SINGAPORE: Housing Development Board (HDB) flats that are older than 30 years depreciate less than private non-landed housing, according to a study conducted by the National University of Singapore (NUS).

The results of the study, which were announced in a press release on Wednesday (Feb 13), also revealed that differences in depreciation between freehold and leasehold residential properties and HDB flats only appear after 10 years.

Depreciation rates are related to building age, said NUS. Other factors such as land tenure and size have also been adjusted in price changes.

The study was conducted by mapping age-related depreciation rates against transaction prices of resale properties. This was done using data obtained from the Urban Renewal Authority (URA) and HDB. Historical resale transaction prices for both property types were used to study the depreciation rates of resale houses over twenty years, from 1997 to 2017, the news release said.

Block 259 is the only circular HDB block in Singapore. (Photo: Gaya Chandramohan)

The properties were then divided and categorised into three housing types – HDB flats, 99-year leasehold non-landed residential properties and freehold non-landed residential properties.

Control measures for factors unrelated to age were also accounted for. These factors include housing size, type, number of housing units in the neighbourhood and distances to the nearest MRT station and to the Central Business District.

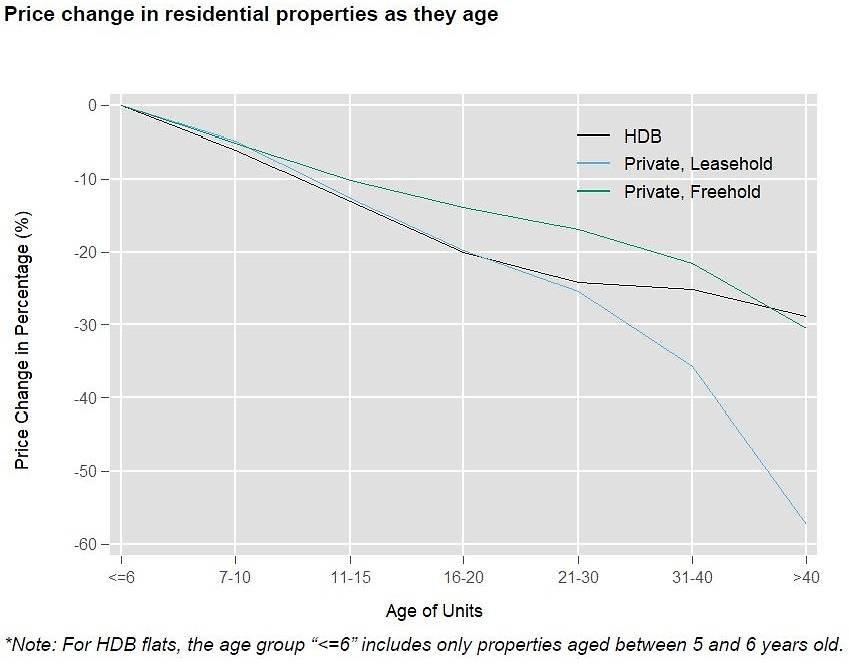

According to the study, prices for all housing types declined as the house aged. Depreciation rates for all types were similar within the first 10 years, though HDB flats were depreciating one per cent faster than the two other property types.

After the 10-year mark, private freehold properties generally see a slower rate of depreciation, as compared to private leasehold properties and HDB flats, the study found. The latter two types depreciated at similar rates for up to 20 years, it added.

When the properties reach 21 years and above, the depreciation rate for HDB flats is around 3 per cent, while private properties depreciate by more than 10 per cent. Leasehold private residential property prices depreciated by more than 30 per cent once they reach the same age, the study said.

The study found that prices declined at a much slower rate for HDB flats aged 30 years and above, compared to private properties.

“The increasing aging effects of private properties above 30 years old is probably due to lack of maintenance of the building and its surroundings,” said Associate Professor Sing Tien Foo, who co-authored the study.

“HDB flats enjoy the benefits of upgrading efforts such as the Singapore Government’s Home Improvement Programme that help reduce the aging effects more effectively than private properties.

“The problem seems more serious for leasehold private property owners who face both aging and lease decaying effects as aging can hasten economic obsoleteness of older buildings.”

The total length of 34 Whampoa West’s corridor is about three football fields. (Photo: Gaya Chandramohan)

In addition to redevelopment schemes that slow down the declining prices of older HDB flats, subsidy grants of up to S$50,000 for first-time buyers of resale flats also help mitigate the price depreciation as the property ages, said Professor Sumit Agarwal.

The study was co-authored by a team at NUS, consisting of Prof Sing, Prof Agarwal, NUS Business School professor Low Tuck Kwong and PhD student Zhang Xiaoyu.