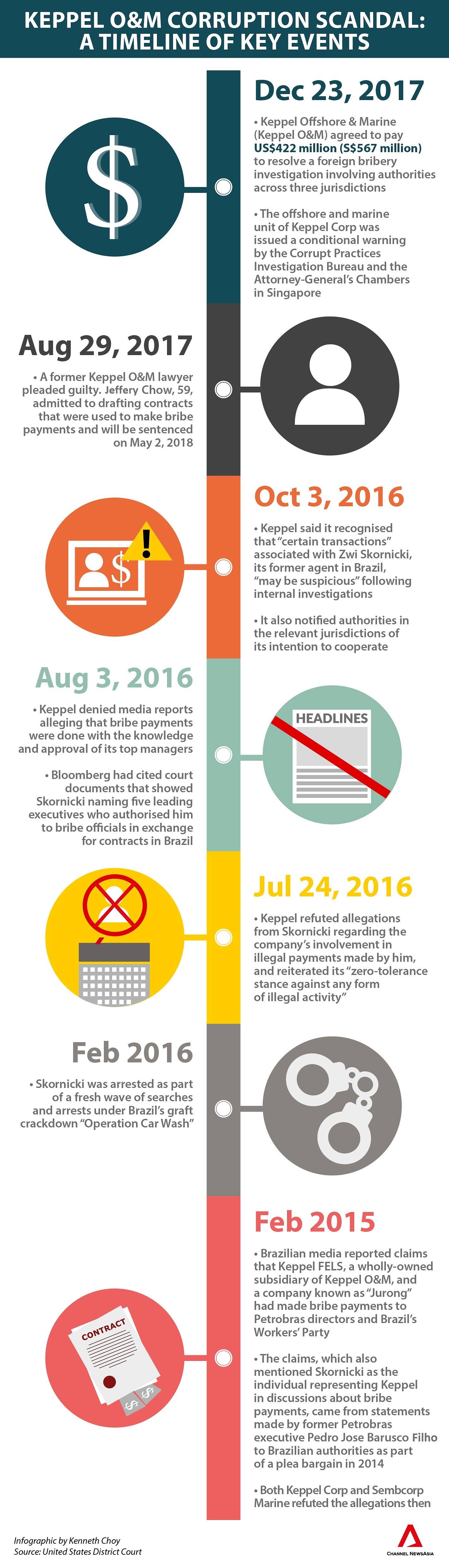

SINGAPORE: Keppel Offshore & Marine’s (Keppel O&M) involvement in an international corruption scandal came to light last month as Singapore’s largest oil rig builder said it would pay a hefty fine as part of a global resolution with authorities in three countries.

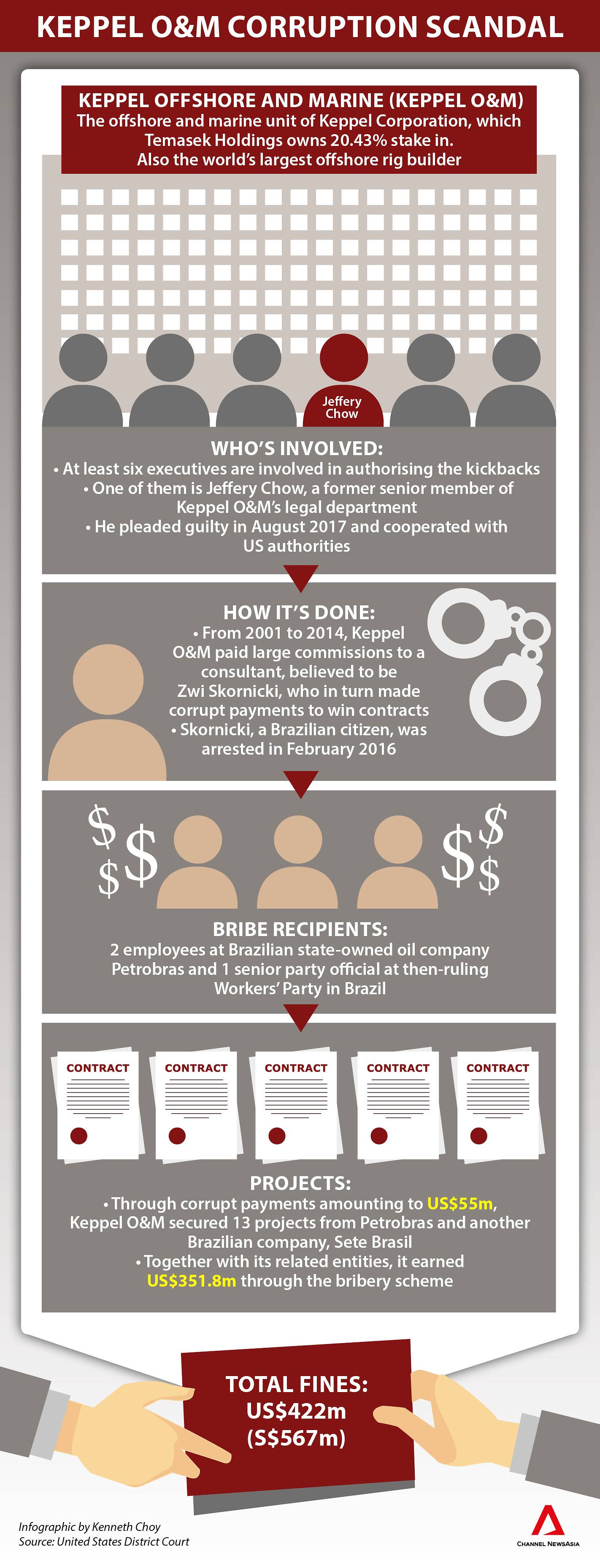

The settlement, reached with criminal authorities in the United States, Brazil and Singapore, is unprecedented for a local company. So is the penalty, totalling US$422 million (S$567 million), which is believed to be a record involving a Singapore-listed entity.

The corrupt payments of US$55 million made between 2001 and 2014 also surpassed the bribes unearthed in a corruption bust at shipbuilder Singapore Technologies Marine (ST Marine) in 2014.

Then, at least S$24.9 million in bribes were falsely claimed as entertainment expenses and made to employees of ST Marine’s customers in return for ship repair contracts. Seven former ST Marine executives were convicted last year for their part in the graft scandal.

The latest bribery scandal involving Keppel O&M, a unit of conglomerate Keppel Corporation, has raised questions about its corporate governance and caused turbulence, albeit temporarily, in the shares of mainboard-listed Keppel.

State investment firm Temasek Holdings holds a 20.43 per cent stake in Keppel as of Aug 15, 2017.

WHAT HAPPENED: According to court documents released by the US Justice Department, Keppel O&M “knowingly and willfully conspired” to pay bribes as part of a “decade-long scheme” to win 13 contracts with Petrobas and Sete Brasil.

These two Brazilian oil companies have been embroiled in a sprawling graft probe dubbed “Operation Car Wash” carried out by the country’s federal police since 2014.

From 2001 to around 2014, millions of dollars in bribes were disguised as large commissions to a consultant in Brazil under legitimate consulting agreements.

These illicit payments, made to bank accounts in and out of the US under the names of shell companies controlled by the consultant, were then transferred to bank accounts elsewhere and into the pockets of Petrobras officials and politicians at the then-governing Workers’ Party in Brazil.

From the 13 contracts that it secured through the 13-year-long bribery scheme, Keppel O&M and its related entities earned US$351.8 million.

WHO’S INVOLVED: The consultant, who played the key intermediary role in this bribery scheme, was not named in the US court documents but is believed to be Mr Zwi Skornicki, Keppel’s former agent in Brazil from 2000 to 2016.

Mr Skornicki was arrested in February 2016 as part of a fresh wave of searches and arrests under “Operation Car Wash”. He was nabbed after former Petrobras executive Pedro Jose Barusco Filho made the allegations against him in his testimony to Brazilian police as part of a plea bargain in November 2014.

US court records also pointed out the involvement of six former executives at Keppel O&M, with four of them being Singapore citizens. One of the remaining executives is a legal permanent resident of the US, while the other holds US citizenship.

The executives are unnamed in the US court documents. An August 2016 report by Bloomberg, which referred to Mr Skornicki’s Jul 21 testimony in court, named five top managers at Keppel and its marine and offshore units who allegedly knew about and authorised his bribe-for-contract payments in Brazil.

They include former CEOs of Keppel O&M Chow Yew Yuen and Tong Chong Heong, former CEOs of Keppel FELS Brasil Tay Kim Hock and Kwok Kai Choong, as well as former Keppel CEO Choo Chiau Beng. Mr Choo was also Singapore’s non-resident ambassador to Brazil from 2004 to 2016.

The Keppel executive, who is a US citizen, is believed to be Mr Jeffery Chow – a senior member at Keppel O&M’s legal team from 1990 to 2017.

The 59-year-old admitted to drafting contracts for bribe payments and has pleaded guilty on Aug 29, according to US court documents. He is scheduled to be sentenced on May 2, 2018.

Bribe recipients were two Brazilian officials who worked at Petrobras between 2003 and 2012, and one party official who held a senior position in Brazil’s Workers’ Party.

According to Mr Skornicki’s testimony, the party official is believed to be Mr Joao Vaccari Neto, the former treasurer of Brazil’s Workers’ Party. He has been sentenced to 15 years and four months in jail for corruption and money laundering in September 2015.

THE PROJECTS: The bribery scheme landed Keppel O&M with 13 contracts from Petrobras and Sete Brasil. Here are the details of each:

1. The P-48 Project

Around 2001, Keppel O&M, through a joint venture, won a subcontract to convert a floating platform for Petrobras. From around June 2001 to April 2002, bribe payments of US$300,000 were made to government officials in Brazil with “instructions and authorisation” from Keppel O&M’s executives, according to court documents.

2. The P-51 and P-52 Projects

In 2003, the consultant received authorisation from Keppel O&M executives and the firm’s joint venture partner to pay bribes equal to a percentage of the contracts’ value. That added up to about US$13.3 million.

The consultant made the illicit payments through an intermediary to a Brazilian official at Petrobras, who kept some of the money for himself and shared the rest with another company official and Brazil’s Workers’ Party.

3. The P-56 Project

Around 2007, the consultant learned from a Brazilian official that Keppel O&M and its joint venture partner would need to pay bribes in an amount equal to a percentage of the contract value to obtain the P-56 project which resulted in about US$14.2 million in bribes. The money went to a Brazilian official and the Workers’ party.

In the same year, the consultant received authorisation to pay the bribes, which was approximately US$14.2 million.

4. The P-53 and P-58 Projects

In 2005 and 2009, executives of Keppel O&M and a Keppel O&M subsidiary in Singapore authorised the consultant to pay bribes equal to a percentage of the contract value of both projects to a Brazilian official and the Workers’ Party. The bribes paid to secure portions of two floating platform hull conversion projects from Petrobras, was approximately US$4.4 million.

5. The P-61 Project

Around 2007, Keppel O&M and Keppel O&M USA, as part of a joint venture with an engineering company, began work to obtain a large platform construction contract from Petrobras.

In 2009, the consultant received authorisation from a Keppel O&M executive and an executive at Keppel O&M’s Brazil subsidiary to pay bribes equal to a percentage of the project’s contract value to a Brazilian official and the Workers’ Party. The sum was about US$8.8 million.

6. The Sete Brasil Projects

Between 2011 and 2012, Sete Brasil contracted with five companies to commission the construction of a fleet of ultra-deepwater rigs for which Petrobras would be the end user. The construction contracts were split among the companies, with a Keppel O&M subsidiary successfully bidding for contracts for construction of six semi-submersible units.

Court documents showed that participating companies, including Keppel O&M, negotiated bribes with a Brazilian official equal to 0.9 per cent to one per cent of the value of their respective contracts.

Two-thirds of the payments were designated to the Workers’ Party and one-third was to be divided equally between the relevant Petrobras and Sete Brasil executives.

During the negotiation period, Keppel O&M executives authorised the consultant during several telephone calls to pay one per cent of the contract value as bribes. Accordingly, the consultant received approximately US$14.4 million in bribes to the Brazilian officials and the Workers’ Party.

WHAT KEPPEL DID: Keppel was first cited in the “Operation Car Wash” investigation in February 2015 when Brazilian media reported claims that Keppel FELS, a wholly-owned subsidiary of Keppel O&M, and Sembcorp Marine’s shipyard in Brazil had made bribe payments to Petrobras directors and the Workers’ Party in Brazil.

Both companies refuted the allegations then.

When court testimonies from Mr Skornicki emerged in July 2016 with allegations of Keppel’s involvement in illegal payments made by him, the Singapore conglomerate denied the allegations and reiterated its “zero-tolerance stance against any form of illegal activity” in a filing to the Singapore Exchange on Jul 24.

Later in August 2016, Keppel denied the Bloomberg report that bribe payments were done with the approval and endorsement of its senior management.

It said: “None of the individuals named in the article, including the current CEO of Keppel Offshore and Marine Mr Chow Yew Yuen, have ever authorised Mr Skornicki to make any payments as bribes.”

Only in October 2016 did it announce that it recognise “certain transactions” associated with the company’s former agent in Brazil “may be suspicious” following internal investigations. It also notified authorities in the relevant jurisdictions of its intention to cooperate.

Following the disclosure last month, Keppel Corp chairman Dr Lee Boon Yang said the company was “deeply disappointed” by the incident, adding that “global companies such as Keppel have both a legal and moral duty to operate fully within international laws and regulations”.

“Since the allegations emerged, we have moved quickly and decisively to put in place stricter controls and embedded best practices across the group to ensure that such unacceptable behaviour will not be repeated,” Dr Lee added.

Keppel Corp CEO Loh Chin Hua also said that “effective compliance controls are now thoroughly embedded” across its businesses, “supported by rigorous anti-corruption training and robust compliance and governance regimes”.

US court documents said Keppel O&M has taken on “extensive remedial measures” as part of the deferred prosecution agreement.

Those included disciplinary action against 17 former or current employees which led to seven employees departing the company; demotions and/or written warnings to seven employees; approximately US$8.9 million in financial sanctions on 12 former or current employees; and anti-corruption and compliance training for six employees.

A Keppel spokesperson told Channel NewsAsia that the company has “separated with all the executives defined as ‘relevant individuals’ in the Statements of Facts released by the authorities.”

Disciplinary action has been taken against employees involved in the misconduct, including separation and financial penalties, added the spokesperson. But the company is unable to “comment on any individual employee, or the specific penalties imposed against individuals” for legal reasons.

When asked about the guilty plea by former lawyer Jeffery Chow, Keppel’s spokesperson mentioned deep disappointment in the behaviour uncovered.

“It is not how Keppel conducts business. We have taken robust steps to strengthen controls and compliance to ensure that such unacceptable behaviour is not repeated,” the emailed response added.

Amid questions raised by corporate governance experts about the efficacy of its auditing and internal governance, the spokesperson responded to queries on Jan 5 that the current boards of directors of Keppel Corp and Keppel O&M “were not aware of the illegal payments” made in Brazil.

The illegal payments were “deliberately concealed by those complicit in the bribery and structured as agency fees”.

“The agency fees were not approved by the Boards of Keppel Corporation or KOM as they were built into the contract values of the respective projects and bidding for projects is in the ordinary course of KOM’s business,” the spokesperson added.

Keppel also revealed that it began its internal inquiry led by external counsel when allegations first surfaced in 2015.

The denials by Keppel then, and in July as well as August 2016, were issued after taking into consideration the relevant evidence available at that time.

“As the inquiry continued and suspicious transactions in Brazil were uncovered, Keppel promptly announced in October 2016 that it had notified the authorities in the relevant jurisdictions and offered to cooperate fully and extensively in the investigations. Keppel also encouraged all its employees to cooperate fully with the authorities,” the spokesperson added.

WHAT’S NEXT: In Singapore, Keppel O&M has accepted a conditional warning from the Corrupt Practices Investigation Bureau (CPIB).

This was issued in lieu of prosecution for corruption offences punishable under the Prevention of Corruption Act and part of the global resolution, said the Dec 23 joint statement from the Attorney-General’s Chambers (AGC) and the CPIB.

The local authorities said that in issuing the conditional warning in lieu of prosecution, “due consideration was given to the substantial cooperation” rendered by Keppel O&M to the investigations – which included the unit’s self-reporting to AGC and CPIB of the corrupt payments made by it – and the “extensive remedial measures taken”.

“Investigations in respect of the individuals involved are ongoing,” the statement added.

Meanwhile, Singapore’s Workers’ Party (WP) has filed questions related to the bribery scandal for the Parliament sitting on Jan 8.

Members of Parliament Pritam Singh, Sylvia Lim and Png Eng Huat have collectively tabled four questions to seek details about the global resolution that Keppel O&M reached with authorities, the investigations being carried out by local authorities, as well as answers about the role of the finance ministry and Temasek Holdings in overseeing the conduct of government-linked companies (GLCs) overseas.