Faced with a sluggish public resale market, fewer home owners are selling their flats once they become able to do so.

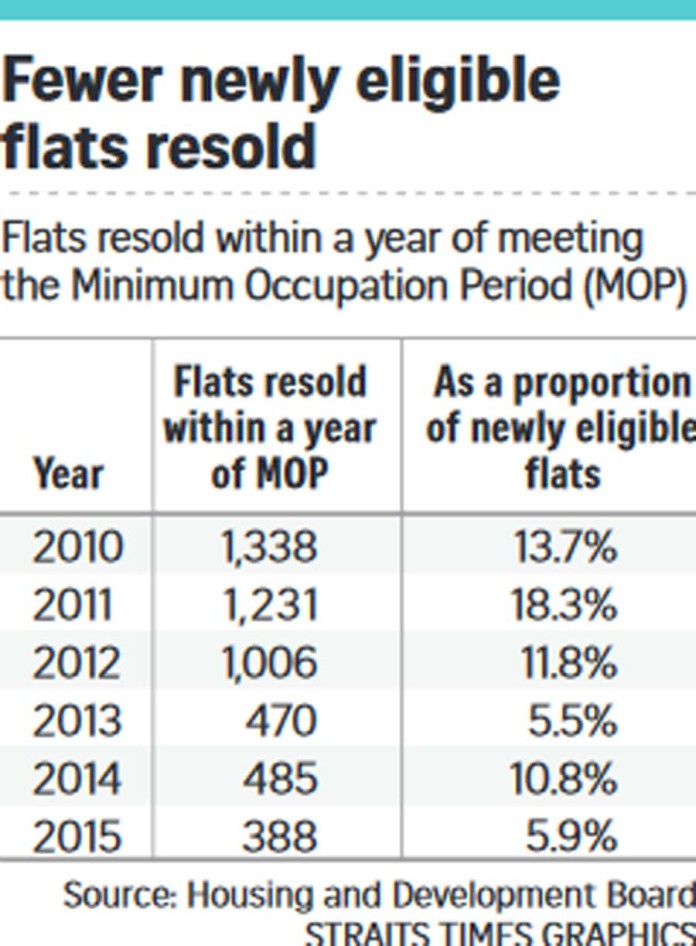

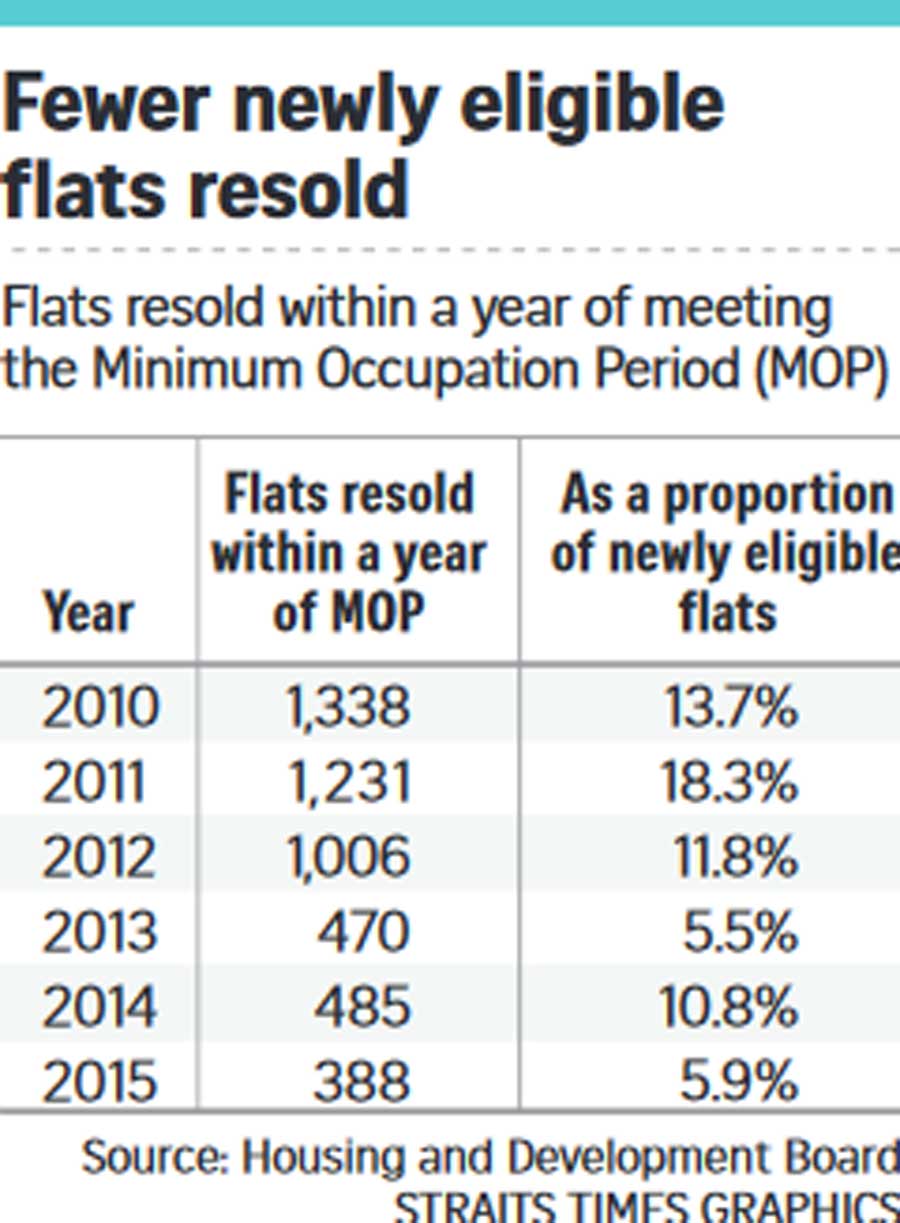

Last year, 388 flats were resold within a year of meeting their five-year Minimum Occupation Period (MOP), the Housing Board told The Straits Times.

This was 6 per cent of the 6,623 newly eligible flats, down from about 11 per cent in 2014.

Experts said market conditions were behind the fall, but offered differing explanations.

Resale prices fell 1.6 per cent last year. A total of 19,306 flats changed hands, up from 2013’s record low of 17,318, but still low compared with preceding decades.

The quiet property market might have cooled housing aspirations, with home owners feeling “no hurry… to upgrade”, said R’ST Research director Ong Kah Seng.

In previous years, when the public resale market was hot, more flats were resold upon becoming eligible. From 2010 to 2012, more than 1,000 such flats were resold each year, representing between 12 per cent and 18 per cent of newly eligible flats.

But after the introduction of cooling measures such as loan curbs, HDB resale prices began to fall in the second half of 2013. That year, only 5.5 per cent of flats were resold within a year of meeting the MOP – comparable with last year.

Why were proportionately fewer newly eligible flats resold in 2013 and last year, compared with 2014?

Unlike 2014, which had steadily falling prices, the other two years were turning points for the market, said OrangeTee research manager Wong Xian Yang. He said: “When the price trend is uncertain, there will be a mismatch in buyer-seller expectations as the market figures out where prices may be heading.

“The gap in expectations between buyers and sellers may have widened during these periods of uncertainty, leading to the lower proportions seen in 2013 and 2015.”

In contrast, the proportion of home owners choosing to sublet their newly eligible flats has remained fairly constant since 2010.

Last year, 259 flats, or 4 per cent of newly eligible flats, were sublet within a year of meeting the MOP.

Compared with resale plans, subletting intentions immediately after the MOP are less affected by market conditions, said experts.

“Most owners of newer flats generally do not favour subletting unless forced by circumstances,” said Mr Ong, adding that such flats are still in a fairly new condition and subletting carries the risk of poor upkeep.

This article was first published on March 12, 2016.

Get a copy of The Straits Times or go to straitstimes.com for more stories.