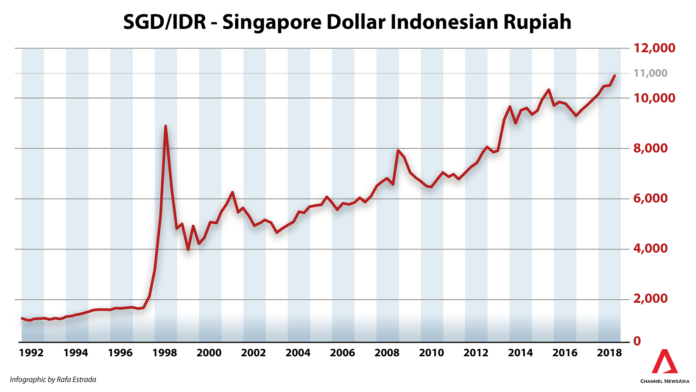

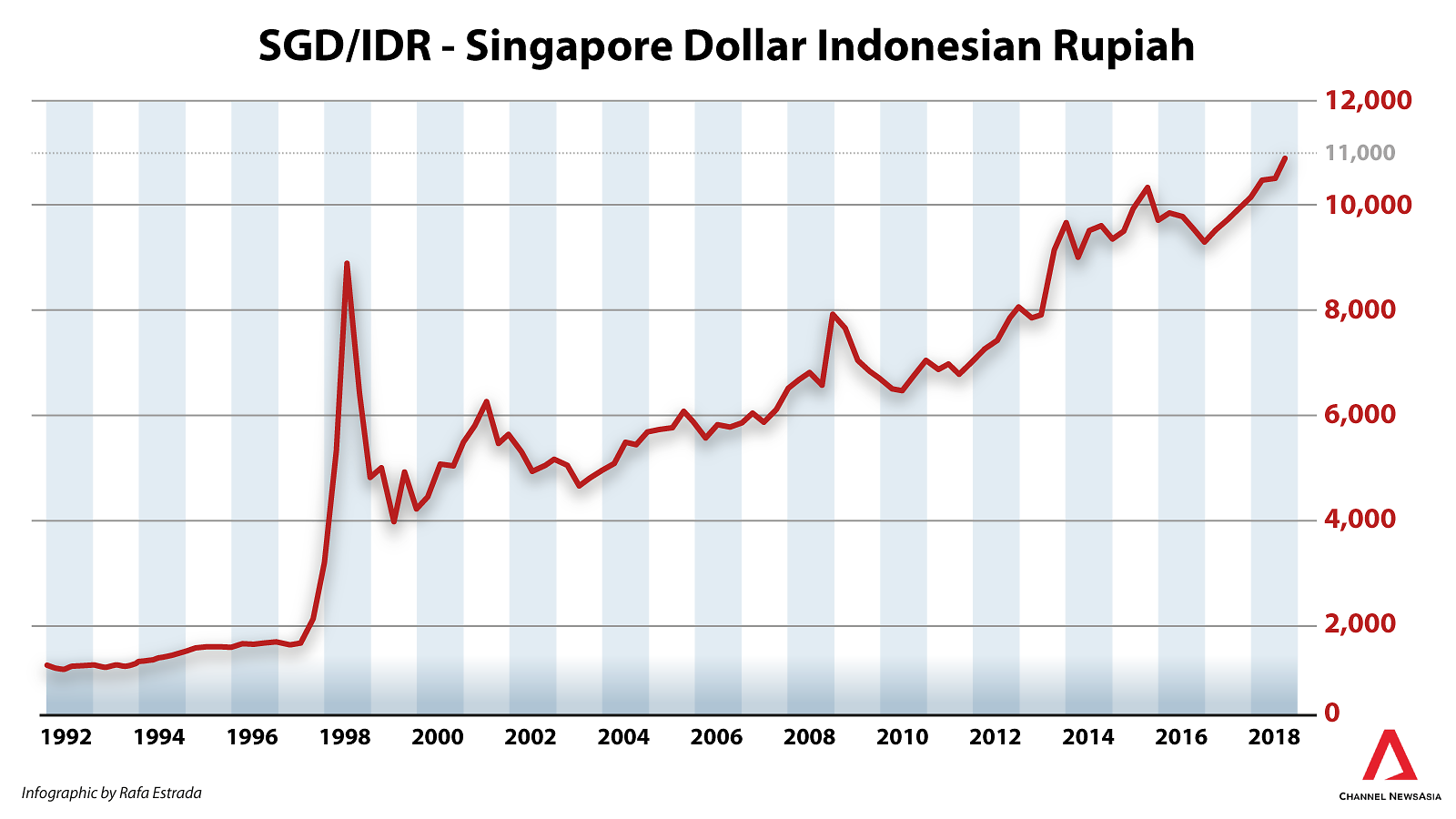

SINGAPORE: Indonesia’s rupiah dropped on Thursday (Sep 27) to its lowest level against the Singapore dollar since at least 1992, even as the government in Jakarta took measures to protect the embattled currency.

The rupiah slumped to as low as 10,968.35 against the Singdollar, amid a sell-off of Indonesian assets due to rising US interest rates, contagion fear from other emerging market crises and the China-US trade war.

Indonesia’s currency has not been this weak since at least 1992, according to Bloomberg data.

“At this point, it looks like emerging market pressures may persist for a while. This pressure has been going on amid the US interest rate normalisation and the Sino-US trade tensions,” said OCBC Bank economist Alan Lau.

The persistent weakening of the rupiah is, however, beneficial for visitors to Indonesia like Singaporean Herman Armando, who is able to use the rate to his advantage.

“Being half-Indonesian, it means so much more for me as I am able to go back more often to visit my relatives,” he told Channel NewsAsia.

A cheaper rupiah also benefits visitors from Singapore, like Ms Veronica Song, who frequent Batam for weekend trips.

“I’m very pleased because I go to Indonesia often with my friends. This will make it even more affordable for me to go there,” she told Channel NewsAsia.

On the flip side, the ongoing depreciation places pressure on the financials of Indonesian businesses.

“The ongoing depreciation on the rupiah has definitely taken a toll on our business in Batam,” Mr JT, the director of solar panel company Batam Surya Pertama, told Channel NewsAsia.

“Most of the quotations we have sent out have a two-week to one-month validity period. We have to honour those quotations even though the costs of shipping and materials have increased,” he added.

Indonesia hiked interest rates again on Thursday by 25 basis points to 5.75 per cent – its fifth rise since May – after the government said it was taking other measures to protect the weak currency.

“This (rate) decision is to control the current account deficit and to maintain the attractiveness of the domestic market in the midst of global uncertainty,” central bank governor Perry Warjiyo told reporters.

There have been growing concerns about Indonesia’s current account deficit, which expanded to its highest level in about four years.

The current account is a broad measure of a country’s trading relationship with the rest of the world.

A weak rupiah means it is more expensive to repay debts in dollars and other currencies.

“The authorities are worried about currency weakness because of the relatively high level of foreign currency debt in the country,” Mr Gareth Leather at research house Capital Economics said in a report after the rate hike.