SINGAPORE: Starting Nov 30, those borrowing from moneylenders will be subject to loan caps based on their income, the Ministry of Law said on Friday (Nov 16).

The new regulations, first announced on Oct 4, will apply to Singapore citizens and permanent residents, as well as foreigners residing here.

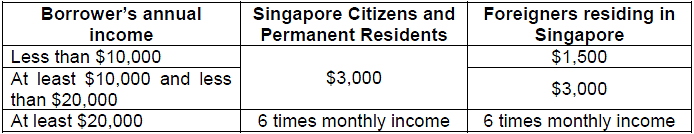

Singaporeans and PRs earning less than S$20,000 a year will be able to borrow up to S$3,000, no matter how many moneylenders they approach.

Those earning above this amount may borrow up to six times their monthly income – which means someone earning S$48,000 a year could borrow up to S$24,000 from moneylenders.

Foreigners will be subject to lower loan caps.

Borrowing limits on personal loans will come into force on Nov 30, 2018. (Table: MinLaw)

A self-exclusion system for borrowers to opt out from taking additional loans will also be put in place. Moneylenders are prohibited from lending to a person who has applied for self-exclusion. This will help those participating in debt assistance schemes, which typically require self-exclusion, the ministry said.

Implementation of the self-exclusion system is ongoing and more details will be announced at a later date, it added.

READ: Plan to cap loans from licensed moneylenders to protect people from borrowing too much

A regulatory framework has also been introduced for the Moneylenders Credit Bureau, which “places obligations” on the bureau and licensed moneylenders to keep borrowers’ data secure and confidential.

REGISTRAR TO VET NEW EMPLOYEES AND SHAREHOLDERS

Moneylenders seeking to employ an assistant will need to get approval from the Registrar of Moneylenders. This is done “to prevent undesirable characters from entering the moneylending industry”, the ministry said.

The registrar’s approval will also be needed for anyone to become a substantial shareholder of, or increase his substantial shareholdings in, a moneylending company.

In addition, it is now an offence for a licensed moneylender to enter into a loan contract that breaches regulatory caps on interest and fees.

READ: Changes to Moneylenders Act to help improve protection for borrowers

The new regulations, which come under the first phase of amendments to the Moneylenders Act, will provide better protection for borrowers and strengthen the regulation of licensed moneylenders, the law ministry said.

A second phase to professionalise the industry will take effect in the first quarter of next year. New rules under this phase include requiring moneylenders to be incorporated as companies limited by shares with a minimum amount of paid-up capital of S$100,000, and to submit annual audited accounts to the Registry of Moneylenders.

“Together, these improvements to the moneylending regime will help to ensure that borrowers have safe access to personal credit,” the ministry said.