SINGAPORE: A local singer was fined S$30,600 on Friday (Oct 10) for evading tax on goods she had bought overseas and intended to sell in Singapore.

Nur Sarah Aqilah Sumathi, 35, pleaded guilty to two charges of fraudulent evasion of Goods and Services Tax (GST), with another five charges taken into consideration in sentencing.

If she does not pay the fine, she will have to serve 55 days’ jail in default.

Sarah, who is better known as Sarah Aqilah, paid S$10,000 upfront on Thursday and was given until Dec 10 to pay the rest.

The court heard that Sarah, who won reality singing competition Anugerah in 2009, was a personal shopper.

Singapore Customs began investigating her business activities of selling branded goods bought from overseas after receiving a tip-off.

Its investigation found that Sarah travelled to Europe to buy branded goods such as handbags, wallets and shoes, and took these back to sell in Singapore without paying tax for them.

In 2017, she expanded her business and started to provide personal shopping and concierge services for her clients during her travels, via social media platforms.

She also did not declare these goods nor pay GST for them on returning to Singapore, said the Singapore Customs prosecutor.

Investigations found that Sarah did not declare 141 pieces of branded goods which she had bought overseas between June 2015 and November 2017.

These goods were worth more than S$205,980 in total, and she evaded about S$14,460 in tax, said Singapore Customs in a statement.

She was stopped by Customs officers on Jan 23 last year when returning from a trip overseas, and her purchased items were seized.

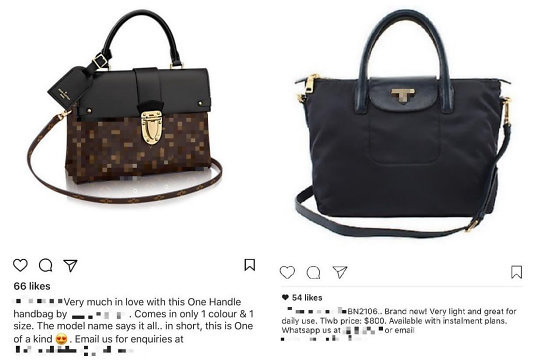

Two of the branded goods for sale on Sarah’s Instagram account. (Photo: Singapore Customs)

The prosecutor on Thursday asked for a fine of at least five times the duty evaded, noting that Sarah had made restitution of the full S$14,460 to Singapore Customs and had cooperated with the authorities.

Defence lawyer Sofia Bakhash said her client was the director of BFF Avenue, a personal shopping service which was incorporated in January 2017.

“Sarah asserts that she had been law-abiding and a functioning member of society and that her commission of the offence was due to her ignorance of the law,” she said.

“She is by trade a personal shopper and her business thrives on her primary ability to purchase the designer items overseas at a discounted price,” said the lawyer.

Sarah’s services involved her travelling personally to the country of origin of the designer items requested by her customers and buying them directly.

She then travelled at least three times a year to fulfil the orders, and carried the purchases in her suitcase.

MINIMAL AMOUNT EVADED: DEFENCE

The lawyer said the amount of duty evaded in the proceeded charges was S$6,184, and “its minimal amount should be taken as a mitigating factor”.

She added that since January 2018, Sarah has obtained permits and made the necessary duty payments after appointing a shipping company in Singapore to act as a declaring agent for her item imports.

The lawyer urged the court to impose a fine that was not “too crushing”, taking into account that the profit she gained from the items was “not significant”.

She sought the lowest possible fine, saying it was “not a syndicated operation but rather a woman who was trying to earn a living through a means she knew would appeal to a certain demographic of people”.

The lawyer added that Sarah has “suffered some setbacks in her media appearances” after the incident was reported in the news, and “faces the possibility of losing that as a source of income”.

Her husband, a real estate agent, has also “suffered a cut due to his association with Sarah”.

Sarah, who has three young children, is also facing civil proceedings against her and has had to take out loans to finance the repayments of the undelivered items and GST.

“She is indeed remorseful for the ordeal and hopes to be able to put this behind her at the earliest possible juncture,” said the lawyer.

Singapore Customs said in a statement after the hearing that “it is the responsibility of all arriving travellers to make accurate and complete declaration of the dutiable and taxable items in their possession of duty and GST payment”.

Anyone found guilty of fraudulent evasion of GST can be fined up to 20 times the amount of evaded tax, jailed for up to two years, or both.