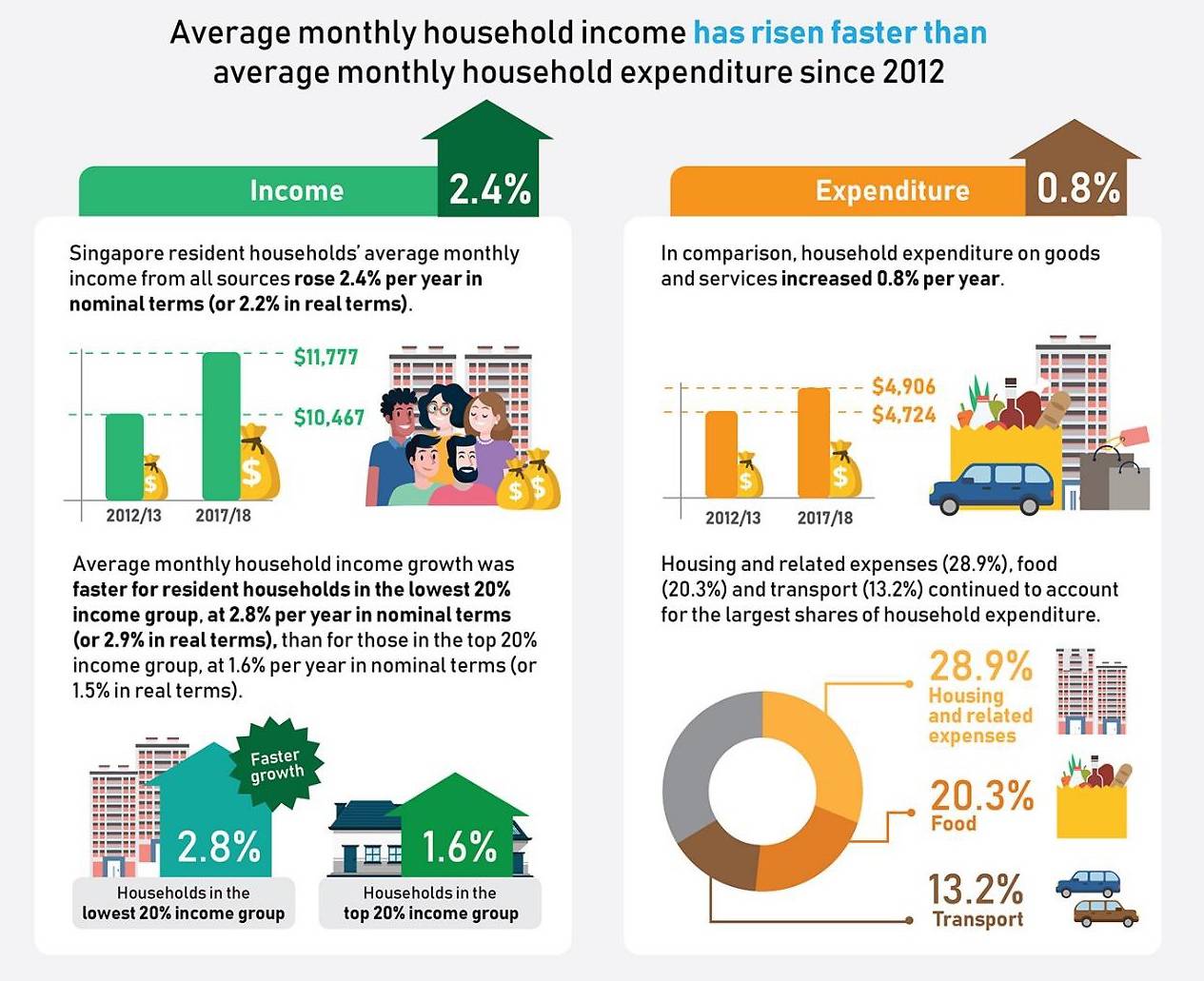

Resident households’ average monthly household income from all sources – defined as regular income from employment, business, investment and others, as well as regular government transfers such as the Workfare Income Supplement – was S$11,780, up from S$10,470 in 2012/13 when the survey was last conducted.

This was an increase of 2.4 per cent per annum in nominal terms, or 2.2 per cent a year in real terms after factoring in inflation.

Average nominal and real monthly household income rose for all income groups over the last five years.

For households in the top 20 per cent, their income increased by 1.6 per cent a year in nominal terms, or 1.5 per cent in real terms.

Other income groups saw a rate of 2.7 to 3.3 per cent per annum in nominal terms, or 2.4 to 3 per cent in real terms. Specifically, households in the bottom 20 per cent clocked average monthly income growth of 2.8 per cent a year in nominal terms, or 2.9 per cent in real terms.

Across housing types, those living in HDB 1- and 2-room flats experienced the highest income growth at 6.3 per cent per annum in nominal terms, or 6.1 per cent in real terms.

READ: Singapore household incomes grew in 2018, income inequality stable

EXPENDITURE TRENDS

In terms of expenditure, households spent an average of S$4,910 a month on goods and services, compared with S$4,720 in the previous survey conducted five years ago. This translates into an increase of 0.8 per cent per annum.

“Household income rose faster than household expenditure on an overall and per household member basis over the five-year period,” said SingStat in its press release detailing the survey results.

Average monthly household income has risen faster than average monthly household expenditure since 2012. (Graphic: SingStat)

Across income groups, the average monthly expenditure of households in the top fifth remained relatively stable over the last five years.

On the other hand, households in the other income groups saw increased spending by 0.4 to 3 per cent per annum.

Breaking down by housing types, households staying in HDB 4-room flats, condominiums and other apartments, and landed properties had generally stable average monthly expenditure.

By contrast, the monthly expenditure of households staying in HDB 1- and 2-room, 3-room, and 5-room and executive flats increased by 0.8 to 3.7 per cent per annum.

SingStat said that across income groups and housing types, income growth generally outpaced expenditure growth, except for households in the lowest 20 per cent income group.

These families were the only group whose expenditure growth of 3 per cent per annum outpaced income growth in nominal terms, which was 2.8 per cent a year. Over a third of these households were headed by persons aged 65 years and above in 2017/18, the press release said.

Shedding more light on household spending here, the survey said housing (28.9 per cent), food (20.3 per cent) and transport (13.2 per cent) made up the largest shares of monthly household expenditure.

Collectively, they contributed to 62 per cent of monthly household expenditure, slightly below the 65 per cent recorded in the previous survey.

The average expenditure on transport declined from S$810 a month to S$780 over the last five years, mainly due to a fall in spending on private road transport from S$580 to S$510.

Average expenditure on bus and MRT/LRT fares also decreased by an average of S$6 over the same period, while average expenditure on taxi and private hire car services rose by S$10.

However, families are spending more on dining out, according to the survey.

On average, households spent S$810 a month on food serving services in 2017/18, up from S$760 per month in 2012/13.

While meals at hawker centres and food courts continued to make up the bulk of expenses in this area, the increase was mainly due to higher spending in restaurants, cafes and pubs.

Online expenditure also increased with the growth of e-commerce.

About 60 per cent of households reported online purchases in 2017/18, up from 31 per cent in 2012/13. The share of online expenditure also rose from 1.7 per cent to 5 per cent over the same period.

READ: Cost of living in Singapore: Slow overall inflation but some pressure points

IMPROVED LIVING STANDARDS

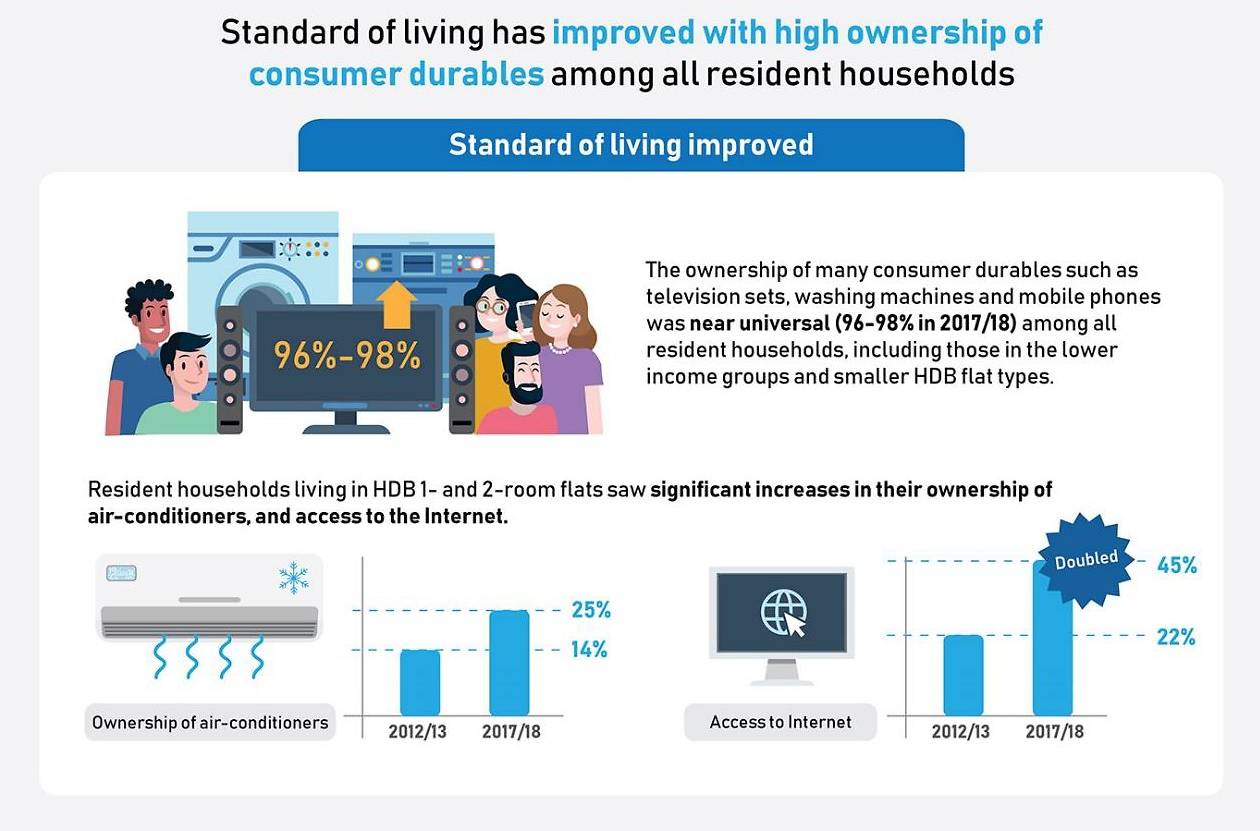

The survey also indicated improvements in standards of living, as well as technological and lifestyle changes, with a high ownership of consumer durables among all resident households here.

Standard of living has improved with high ownership of consumer durables among all resident households. (Graphic: SingStat)

According to SingStat, the ownership of consumer durables, such as television sets, washing machines and mobile phones, was “near universal” at between 96 and 98 per cent in 2017/18. This includes those in the lower income groups and smaller HDB flat types.

At the same time, households in the bottom 20 per cent income group and HDB 1- and 2-room flats saw significant increases in their ownership of air-conditioners, as well as Internet access.

For example, 25 per cent of households living in HDB 1- and 2-room flats owned an air-conditioner in 2017/18, up from the 14 per cent in 2012/13.

Over the same period, Internet subscription rates among these families doubled from 22 per cent to 45 per cent.

On the other hand, the ownership of items, including residential telephone lines, digital cameras and Pay TV, generally fell for households in most income groups and housing types.

This is “possibly due to the availability of substitutes such as mobile/smart phones and online video streaming platforms”, SingStat said.

Car ownership also declined, likely on the back of more transportation alternatives, added the survey.

Home ownership rate among resident households remained high at 89 per cent in 2017/18.

Among households in the bottom fifth income group, the proportion of home owners rose to 85 per cent last year, from 82 per cent five years ago.

The Household Expenditure Survey, which collects information on households’ expenditure, income, savings and selected household characteristics, is carried out by SingStat once every five years.

The year-long survey started in October 2017 and concluded in December 2018.