SINGAPORE: In a bid to cut overall sugar intake, the Ministry of Health (MOH) has started consulting the public on four possible measures that include banning and taxing some pre-packaged sugar-sweetened beverages (SSBs).

The other proposed measures are tightening regulations on the advertising of less healthy food and drinks to children, and implementing a mandatory front-of-package label that indicates how healthy the SSB is.

On average, Singaporeans currently consume more than 1,500 teaspoons of sugar from pre-packaged sugar-sweetened beverages every year.

SSBs refer to drinks containing added sugar as well as juices with naturally occurring sugars. Pre-packaged SSBs include dry mixes like three-in-one coffee powder, cordial, soft drinks, isotonic drinks, commercial fruit juices and regular yoghurt drinks.

Pre-packaged SSBs do not include bubble tea and freshly-brewed drinks like a Starbucks frappucino or teh from a hawker centre.

WHY NOW?

The public consultation comes as Singapore has the highest prevalence of diabetes among developed nations, with almost one in nine people having the illness.

“High sugar intake is linked to increased risk of obesity and diabetes,” MOH said in a media release on Tuesday (Dec 4). “The number of Singapore residents with diabetes is projected to reach one million by 2050 if nothing is done to curb the rising trend.”

Singaporeans are also consuming an average of 12 teaspoons (60g) of sugar every day, with more than half of this coming from SSBs. Of this source, pre-packaged SSBs make up 64 per cent.

Furthermore, medium and higher sugar products – defined as those with at least four teaspoons of sugar per 250ml serving – make up more than half of the total sales of pre-packaged SSBs in Singapore.

Diabetes is currently the second leading cause of ill health of Singapore, behind Ischemic Heart Disease. (Photo: Reuters/Muhammad Hamed)

While Health Promotion Board (HPB) chief executive officer Zee Yoong Kang said the Government has made “quite significant progress” in tackling diabetes through voluntary measures and public education, he said more can be done to reduce the proportion of higher sugar drinks in the market.

According to GlobalData, 80 per cent of all pre-packaged non-alcoholic drinks sold in Singapore are SSBs, with the remainder being pre-packaged water.

“So now we are looking to consult the public on whether we can take a more regulatory-style approach to try to reduce the sugar content in these drinks,” Mr Zee added.

BANNING HIGHER SUGAR PRE-PACKAGED SSBs

The first measure under consideration is implementing a nationwide ban on the sale of higher sugar pre-packaged SSBs, which contain at least 5.5 teaspoons of sugar per 250ml serving, to discourage consumption.

The proposed measures come as the Government looks to step up its war on diabetes.

While SSBs with more than three teaspoons of sugar per 250ml serving cannot be sold in schools and on Government premises, MOH said consumers can still get these drinks elsewhere.

Furthermore, MOH said the public has called for the industry to lower its sugar threshold further, following a pledge by seven major SSB producers last year.

READ: 7 major soft drinks manufacturers in Singapore to reduce sugar content in drinks

These producers, which include Coca-Cola, Nestle and Yeo Hiap Seng, pledged to limit the sugar content in their Singapore-sold products to no more than six teaspoons per 250ml serving. However, MOH said many drinks in the market still contain high levels of sugar.

TAXING MANUFACTURERS AND IMPORTERS

The second measure is imposing a tax on manufacturers and importers of pre-packaged SSBs to encourage the industry to reformulate and reduce sugar content in their products. This could help alter the public’s palate and reduce demand for sweet drinks, Mr Zee said.

According to the World Cancer Research Fund Nourishing database, about 45 jurisdictions including Brunei, Thailand and Mexico have imposed taxes on sugar-sweetened beverages. (Photo: Pixabay/igorovsyannykov)

“Globally, jurisdictions have required manufacturers and importers to pay duties around 10 to 35 per cent of the SSB retail price,” MOH said. This means that for a 250ml SSB, the tax would range from S$0.05 to S$0.18.

While MOH acknowledged that manufacturers might pass the tax on to consumers, it said consumers can still choose from a “wide range of options”, including water or healthier SSBs unaffected by the tax.

If the tax is passed on, Mr Zee said he hopes “the increase in price would also serve to encourage consumers to choose the many other alternatives that hopefully will come on and have less sugar”.

READ: Will a sugar tax work in Singapore?

READ: Coca-Cola to help tackle diabetes scourge, but sugar tax won’t help: CEO

The tax itself can come in a flat or tiered form. A flat tax would involve the same rate for all SSBs containing sugar levels beyond a certain threshold. A tiered tax would involve lower rates for SSBs with lower sugar levels.

MOH said a flat tax would be simpler to understand and easier to implement, although manufacturers would see less incentive to drastically reduce sugar levels in their products and compromise taste.

In contrast, a tiered tax would provide more targets for the industry to reduce sugar levels progressively.

This year, the United Kingdom imposed a two-tier tax on SSB manufacturers: £0.04 (S$0.07) per 250ml for SSBs with 2.5 teaspoons of sugar or more, and £0.06 per 250ml for SSBs with four teaspoons of sugar or more.

READ: Britain’s sugar tax on soft drinks comes into effect

READ: Protests as Sri Lanka cuts tax on sugary drinks

According to UK government data, this has resulted in more than half of the manufacturers reducing the sugar in their drinks. The proportion of SSB products in the UK market with four teaspoons of sugar or more also dropped from 57 to 42 per cent two years after the announcement.

MOH stated that the tax will not be a form of revenue generation, adding that the Government will continue to support manufacturers which choose to reformulate.

TIGHTENING ADVERTISING REGULATIONS

The third measure is tightening the regulations on the advertising of less healthy food and drinks to children to reduce consumption.

This includes making current restrictions mandatory and expanding them to include more television time-belts and mass media channels, or banning such advertising across all time-belts and channels.

Singapore has voluntary guidelines to limit such advertising to specific television time-belts. For example, the restrictions apply to Okto from 9am to 9pm on weekdays. Online, there are limited restrictions on four children’s websites and none on social media.

“Children are increasingly exposed to advertisements outside these restrictions,” MOH stated.

MANDATORY FRONT-OF-PACK NUTRITION LABEL

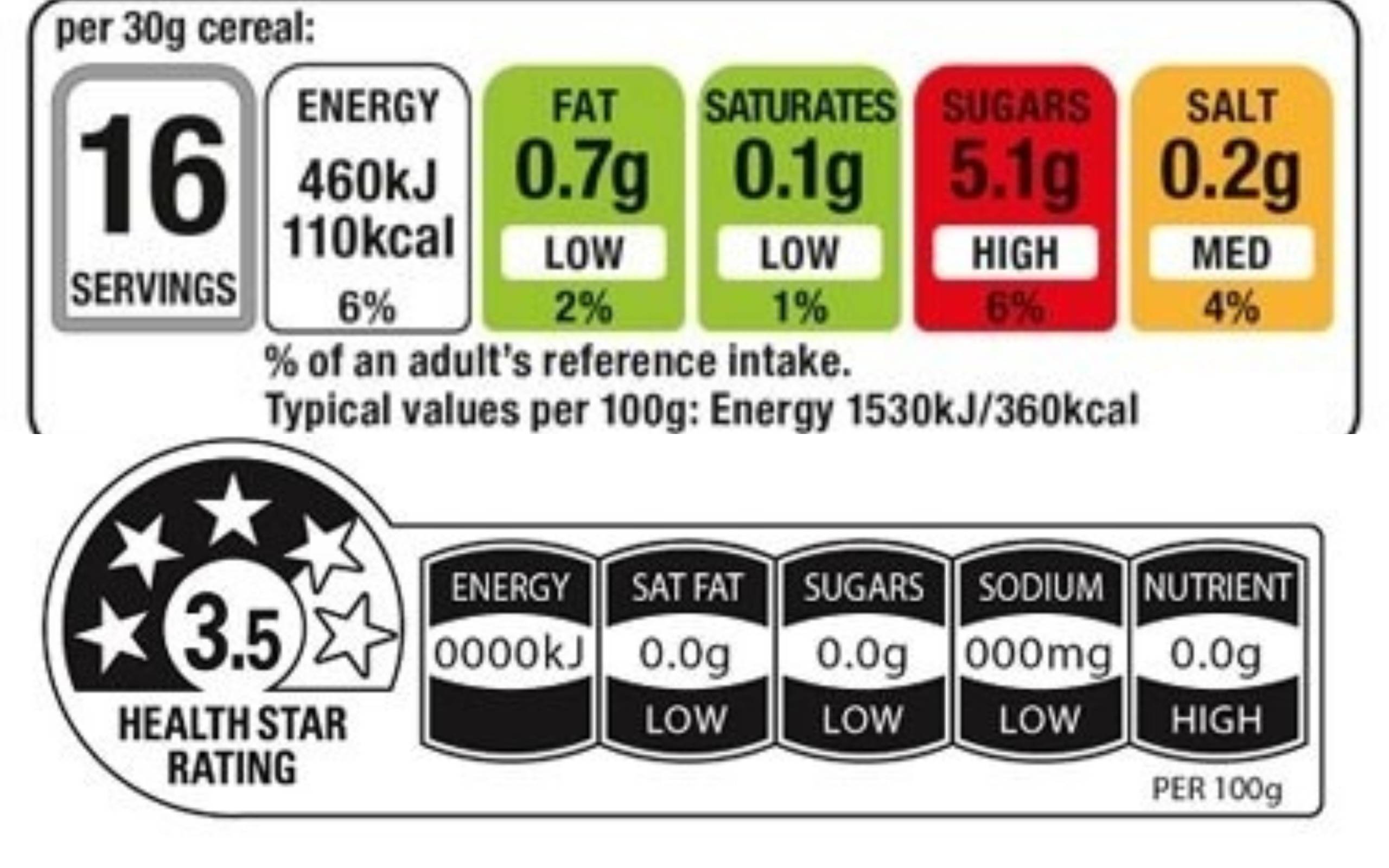

The fourth measure is introducing a mandatory front-of-pack nutrition label to help consumers make healthier choices. These labels, which are found in countries like France, Australia and New Zealand, can mark out the full range of SSBs, from healthier to less healthy.

These front-of-pack nutrition labels are found in countries like Ecuador, South Korea and New Zealand. (Photo: MOH)

“Evidence has shown that front-of-pack nutrition summary labels, as compared to a full listing of nutrition information, are more effective in helping consumers easily identify products with higher sugar content and/or poorer nutrition quality,” MOH said.

The labels can also complement the Healthier Choice Symbol programme, which is voluntary and only indicates the healthier choices, the ministry added.

WHEN WILL THE MEASURES BE IMPLEMENTED?

MOH said the four measures are not mutually exclusive, meaning they could be implemented in different combinations. Depending on public feedback, none of the measures could be implemented as well.

READ: A commentary on why a tax on sugary drinks is not enough on their own to halt obesity in Asia

The public can submit their views and other suggestions through the REACH website from Tuesday till Jan 25, 6pm next year. As part of the consultation, MOH and HPB will also organise dialogues with the public as well as the SSB and advertising industry.

And if a potential implementation proves successful, Mr Zee said there is scope to expand the measures to other types of SSBs.

When asked when the measures could possibly be implemented, MOH declined to commit to a timeline, stating that it wants to gather public feedback first. But overseas experience indicates that imposing something like a tax on SSBs could take between two to three years.

READ: Singapore’s approach to war on diabetes ‘generally in right direction’: Health Minister Gan Kim Yong

Still, Mr Zee rejected the notion that given Singapore’s growing diabetes problem, the country is too slow in implementing these measures.

“All our measures show that Singapore has been leading the world in terms of sugar reduction through voluntary measures,” he said, pointing out that sugar content in drinks has gone down “very significantly” over the past decade.

“I think it is not because we feel that we have not made enough progress, but we really want to do more to get the sugar down as low as possible.”