SINGAPORE: Finance Minister Heng Swee Keat ended his 2018 Budget speech on a “prosperous” note with the handing out of a one-off SG Bonus to Singaporeans, but he also warned of coming tax hikes that are needed to finance the country’s greater spending in the next decade.

How will Singaporeans and Singapore businesses be affected by the measures Mr Heng announced on Monday (Feb 19)?

Here is Channel NewsAsia’s quick guide to the major Budget announcements:

1. GST HIKE COMING

An increase of the Goods-and-Services Tax (GST) was widely anticipated and Mr Heng duly made an announcement about this. When it comes, it will be the first rise in GST for well over 10 years.

The hike of 2 percentage points to 9 per cent will kick in sometime from 2021 to 2025. The exact timing will depend on the state of the economy, how much Singapore’s expenditure grows and how buoyant existing taxes are.

But he expects it to be “earlier rather than later”, Mr Heng said, as after exploring various options to manage future expenditure, there is still “a gap”.

GST will also be imposed on imported services such as apps, movies and music from 2020.

2. LARGEST BUDGET SURPLUS IN 30 YEARS

Singapore also ended 2017 with its largest Budget surplus in recent years in absolute terms – S$9.61 billion, or 2.1 per cent of the GDP.

As a percentage of GDP, the figure outperformed recent years but remained lower than FY2007, 2000, 1999 and 1997.

Spending on housing, transport, education and healthcare was lower than expected, while revenue from Statutory Board contributions and Stamp Duty was higher than anticipated in 2017.

3. BUT SPENDING IS SET TO RISE

So why the need to increase taxes? Mr Heng listed a range of items that will need financing in the next decade – from healthcare and education to security and infrastructure projects.

For infrastructure investments, the Government saves ahead. This year, it will set up a new Rail Infrastructure Fund to save up for major rail lines in the future. Stat Boards and Government-owned companies will also borrow to spread the cost of larger investments, such as the KL-Singapore High-Speed Rail, over more years.

However, for recurrent spending for healthcare, security and other social needs, Mr Heng said that the “responsible way” to pay for them is through taxation so that “every generation pays its share”. Hence, the upcoming GST hike.

4. WHEN IT COMES TO TAX, IT’S NOT JUST GST

Besides the GST, Mr Heng announced a few other tax increases.

Smokers, take note: Tobacco excise duty on all tobacco products just went up by 10 per cent.

For those looking to buy a property of more than S$1 million, the Buyer’s Stamp Duty is going up on Tuesday.

A new top marginal rate of 4 per cent will apply to the portion of residential property value which is in excess of S$1 million, up from 3 per cent.

The foreign domestic worker levy will also go up from the current S$265 a month. From Apr 1, 2019, households will have to pay a levy of S$300 for its first worker and S$450 for the second worker. Families with caregiving needs will continue to pay just S$60.

5. PREPARING FOR CLIMATE CHANGE

Mr Heng also gave more details on a carbon tax, which he already mentioned in last year’s Budget.

From 2019, the tax will be S$5 per tonne of greenhouse gas emissions for large emitters producing 25,000 tonnes or more of greenhouse gas emissions in a year. This will be reviewed by 2023 and raised progressively.

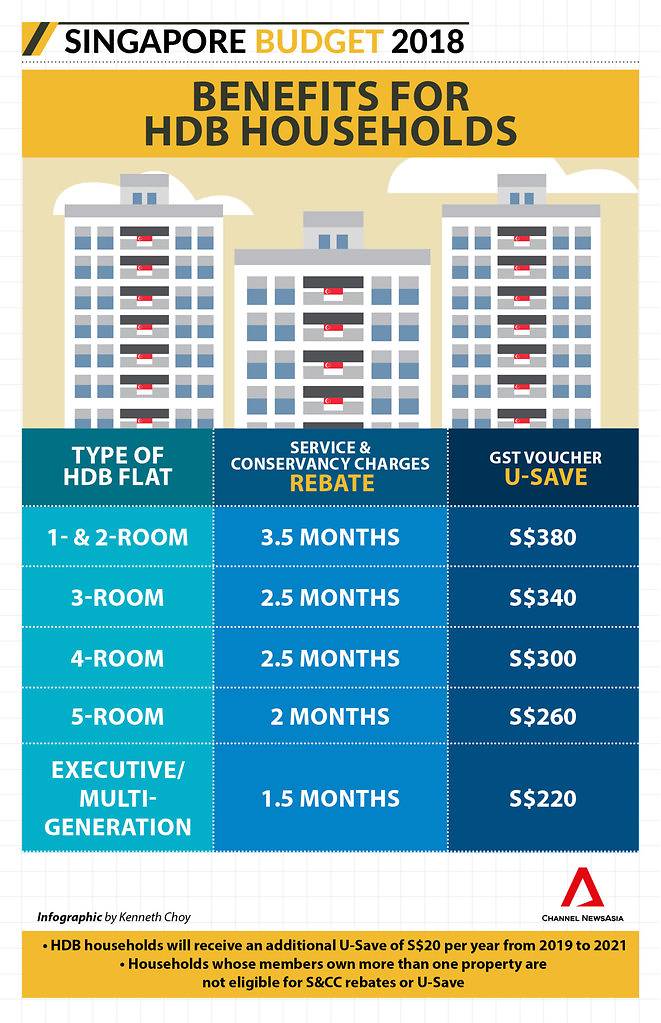

On average, households will experience a small rise in electricity and gas expenses of about 1 per cent but they will get some help in the form of U-Save rebates.

6. MORE GRANTS AND SUBSIDIES

As often happens at Budget time, Mr Heng announced some goodies.

Students will see an increase in annual Edusave contributions – from S$200 to S$230 for each primary school pupil and S$240 to S$290 for each secondary school student.

Those who want to move nearer to their family members will benefit from an enhanced Proximity Housing Grant. Households will also get a one-year extension of the Service & Conservancy Charges (S&CC) rebate.

The Community Networks for Seniors initiative will be expanded nationwide by 2020, among other initiatives to improve care for seniors which Mr Heng announced.

7. HELPING BUSINESSES INNOVATE

With a buoyant economy, Mr Heng focused on measures and initiatives that will help Singapore businesses innovate, build capabilities and expand overseas.

As the Productivity and Innovation Credit (PIC) scheme expires, existing grants supporting the adoption of off-the-shelf technologies will be streamlined into a single Productivity Solutions Grant (PSG).

A virtual crowd-sourcing platform called the Open Innovation Platform will also be piloted this year to “matchmake” companies with technological challenges to ICT firms and research institutes that can work with them to develop solutions.

A new Enterprise Development Grant and other tax incentives were also announced.

There will also be some short-term measures to help businesses, including a larger corporate tax rebate.

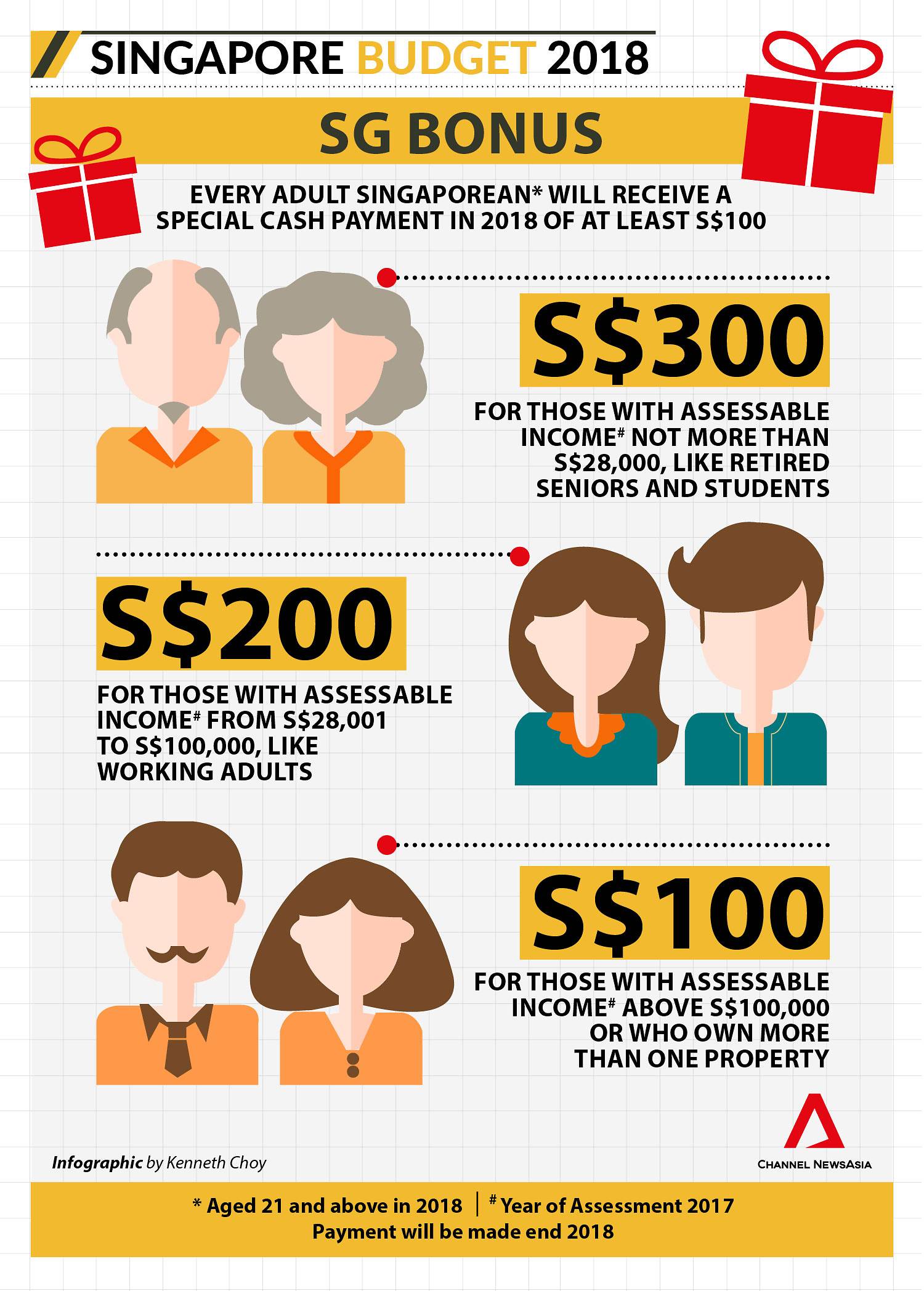

8. HUAT AH! SG BONUS

Singaporeans from the age of 21 will each get a one-time “hongbao” from the Government ranging from S$100 to S$300, depending on their income.

This is to share the surplus of nearly S$10 billion with all Singaporeans and will cost the Government S$700 million.