SINGAPORE: The Monetary Authority of Singapore (MAS) said on Tuesday (Jan 25) that it was tightening monetary policy settings amid a further upward shift in Singapore’s inflation outlook.

The adjustment is outside of MAS’s normal cycle of twice-yearly monetary policy reviews, usually in April and October.

The MAS will increase the rate of appreciation in its monetary policy band “slightly”, given the risk of a near-term rise in core inflation.

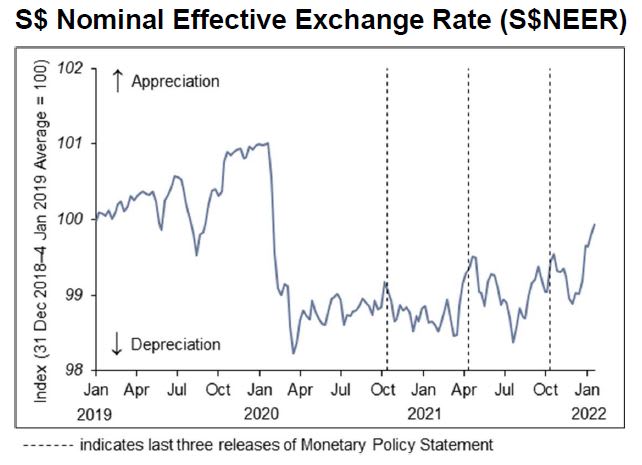

The center width and level of the Singapore Dollar Nominal Effective Exchange Rate (S$NEER) policy band will not change.

“The move builds on a pre-emptive shift to an appreciation stance in October 2021 and is appropriate to ensure price stability in the medium term,” MAS said.

MAS manages monetary policy through exchange rate settings rather than interest rates, allowing the Singapore dollar to rise or fall within an undisclosed range against the currencies of its major trading partners.

It adjusts policy through three levers: the slope, midpoint and width of the policy band, or SGD NEER.

In its assessment last October, the MAS shifted the SGD nominal effective exchange rate band from the previous 0% to a gradual appreciation path.

The authorities said that since the last monetary policy statement last October, “Singapore’s inflation outlook has shifted further upwards, reflecting global and domestic factors”.

“The MAS therefore assesses that another pre-emptive adjustment to its monetary policy stance is appropriate at this juncture,” it said.

MAS is revising its inflation forecast for this year. Core inflation is now expected to be 2% to 3% this year, up from 1% to 2% expected in October.

Meanwhile, CPI-All Items inflation is forecast at 2.5% to 3.5%, compared with a previous forecast range of 1.5% to 2.5%.

In the past three months, the Singapore dollar nominal effective exchange rate has generally appreciated in the upper half of the policy band, the authorities said.

Higher inflation outlook

Singapore’s inflation outlook has turned higher since October amid a recovery in global demand and “ongoing supply-side frictions”.

“Upside risks to inflation remain due to the impact of the pandemic and geopolitical shocks on global supply chains,” MAS said.

Energy prices rose further, while imported food inflation remained high due to regional supply disruptions, MAS added.

The authorities noted that core inflation rose between October and December last year.

Core inflation rose to 1.5% in October — the highest level in nearly three years — and to 1.6% in November.

Data on Monday showed that core inflation rose to 2.1% in December, mainly due to a rise in service sector inflation due to a surge in air ticket prices.

“The CPI for airfare also rose sharply, largely reflecting the cost of COVID-19 testing requirements for international travel,” the MAS said, referring to the consumer price index.

MAS said the domestic labour market had tightened, with resident unemployment now close to pre-pandemic levels and wage growth above historical averages.

“Against this backdrop, price increases for various goods and services were stronger than expected,” the authorities said.

It expects core inflation may pick up and hit 3% by the middle of the year before slowing.

Growth prospects unchanged

MAS said Singapore’s gross domestic product (GDP) growth forecast for 2022 was unchanged at 3% to 5% “barring new disruptions”.

It noted that in the fourth quarter of 2021, the economy expanded by 2.6% quarter-on-quarter, stronger than the previous quarter, according to advance estimates released earlier this month.

“With the gradual easing of domestic security management measures and border restrictions, the economic recovery so far led by trade-related and modern service industries should extend to domestic and tourism-related industries this year,” Maas said.

It added that the global economic outlook is “basically intact”.

“The emergence of Omicron variants in late 2021 may temporarily suppress specific clusters of activity, but is unlikely to derail the broader sustained economic recovery,” MAS said.