NEW DELHI – Indian banks will strive to recover “every penny” from a beleaguered liquor baron who left the country owing more than US$1 billion (S$1.35 billion), the finance minister said Thursday, as warnings sound over a mounting bad debt problem.

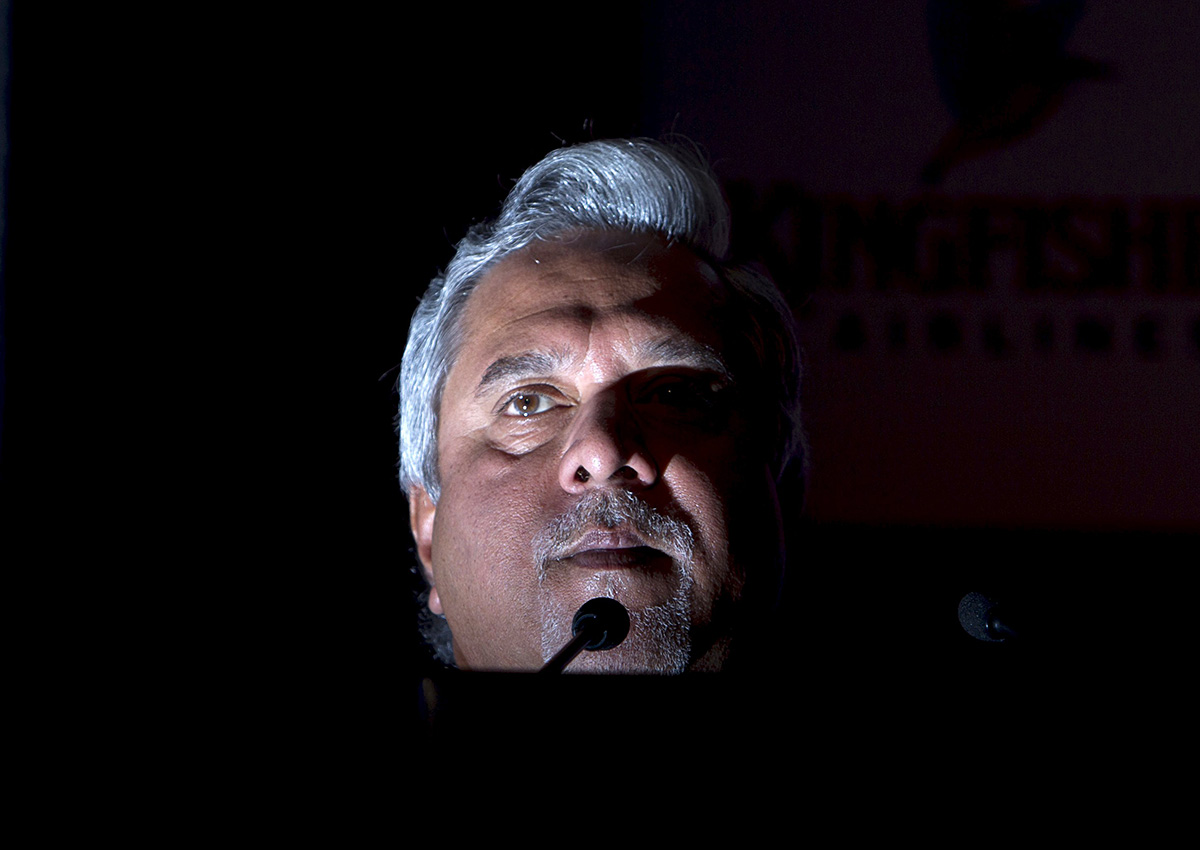

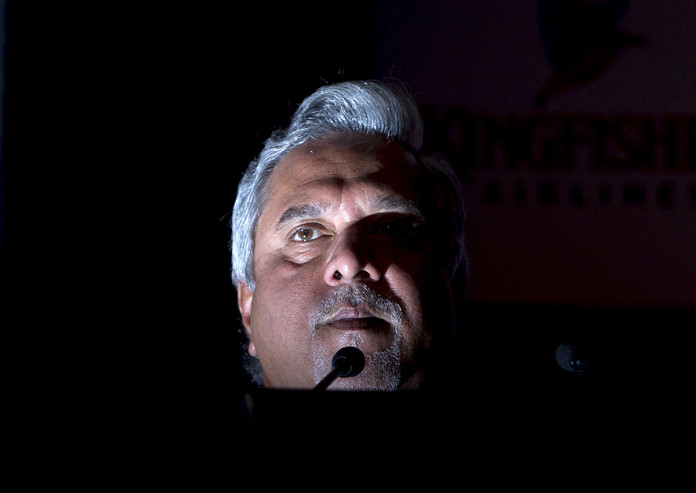

More than a dozen lenders are chasing Vijay Mallya, once dubbed The King of Good Times, for 90 billion rupees (S$1.8 billion) in unpaid loans, but he left the country on March 2 despite calls for his arrest.

“Every government agency, whether it’s the taxation department or the investigative agencies, wherever he has violated the law, is going to take strong action,” Finance Minister Arun Jaitley told a conference organised by India Today television channel in New Delhi.

“As far as the banks are concerned… I’ve been briefed that they are going all out to recover every penny of the last rupee that they can.” The country’s financial crimes agency has summoned Mallya to appear before investigators on March 18 in connection with a money-laundering probe.

But he has asked the Enforcement Directorate to give him until April to appear, the Press Trust of India news agency reported Thursday. A spokesman for Mallya declined to comment when contacted by AFP.

In a further blow, an auction Thursday of Kingfisher House, the former headquarters of the entrepreneur’s now-defunct Kingfisher Airlines in Mumbai, attracted no bids, PTI reported.

The businessman’s massive debt has become a symbol of Indian banks’ vast volume of bad loans – meaning in default or close to it – seen as a threat to financial stability in Asia’s third-largest economy.

Critics say the government has not done enough to tackle the issue of wealthy individuals, such as Mallya, who obtain huge loans that they later fail to repay.

Jaitley told the gathering that many bad loans were due to a slowdown in sectors such as steel, which is suffering after China flooded the market with cheap excess metal.

But the finance minister also said that lenders granting individuals large loans – sometimes in unusual circumstances – which then went awry was “the real cause of worry”.

“This has brought a huge bad name both to India’s banking and also to India’s private sector. It’s extremely dangerous for the future if we are not able to remedy this,” he said.

Mallya, who has not been charged with any crime, denies absconding and has lashed out at media who accuse him of fleeing the country.

In its budget last month Prime Minister Narendra Modi’s government announced recapitalisation measures for public sector banks, although some economists said the funds were not sufficient.

On Saturday the market regulator laid out tougher measures to tackle individuals or businesses classified as “wilful defaulters”, preventing them from raising fresh funds on capital markets or from sitting on listed company boards.

Mallya was known as the “King of Good Times” before the 2012 collapse of his Kingfisher Airlines, which left thousands of workers unemployed and millions of dollars in unpaid bills.