SINGAPORE: The Government’s Budget statement for Financial Year (FY) 2018 was unveiled by Finance Minister Heng Swee Keat in Parliament on Monday (Feb 19).

Chief amongst the announcements was the raising of Goods and Services Tax (GST) from 7 to 9 per cent “sometime in the period” from 2021 to 2025, cushioned by news of a one-off “hongbao” or red packet for Singaporeans.

“This GST increase is necessary because even after exploring various options to manage our future expenditures through prudent spending, saving and borrowing for infrastructure, there is still a gap,” Mr Heng explained.

“Increasing GST by two percentage points will provide us with revenue of almost 0.7 per cent of GDP per year. This boost … will be vital in closing this gap.”

Mr Heng said the Government will continue to absorb GST on publicly-subsidised education and healthcare, while topping up the permanent GST Voucher Fund to help seniors and the lower-income bracket, and also implementing an offset package to help Singaporeans adjust to the increase.

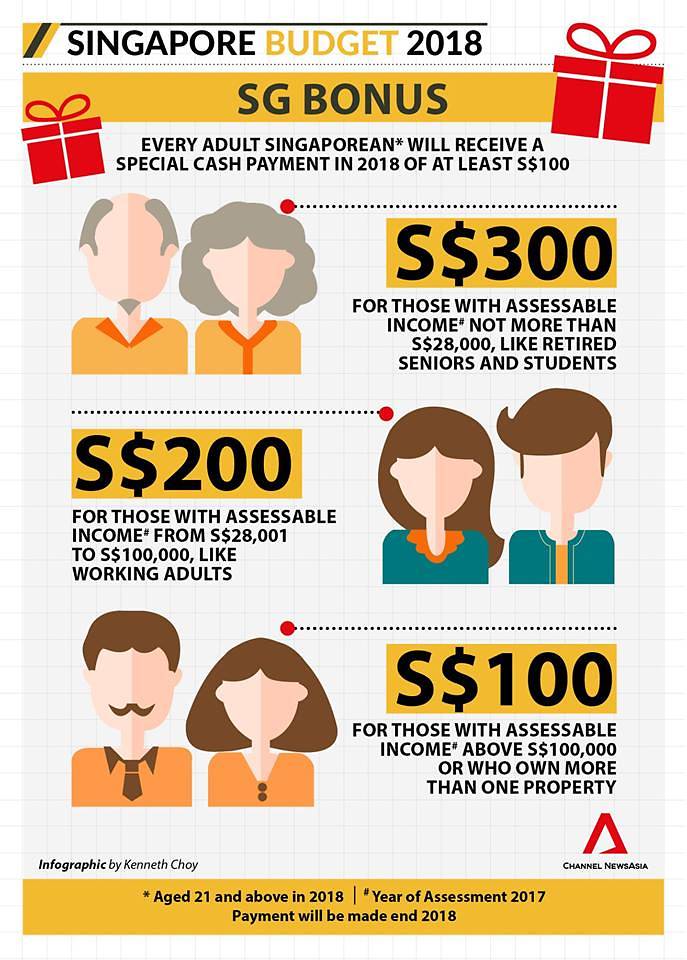

Another highlight of Budget 2018 was an “SG Bonus”, where part of the expected FY2017 budget surplus of S$9.6 billion will be “shared” with Singaporeans aged 21 years and above in 2018. They will receive S$100 to S$300, depending on their income, in a payout costing the Government S$700 million.

FOR SOCIETY

Earlier, Mr Heng introduced measures aimed at helping Singaporeans prepare for their futures, care for those in need and adopt a spirit of giving.

From January 2019, students will see an increase in annual Edusave contributions by the Government, from S$200 to S$230 for each primary school student, and S$240 to S$290 for secondary school ones.

There will also be updates to the income eligibility criteria for bursaries, and greater assistance for lower-income families with the annual bursary quantum for pre-university students raised from S$750 to S$900. Additionally, the School Meals Programme will cover more meals for secondary school students.

A new financial education curriculum will also be piloted at polytechnics and ITEs.

With immediate effect, the Proximity Housing Grant (PHG) will be increased to S$30,000 for families buying a resale flat to live with their parents or children. The PHG will be raised to S$15,000 for singles – identified by Mr Heng as “often a key source of caregiving support within their families” – who buy a resale flat to live with their parents. Those who buy a resale flat near their parents will receive a PHG of S$10,000.

The criterion for “near’ will also be revised to “within 4km”.

Households will see a one-year extension to the S&CC rebate.

From Apr 1, 2019, the foreign domestic worker (FDW) levy framework will be adjusted from S$265 to S$300 for the first FDW and S$450 for the second. Concessionary levy rates will remain at S$60 for qualifying families with elderly, children or members with disabilities. But the qualifying age for the levy concession under the aged person scheme will be raised from 65 to 67 years old.

The Community Networks for Seniors initiative will be expanded nationwide by 2020. Health and social-related services for seniors will be consolidated under the Health Ministry from April this year.

The Agency for Integrated Care (AIC) will be designated the central implementation agency, and merge with the Pioneer Generation Office – which in turn will be renamed the Silver Generation Office.

The Community Silver Trust and Seniors’ Mobility and Enabling Fund will be topped up by the Government to the tune of S$300 million and S$100 million respectively. Another S$150 million will be spent over the next five years for transport to subsidised eldercare and dialysis centres, said Mr Heng.

He also announced extended tax deductions for donations to Institutions of Public Character, for another three years until Dec 31, 2021. For Community Development Councils, the current annual matching grant cap will be upped from S$24 million to S$40 million.

The Business and IPC Partnership Scheme will be extended for three more years to Dec 31, 2021, with the SHARE as One scheme stretched till FY2021. For the next five years, there will also be dollar-for-dollar matching on donations received by the Empowering for Life Fund (ELF) under the President’s Challenge.

In total, around S$190 million will be set aside each year to support such enhancements in the realm of philanthropy and volunteerism, said Mr Heng.

FOR THE ENVIRONMENT

Pointing to climate change and Singapore’s particular vulnerability to rising sea levels, Mr Heng provided an update on a move which was first announced last year to encourage companies to further reduce emissions.

There will be a carbon tax of S$5 per tonne of greenhouse gas emissions for all facilities producing 25,000 tonnes or more of greenhouse gas emissions in a year, in the first instance, from 2019 to 2023.

This rate will be reviewed by 2023, and the Government intends to increase it to between S$10 and S$15 per tonne of emissions by 2030.

Starting from 2019, schemes like the Productivity Grant (Energy Efficiency) and Energy Efficiency Fund will be enhanced to support companies in their efforts to improve energy efficiency and reduce emissions.

“We expect to collect carbon tax revenue of nearly S$1 billion in the first five years,” said Mr Heng. “I am prepared to spend more than this in the initial five years, to support worthwhile projects which deliver the necessary abatement in emissions.”

Households will experience a small impact at about 1 per cent of total electricity and gas expenses on average. To help with the transition, there will be additional U-Save for three years, and eligible HDB flats will receive an annual increase of S$20 from 2019 to 2021.

This increase will cover the expected average increase in electricity and gas expenses, said Mr Heng.

FOR THE ECONOMY

The Wage Credit Scheme, which co-funds wage increases for Singaporean employees up to a gross monthly wage of S$4,000, will be extended for three more years to provide 20 per cent co-funding for 2018, 15 per cent for 2019 and 10 per cent for 2020.

This will cost about S$1.8 billion, said Mr Heng.

The Corporate Income Tax rebate will also be raised to 40 per cent of tax payable, capped at S$15,000, for Year of Assessment (YA) 2018. It will be extended to YA2019 at a rate of 20 per cent tax payable, capped at S$10,000. Mr Heng said these changes are projected to cost an additional S$475 million.

Increases in the Foreign Worker Levy rates for the Marine Shipyard and Process sectors, which were announced earlier, will be deferred another year.

Further, Adapt and Grow initiatives will help workers facing career transitions to stay employed and employable. The current Work Trial scheme will be upgraded into a Career Trial programme, with more funds for workers to try out new careers.

Businesses will be helped in their efforts to innovate through the likes of a Productivity Solutions Grant, which will streamline existing grants supporting the adoption of pre-scoped, off-the-shelf technologies. There will also be raised tax deductions on IP licensing payments to unrelated parties as well as IP registration fees and local R&D, plus an Open Innovation Platform to find partners to co-create solutions.

The National Research Foundation (NRF) and Temasek will launch an NRF-Temasek IP Commercialisation Vehicle, while R&D programmes such as Aviation and Maritime Transformation programmes will be launched

The National Robotics Programme will be expanded to encourage wider use, particularly in construction.

In April, Spring and IE Singapore will merge into Enterprise Singapore. An integrated Enterprise Development Grant (EDT) will provide more targeted support to companies.

The Start-up Tax Exemption and Partial Tax Exemption schemes will be adjusted to more directly help firms develop capabilities.

And the Tech Skills Accelerator, launched in 2016, will be scaled up into new sectors like manufacturing and professional services.

A Capability Transfer Programme will be piloted to support the transfer of skills from foreign specialists to Singaporean trainers and trainees.

In addition, an Infrastructure Office will be set up to bring together local and international partners to work on projects in Asia.

FOR FISCAL FUTURE

In closing, Mr Heng warned that although Singapore was “on sound fiscal footing … In the next decade, between 2021 to 2030, if we do not take measures early, we will not have enough revenues to meet our growing needs”.

“We must continue to manage our expenditure growth carefully and get the best value for every dollar we spend,” he added.

Measures to achieve this include reducing the pace of ministries’ budgets growth from 0.4 to 0.3 times of GDP growth from FY2019.

A new Rail Infrastructure Fund will be set up to save for major rail lines ahead, and will start out with a S$5 billion injection which can be topped up in future. This is on top of a Changi Airport Development Fund which now has S$4 billion in reserves.

Mr Heng also announced the top marginal Buyer’s Stamp Duty (BSD) rate for residential properties will be raised from 3 to 4 per cent.

“The new top marginal rate of 4 per cent will apply to the portion of residential property value which is in excess of S$1 million,” he said. “This change will apply to all residential properties acquired from tomorrow.”

Mr Heng also revealed that GST will be introduced on imported services with effect from January 1, 2020. “Local consumers … do not pay GST when they download apps and music from overseas,” he explained. “This change will ensure that imported and local services are accorded the same treatment.”

“Finally, to discourage consumption of tobacco products, I will implement a 10 per cent increase in tobacco excise duty across all tobacco products with effect from today,” added Mr Heng.

Some of the FY2017 budget surplus will also be channelled for future spending such as in the aforementioned Rail Infrastructure Fund. A further S$2 billion will be set aside for premium subsidies and other support when the ElderShield review is complete.

“In FY2018, our budget position will remain expansionary,” said Mr Heng, noting that the ministries’ total expenditures are expected to be S$80 billion, 8.3 per cent higher than in FY2017.

“Budget 2018 is about laying the foundation for our nation’s development in the next decade,” he concluded. “At its heart, the Budget is a strategic and integrated financial plan to position Singapore for the future. It is a means for us to achieve the aspirations of our people, a roadmap for us to achieve our vision for Singapore.”