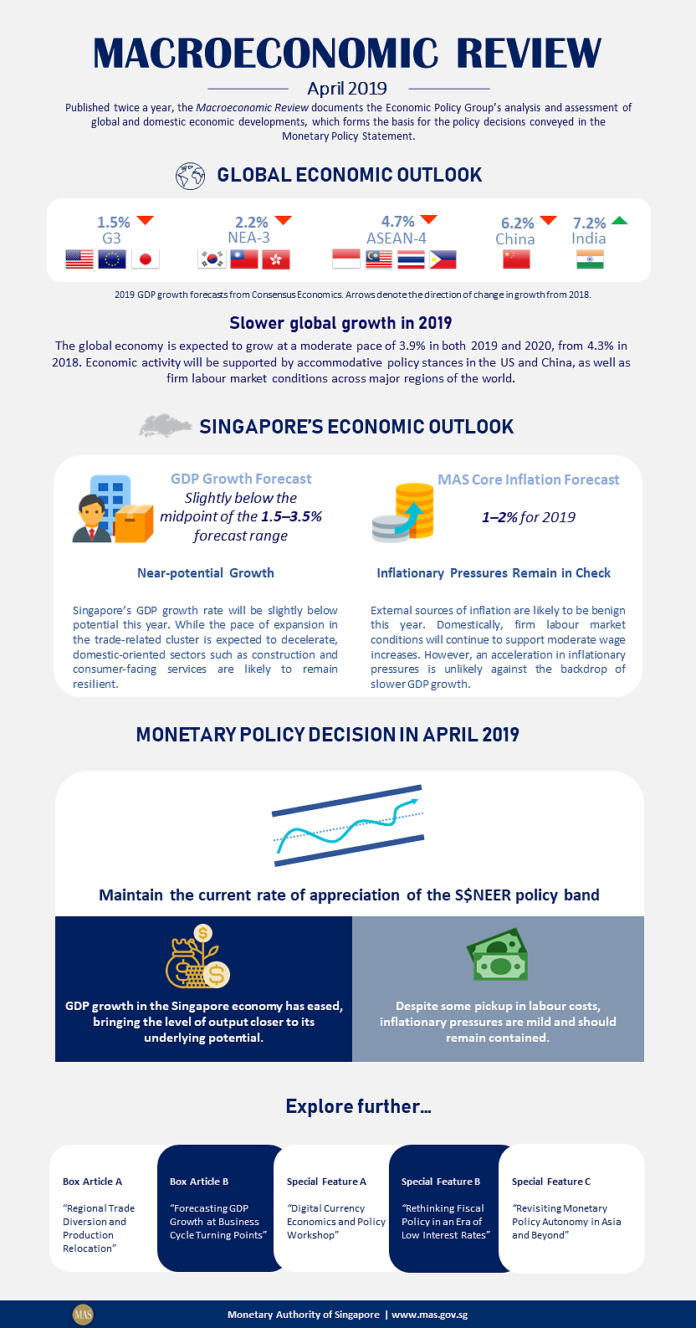

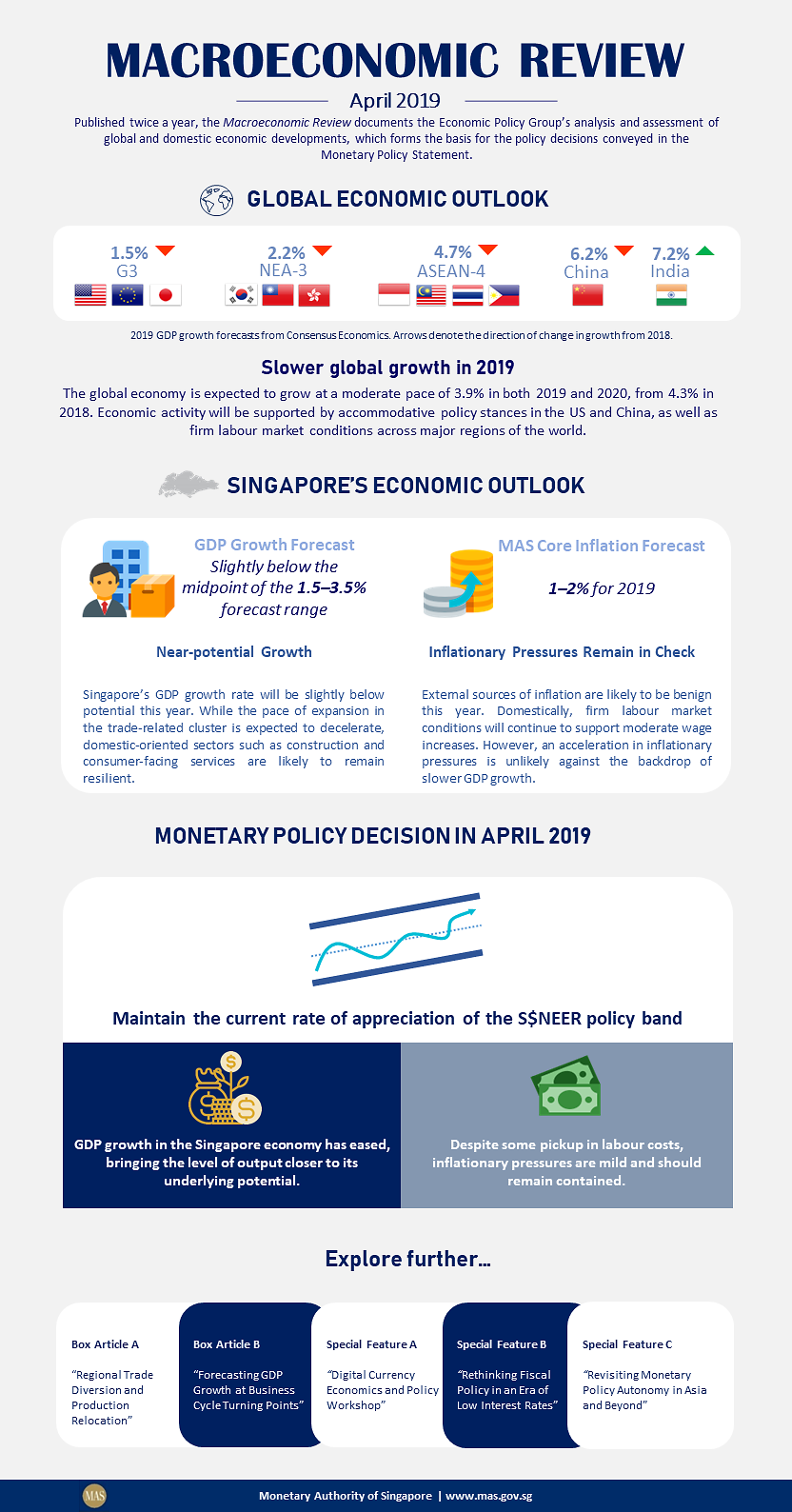

SINGAPORE: Singapore’s economic growth in 2019 is expected to come in slightly below the mid-point of the 1.5 to 3.5 per cent forecast range, barring an external setback, said the Monetary Authority of Singapore (MAS) in its latest macroeconomic review released on Friday (Apr 26).

This is down from the 3.2 per cent growth in 2018.

The domestic economic outlook over the next few quarters continues to be clouded by uncertainty in the global economy, the report said.

The slowdown was already felt in the fourth quarter of 2018 and first quarter of 2019.

READ: Singapore’s GDP growth slows to 1.3% in Q1: MTI advance estimates

“Broadly, the subdued prospects for global growth will weigh on the externally-oriented segments in Singapore,” it said.

“Further, the global electronics sector faces significant headwinds owing to market oversupply, exacerbated by the softening of demand due to the uncertain business environment.”

The step-down in growth was mainly driven by weakness in the trade-related cluster, notably in electronics-related production and trade, as well as certain pockets in the modern services cluster such as the externally-oriented segments of financial intermediation.

Given the external challenges, MAS said the Singapore economy will have to turn towards domestic drivers for growth this year.

DIGITAL SERVICES, CONSTRUCTION ACTIVITIES TO SUPPORT GROWTH

This will be led by the ongoing expansion in services arising from the digital transformation of the economy.

“Activities of payment services players should continue to pick up as Singapore progresses towards a more cashless society. Competition, improved product offerings amongst incumbents, and entry of newer players will drive the momentum of this segment,” the central bank said.

Elsewhere in modern services, ICT and business services will benefit from the ongoing push towards a Smart Nation. Public investment in digitalisation, in accord with the “Digital Government Blueprint”, will provide a further fillip to these sectors, it added.

The domestic-oriented cluster saw an uptick in activity, alongside the recovery of the construction sector.

MAS said the recovery in the construction sector is expected to continue, led by public sector projects such as JTC’s upcoming developments at Punggol Digital District and Bulim, NEA’s Integrated Waste Management Facility, as well as civil engineering projects such as the Jurong Regional Line and North South Corridor.

Private sector construction is also expected to gain momentum in 2019, spurred by the redevelopment of en-bloc residential sites and institutional building activities, it added.

Meanwhile, the broadly supportive conditions in the domestic labour market should benefit consumer-facing industries.

(Graphic: MAS)

LABOUR MARKET, INFLATION OUTLOOK

MAS said despite the moderation in economic growth in 2019, the labour market is expected to remain firm.

In 2018, retrenchments declined, job vacancies rose and the resident unemployment rate fell by 0.2 per cent to 2.9 per cent.

READ: Jobless rate for Singaporeans in Q1 grows slightly to 3.2%: MOM

This improvement translated to higher resident wage growth of 3.5 per cent in 2018, compared to 3.1 per cent in the previous year.

“With changes in labour demand and supply being broadly balanced, wage growth is projected to ease only slightly,” said MAS.

Friday’s report comes two weeks after the MAS kept its exchange rate-based monetary policy unchanged after tightening twice last year.

It reiterated the central bank’s expectations for core inflation to fall in the 1 to 2 per cent range this year.

It said while other sources of external inflation are likely to remain benign, there are domestic cost pressures given the firm labour market conditions.