SINGAPORE: Keppel Corp CEO Loh Chin Hua on Thursday (Jan 25) called the misdeeds of its offshore and marine unit in Brazil “a painful chapter” for the company and said that compliance controls have been put in place to prevent a repeat of such incidents.

Mr Loh’s comments came as the conglomerate posted a 72 per cent fall in net profit for its financial year in 2017, due mainly to penalties its subsidiary Keppel Offshore & Marine were slapped with as a result of its bribery scandal in Brazil.

Net profit last year came in at S$217 million, down from S$784 million in 2016, the company said.

“The global resolution reached by Keppel Offshore & Marine over past misdeeds in Brazil brings an end to what has been a painful chapter for Keppel – one that we have recognised and dealt firmly with. This is not Keppel. We care not just about results, but also how they are obtained,” Mr Loh said in a prepared address for Keppel’s earnings briefing.

“We have put in place enhanced compliance controls, including comprehensive training and certification, to prevent any repeat of such misdeeds,” Mr Loh said.

Keppel Corp said in its financial report that the net profit took into account a one-off financial penalty of S$570 million arising from Keppel O&M’s global resolution with criminal authorities in the US, Brazil and Singapore, and S$49 million for related legal, accounting and forensics costs.

The offshore and marine division incurred a net loss of S$835 million for 2017, compared to a net profit of S$29 million for 2016. This was mainly due to the one-off impact of the financial penalty and related costs, an additional S$81 million provision for losses made on the Sete Brasil projects and S$54 million in impairment on other assets.

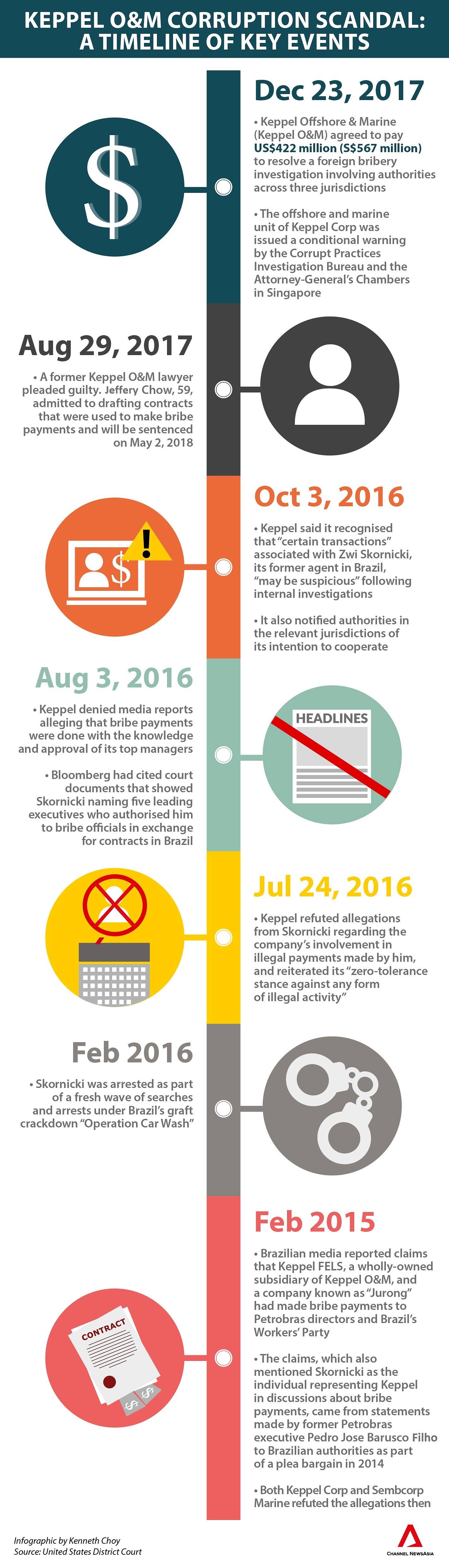

Keppel O&M’s involvement in an international corruption scandal came to light on Dec 23 last year after Keppel Corp announced that its rig building unit would pay US$422 million in fines as part of a global resolution with authorities in the US, Brazil and Singapore over corrupt payments made by a former agent in Brazil.

As part of the resolution, Keppel O&M was also issued a conditional warning by the Corrupt Practices Investigation Bureau.

Court documents released by the US Justice Department said that the company “knowingly and wilfully conspired” to pay bribes between 2001 to 2014 to win business deals with Brazilian oil firms Petrobas and Sete Brasil.

The illicit payments, amounting to US$55 million, helped Keppel O&M to secure 13 contracts from Petrobas and Sete Brasil.

Following the shocking disclosure, Keppel’s stock took a hit. Shares of the conglomerate sank as much as 5 per cent on Dec 26, before clawing back losses to close 2.4 per cent lower at S$7.29.

But the counter has since managed to regain lost ground. Keppel shares ended down 0.6 per cent on Thursday at S$8.58, compared to its closing level of S$7.47 on Dec 22.

Keppel had said in its statement in December that it would make provision for the fines in the current financial year, but that the impact on its profit-and-loss statement is a “one-off” and it will “ringfence” the penalty when considering this year’s final dividend.

The company has proposed a final dividend of 14 cents per share, compared to the final dividend of 12 cents declared for 2016.