SINGAPORE: Central Provident Fund (CPF) members will continue to earn interest at 2.5 per cent per annum on their Ordinary Account (OA) and at 4 per cent per annum on their Special and Medisave accounts (SMA) between Jul 1 and Sep 30.

The concessionary interest rate for Housing and Development Board (HDB) mortgage loans – pegged at 0.1 per cent above the OA interest rate – will remain unchanged at 2.6 per cent per annum for the same period.

The CPF Board and HDB announced the rates in a joint news release on Wednesday (May 15).

READ: New rules on buying properties using CPF, HDB housing loans to kick in on Friday

An additional 1 per cent interest will continue to be paid on the first S$60,000 of their combined balances, earning CPF members up to 3.5 per cent on their OA and 5 per cent per annum on their SMA.

CPF members aged 55 and older will also get an additional 1 per cent interest on the first S$30,000 of their combined balances, earning them up to 6 per cent interest per year on their retirement balances.

As announced last September, the interest rate for the Retirement Account in 2019 is 4 per cent.

NEW RULES ON HOUSING PURCHASE USING CPF, HDB LOANS

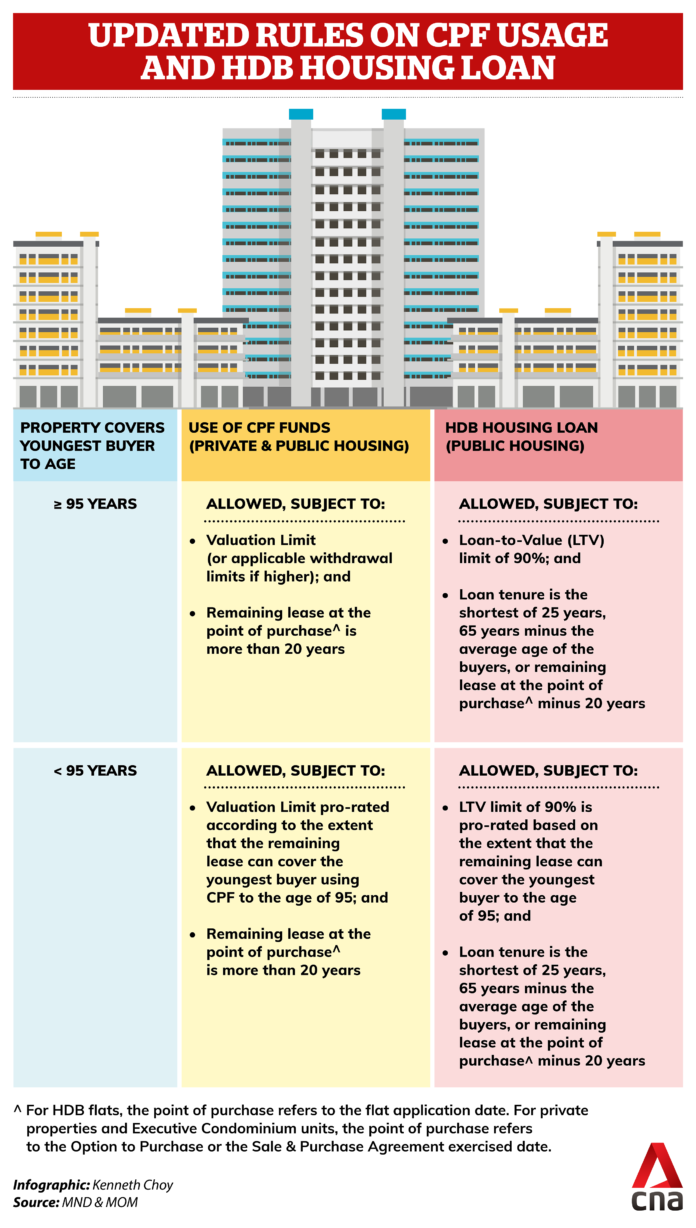

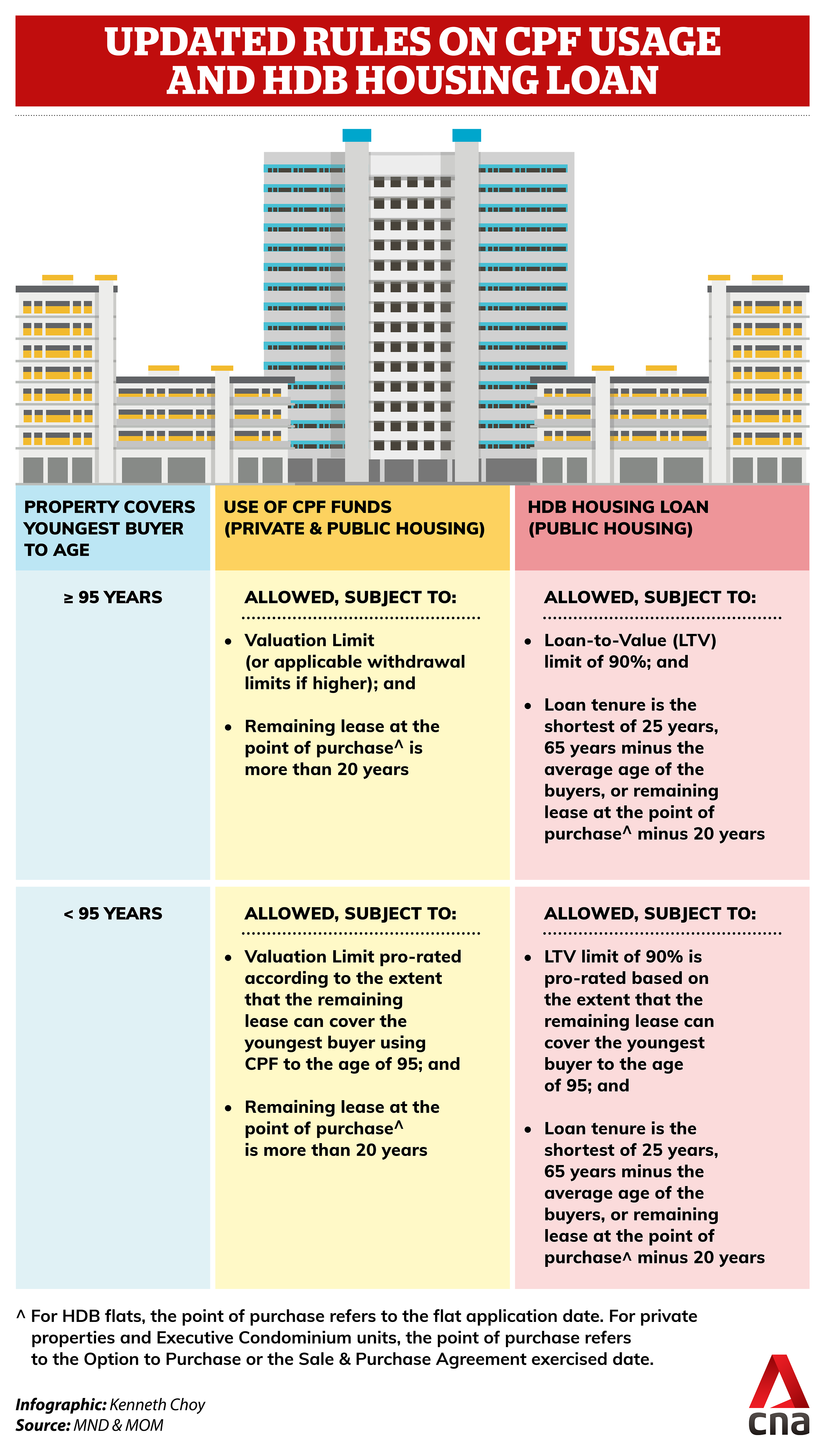

New rules on buying homes using CPF and HDB housing loans were introduced last Friday. The total amount of CPF that can be used to buy a home will depend on whether the remaining lease can cover the youngest buyer until the age of 95.

If this criteria is met, a buyer can use CPF to pay for a property up to its valuation limit. If not, the use of CPF will be pro-rated. Members can use CPF as long as the remaining lease is 20 years or more, lowered from 30 years previously.

READ: New CPF, HDB loan rules give buyers flexibility, may make older properties more attractive – analysts

For those looking to take an HDB housing loan, buyers will be eligible to take the full 90 per cent Loan-to-Value limit, if the remaining lease can cover the youngest buyer to the age of 95.

If the remaining lease cannot cover the buyer until the age of 95, they will be offered a loan on a pro-rated basis.

When CPF members reach 55 years old, they will need to have a property with a remaining lease to cover them until at least 95 years old to be allowed to withdraw their CPF savings above the Basic Retirement Sum.