SINGAPORE: Singaporeans born in 1979 or earlier and are not severely disabled will receive “participation incentives” to encourage them to join CareShield Life from 2021, a year after the new national severe disability insurance scheme is launched.

The group, aged at least 42 in 2021, will receive between S$500 and S$2,500 over 10 years, depending on their age cohort, with the older getting more.

This will be used to offset the annual premiums. To qualify for the incentives, they will have to join CareShield Life in the first two years from 2021. Even those who have pre-existing medical conditions can join the scheme, but underwriting criteria will be tightened after two years.

CareShield Life will provide higher payouts for life compared to ElderShield, where payouts are fixed at $300 or $400 a month, and capped at up to six years, depending on their scheme.

To make joining CareShield Life more convenient, Singapore Residents born in1970 to 1979 or aged 41 to 50 in 2020 will be auto-enrolled into the scheme the next year, if they are insured under the ElderShield 400 scheme and are not severely disabled, the Ministry of Health said on Monday (Jul 2).

They have up to Dec 31, 2023 to opt out and have their CareShield Life premiums refunded.

While there is no upper age limit for CareShield Life, older Singaporeans will have to pay higher premiums, with premiums increasing till they reach the age of 67.

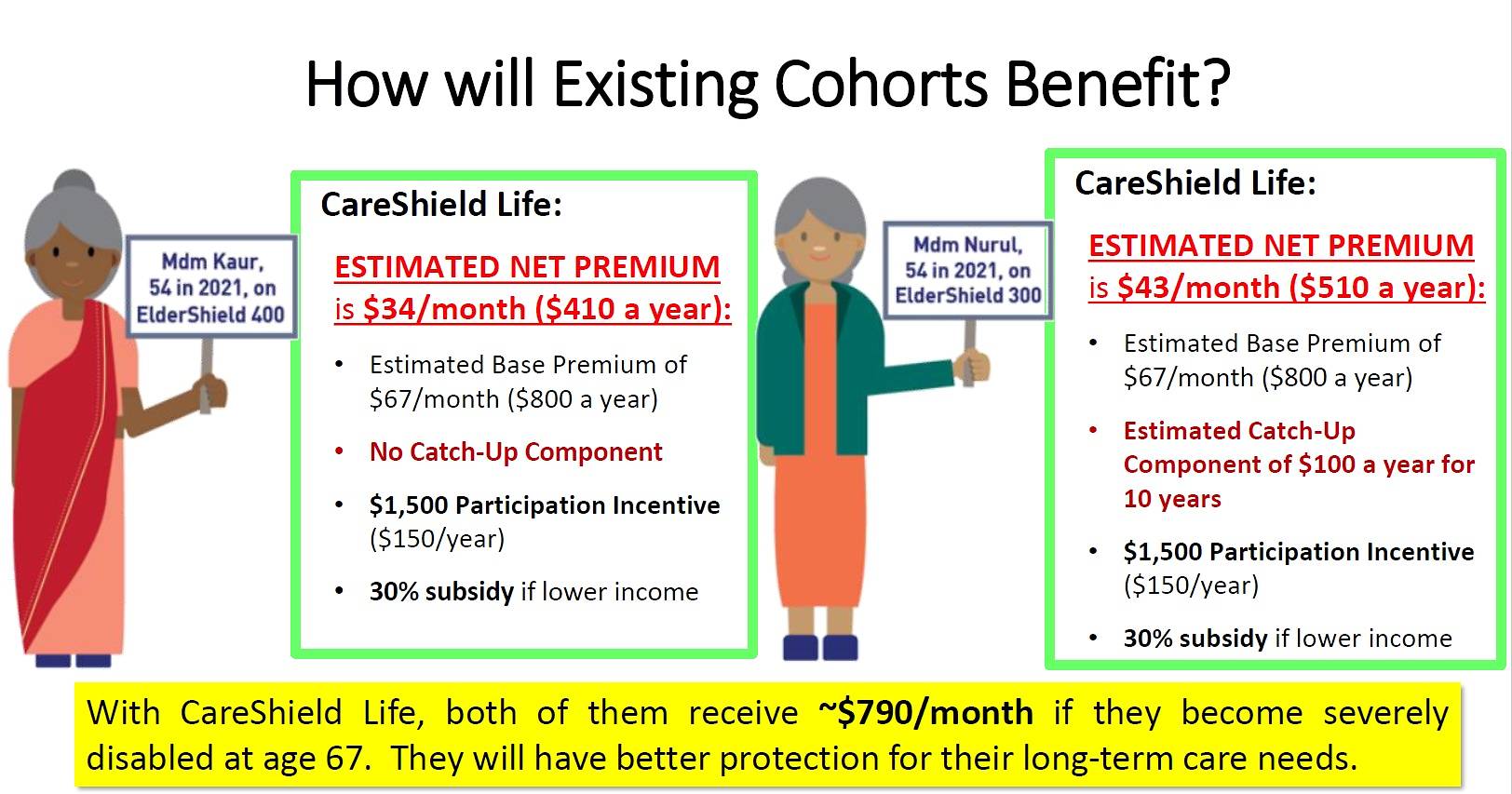

ElderShield 400 policy members who never opted out will have to pay just the base premium for CareShield Life, while others, like those on ElderShield 300 and those not on ElderShield, will have to pay an additional flat “catch-up” component.

Base premiums and “catch-up” component costs have not been fixed.

Illustration: MOH

For example, a 54-year- old woman on ElderShield 400 is estimated to have to pay an annual premium of S$410 in 2021. This is after receiving a participation incentive of S$150 for that year, and only if she receives a permanent means-tested premium subsidy of 30 per cent based on monthly per capita household income and annual value of their residence.

A woman of the same age and profile but on ElderShield 300, however, would have to pay an additional S$100 for that year as the “catch-up” component.

A 54-year-old woman who is not on ElderShield can expect to pay an even higher“catch-up” component.

Of the existing cohorts, 38 per cent are on ElderShield 400, 26 per cent are on ElderShield 300, while 36 per cent are not on ElderShield.

Those with pre-existing chronic conditions will benefit most from the CareShield Life upgrade, said Assistant Professor at the Lee Kuan Yew School of Public Policy, Dr Joelle Fong.

“They are at higher risk of transiting into severe disability, and may otherwise not be able to obtain coverage from private insurers with strict underwriting criteria,” she said.

Ms Sarah Liew, 61, a part-time bank associate is one such candidate. She said she will be joining CareShield Life despite knowing it can “quite expensive”. Ms Liew, who is currently on ElderShield 300, will have to pay a “catch-up” component along with premiums that will be considerably high because of her age.

She was unable to upgrade to ElderShield 400 due to an illness, but will be able to join CareShield Life as it does not take into account pre-existing conditions. Ms Liew said that since these can be paid through Medisave, she finds the scheme affordable.

Ms Liew’s 86-year-old mother suffers from dementia and is considered severely disabled, as she is unable to independently perform three of six activities of daily living. These activities are washing, dressing, feeding, using the toilet, moving around and the ability of transferring oneself from a bed to a chair. Her mother is also on ElderShield 300.

She said S$300 is not enough to cover for disability. While she and her eight siblings are able to provide for her mother, her situation will not be the same.

“I only have one daughter. All the burden will be on her, so I’d better get myself protected,” she said.