SINGAPORE: The income ceilings to qualify for the purchase of new Housing Board flats will be raised from Wednesday (Sep 11) as part of measures “to help more Singaporeans from the lower to upper-middle income households buy their first home”.

The new household income cap will be increased from S$12,000 to S$14,000 for families looking to buy a Build-To-Order (BTO) flat or a resale flat with a CPF housing grant. This increased cap will also apply to HDB housing loans.

Eligible first-timer singles aged 35 and above will also benefit from a higher income ceiling of S$7,000, up from S$6,000.

For 2-room Flexi flats bought on a 99-year lease, and certain 3-room flat projects, the income ceiling for first-timer households will be raised from S$6,000 to S$7,000.

Those looking to buy an Executive Condominium will also benefit from a higher household income cap, up from the current S$14,000 to S$16,000.

The measures were announced by National Development Minister Lawrence Wong at an event to recognise 27 HDB projects for their excellence in design, construction and engineering.

NEW ENHANCED HOUSING GRANT

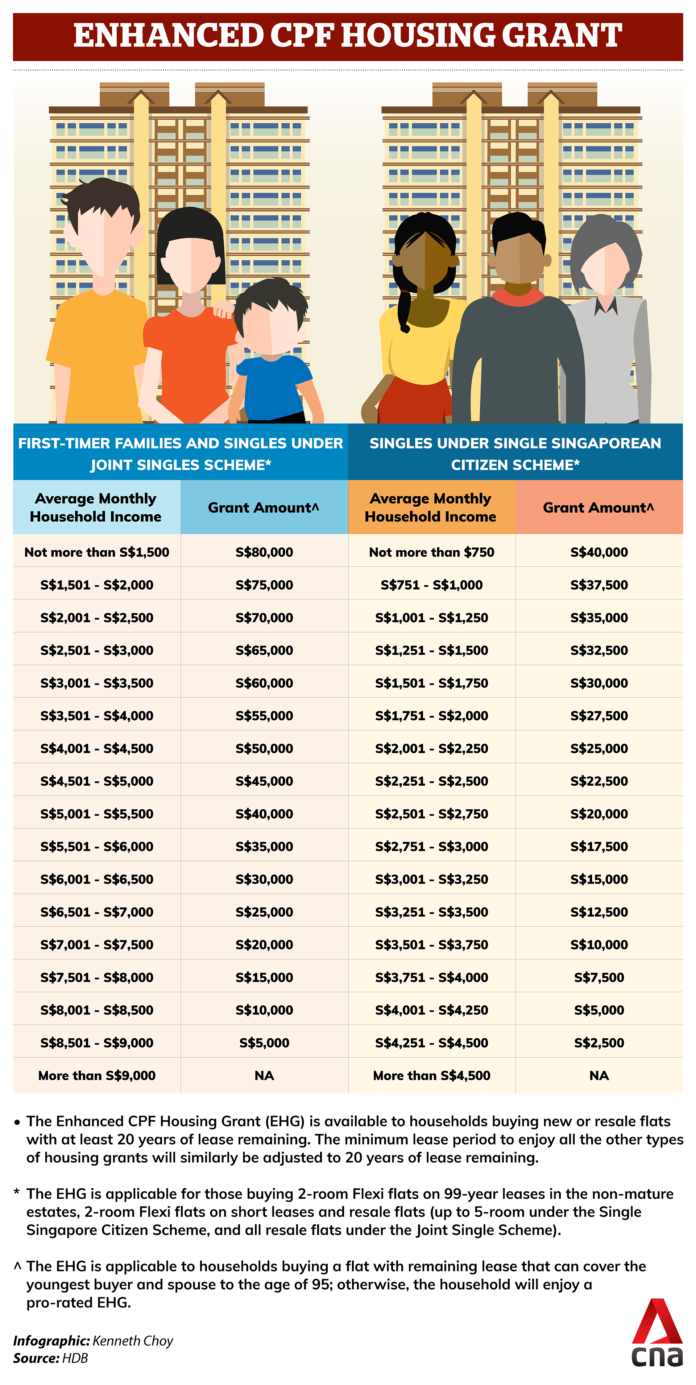

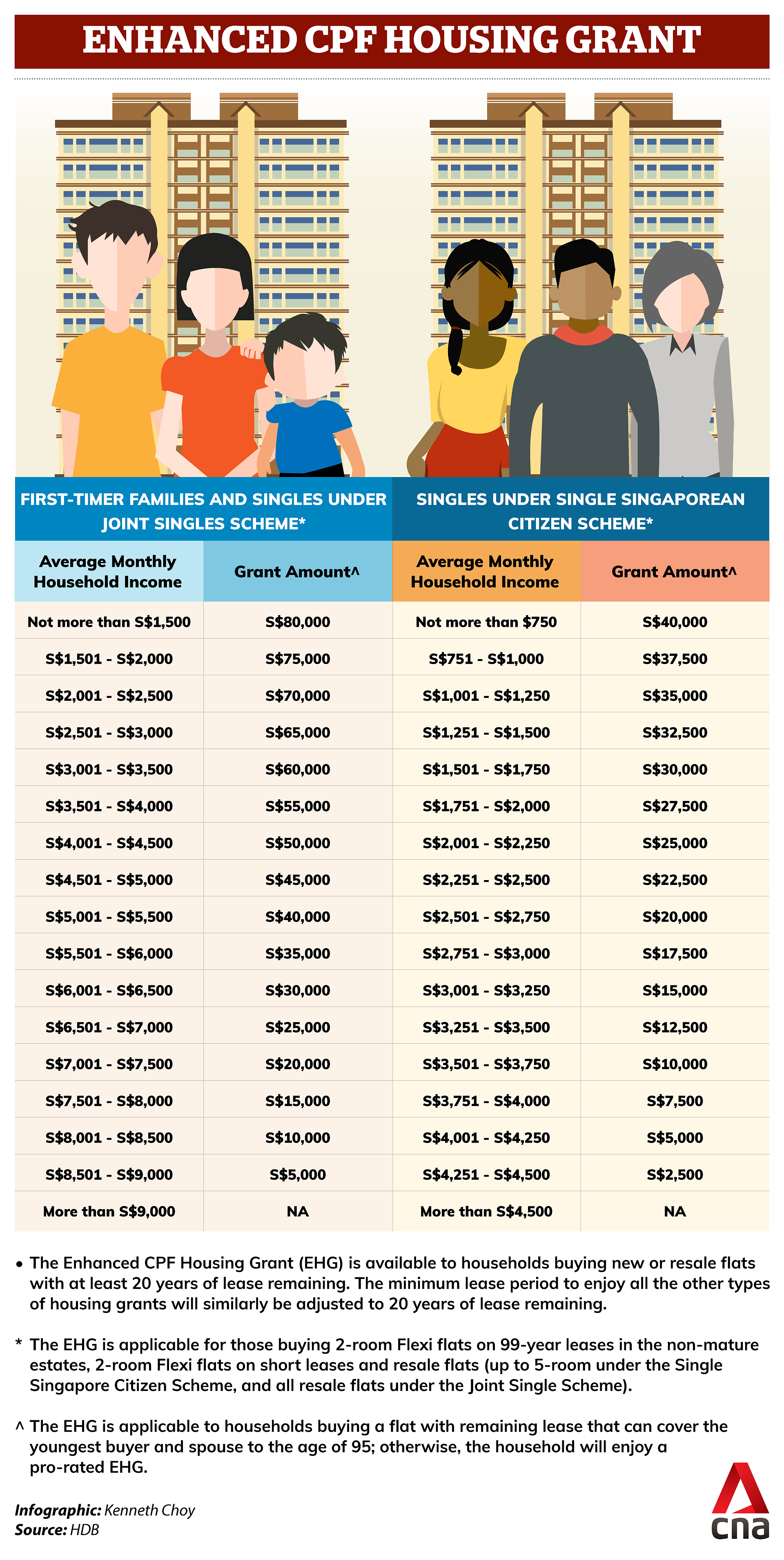

A new Enhanced CPF Housing Grant (EHG) was also announced.

The new grant will be offered to all eligible first-time buyers of new and resale HDB flats, across all flat types and locations.

The EHG will replace the current Additional CPF Housing Grant (AHG) and the Special CPF Housing Grant (SHG).

It is tiered according to income levels, and offered to families and singles under the Joint Singles Scheme earning S$9,000 and below.

First-timer families who buy flats with leases that will cover them till the age of 95 will enjoy an EHG of up to S$80,000, said HDB in a press release.

“This is to ensure that all Singaporeans will be able to live comfortably in a home that can last them for life,” it said.

Families who buy flats with leases that do not cover them until the age of 95 will still receive grants, but this will be pro-rated, said HDB.

For example, a first-timer couple with a combined income of S$4,800 looking to buy a 4-room Build-to-Order (BTO) flat in a mature estate will receive an EHG of S$45,000. Under the current scheme, the couple will only enjoy a S$5,000 AHG.

Families buying resale flats, can also qualify for the Proximity Housing Grant on top of the EHG, provided they fulfil the requirements. This is not unique to first-time buyers.

Singles aged 35 and above under the Single Singapore Citizen Scheme will also benefit from the enhanced grant, provided they are eligible first-timers and earn S$4,500 or less. The grants will be tiered by income level, with a maximum grant of S$40,000.

However, HDB noted that if the total grant exceeds 95 per cent of the price of the flat, buyers will be required to make a co-payment of 5 per cent of the price using their CPF or cash savings. Any excess grant amount will be split equally into the buyer’s CPF Special/Retirement Account and Medisave Account.

HELP FOR SECOND TIMERS FAMILIES

More second-timer families and seniors will also qualify for existing schemes and grants under HDB.

Eligible second-timer families earning up to S$7,000 will now be allowed to apply for the Fresh Start Housing Scheme and the Step-Up CPF Housing Grant, up from the previous cap of S$6,000.

The First Start Housing Scheme aims to help second-timer families with young children currently living in public rental flats to purchase a 2-room Flexi flat, while the Step-Up CPF Housing Grant is offered to eligible second-timers hoping to buy a second subsidised flat.

Eligible seniors with a monthly household income of S$14,000 or less will also be allowed to take part in the Lease Buyback Scheme, the Silver Housing Bonus, and to purchase a short lease 2-room Flexi flat, up from the previous income cap of S$12,000.

The Lease Buyback Scheme allows seniors to sell part of their flat’s lease to HDB to receive more income in their retirement years. The Silver Housing Bonus supplements the retirement income of lower-income elderly households when they downsize their flats.

With these changes, HDB said that it expects demand for public housing to increase. It will likely increase the Build-to-Order (BTO) supply in 2020, it added.