SINGAPORE: For Madam Tan (not her real name), who fell victim to unlicensed moneylenders, it all started with one text message promising fast cash.

Loansharks, who are increasingly tech-savvy, then used various channels such as Whatsapp, to threaten and harass her as her debt grew.

“I had gotten married without savings and I needed a house to stay,” Madam Tan, who is in her early 40s, told reporters at the Police Cantonment Complex on Thursday (Jun 7).

As she had to pay a cash premium for the house, she took out a S$10,000 bank loan. Over the years, when her kids needed hospital treatment, she maxed out her credit cards to pay the bills.

In 2010, her husband lost his job which pays roughly S$3,000 a month. When Madam Tan, who works in an administrative job, couldn’t service the bank loan and credit card payments, her furniture was seized – twice.

“My children saw it,” she said, breaking down and reaching for a pack of tissues. “I was at my wits’ end and I didn’t want to approach family members to let them know my situation.”

“This is the irony,” she lamented as she recalled the text message she received in 2013 which made things go from bad to worse. “Now the whole world knows it and I have to tell the media.”

THE TEXT

The SMS was for a moneylending service accompanied by a company name and telephone number. Madam Tan checked it out online and thought it looked legitimate.

Increasingly mired in debt, she gave her most personal particulars – screenshots of her identification card, her company’s name and address, and even her SingPass login details – to engage the service.

The moneylenders also asked how many family members she had and where her children studied, but it was not enough to raise alarm bells.

“The money came fast,” she admitted. Cash was transferred to her via iBanking within days. It started with S$20,000, then the amount “snowballed” into the hundreds of thousands.

When Madam Tan couldn’t pay off one of her loans due to the exorbitant interest rates and ever-changing terms, she borrowed money from another loan shark to settle it. It became a vicious cycle.

“At first, it could be monthly payments, but next week they would say: ‘Hey your payment is up’,” she said. When she told the moneylender of the original terms, the usual reply would be that the guy who gave it had gotten into an accident.

Madam Tan’s mobile number was also circulated as quickly as the money. Soon, she found herself in debt with more than 50 different moneylenders.

She borrowed from friends and colleagues and worked three jobs to try and pay off her debts. “It was quite a substantial amount,” she said.

THE THREATS

Madam Tan would soon find out that these loan sharks were ruthless.

“When I couldn’t pay on time, they sounded harsh and scolded me,” she said. “They started to threaten me, and no one, including my husband, knew of my situation.”

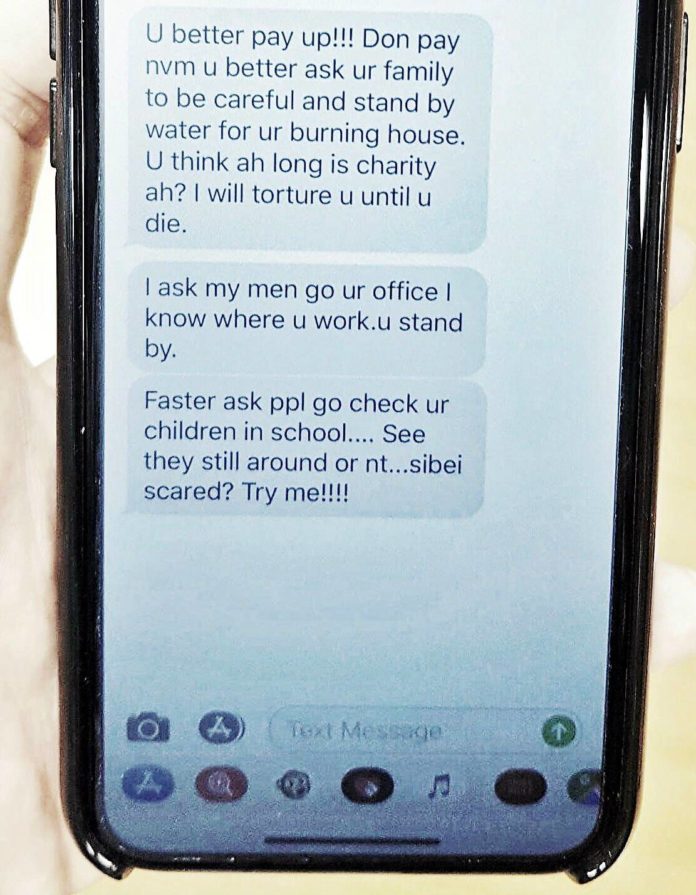

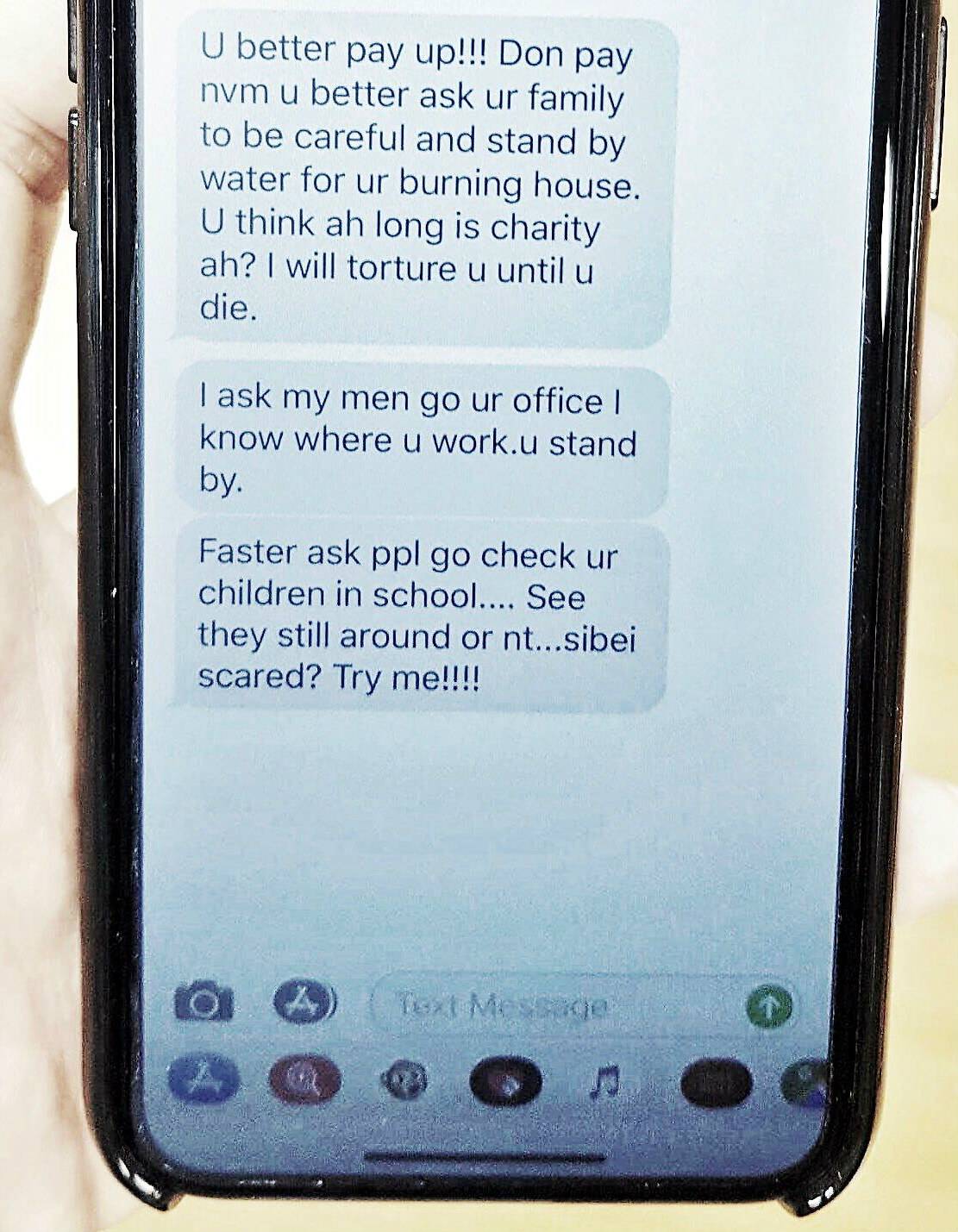

The loan sharks would send threatening messages like “I know where your children study” and “I know your company”. In 2015, the loan sharks shifted gears and started sending WhatsApp messages instead of SMSes.

The kind of threatening text messages that Madam Tan received. (Photo: Madam Tan)

In March this year, Madam Tan got a message which she described as the “last straw”. “I received an SMS cursing my family and threatening to kidnap my children,” she said. “They also sent me videos of a burning housing unit.”

Madam Tan reported the matter to the police and stopped engaging the loan sharks. She estimates that she’s paid around S$400,000 in total, with S$150,000 to go.

But the harassment got physical.

Two months ago the loan sharks spray painted the walls outside her home and threatened her neighbours. “They told my neighbours that I said they’d be my guarantor,” she said. “About 50 per cent of them knew about it.”

The loan sharks also sent unsolicited fruit baskets, McDonald’s and Pizza Hut meals to her home. And they called up her employers and shouted at her colleagues.

Fortunately, she said her three school-going children never encountered the loan sharks personally.

“I don’t know how to face my children,” she said. “On one hand, I’m telling them to be frugal and spend only on what they need, but on the other hand, I’m borrowing.

“But they know I’m alone handling this whole thing.”

THE ADVICE

In light of her “painful” and “traumatising” ordeal, Madam Tan advised the public never to borrow from loan sharks.

“I urge anyone who really needs financial help to seek the correct agency or welfare institution,” she said. “Because the agony I went through – at the start you may not feel it, but the moment you’re out of help, that’s when the worst will come.

“Everybody will know and I don’t know how to lift up my head.”