SINGAPORE: Ms Doleries Kwok remembered having to rely on an old mobile phone for months after her brand new smartphone accidentally took a spin in the washing machine with her laundry.

“I had a hard time because a re-contract wasn’t due yet,” she said.

When she could finally get a new phone with a re-contract plan, she was recommended an insurance policy that covers accidental damage or loss of the mobile device. Monthly premiums cost about S$8. With her previous experience in mind, she took it up without hesitation.

This proved to be useful when she had another case of bad luck with her mobile phone. By topping up S$200, Ms Kwok received a replacement device of the same iPhone model the next day.

“The refurbished phone is like brand new,” she told CNA. “Luckily, I have my insurance.”

Demand from consumers like Ms Kwok has not gone unnoticed, with more companies developing insurance policies to address what they see as pain points in an increasingly technology-dependent lifestyle.

At least two new entrants have joined the mobile phone insurance market this year. Both chose to offer coverage for accidental screen damage – an area they described as a “protection gap”.

“What’s available in the market now tends to be run-of-the-mill sort of product – a flat premium that covers the entire phone,” said Mr Raunak Mehta, chief commercial officer of insurtech start-up Axinan.

“But if you dig deeper, you will find that the majority of the claims is for damage to the screens. So we thought, why not just focus on that?”

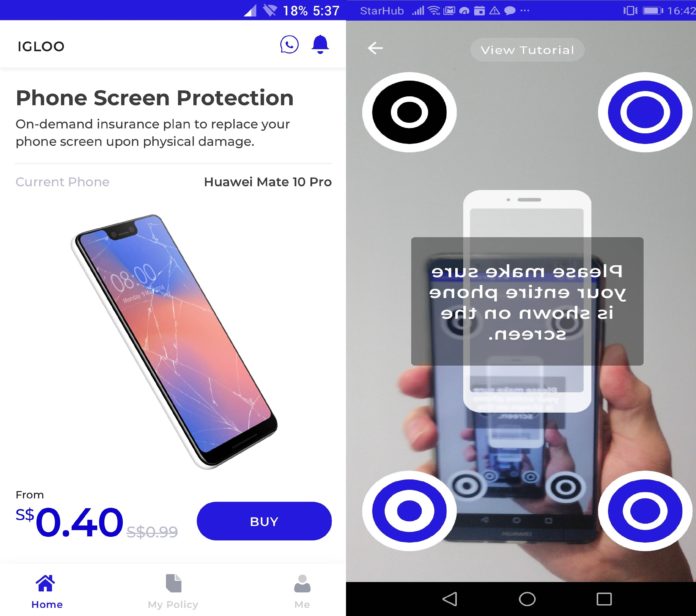

Insurtech start-up Axinan allows consumers to choose from daily, monthly and yearly plans that cover both old and new mobile phones for a one-time screen repair.

Axinan, through its consumer brand igloo, offers daily, monthly and yearly plans that cover both old and new mobile phones for a one-time screen repair. Premiums differ according to coverage duration and phone type. For example, the rates for a 12-month policy can range from S$13 to S$45.

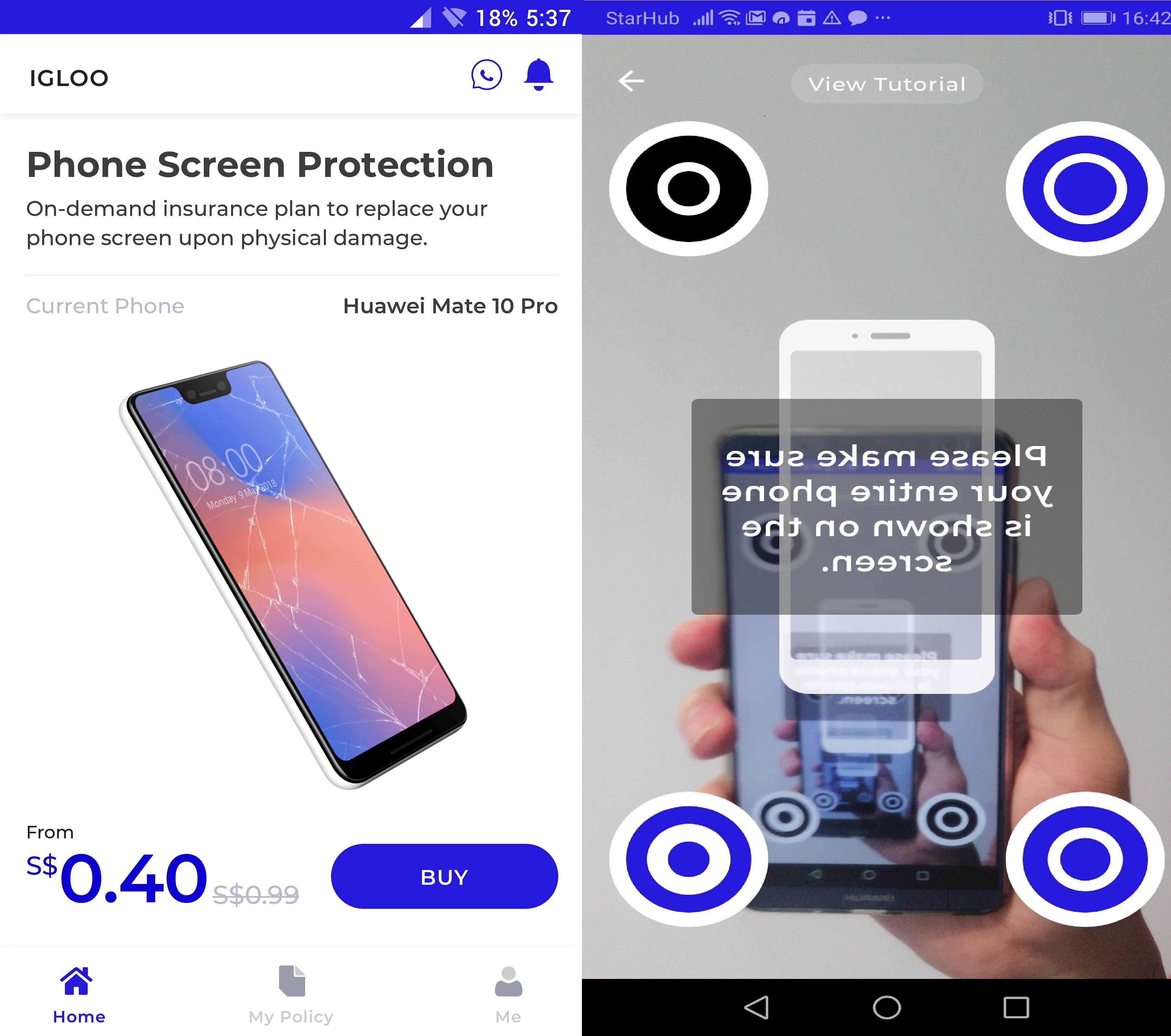

At e-commerce solutions firm Synagie, its insurance product cost S$39.90 a year and covers brand new phones for one screen repair at authorised service centres.

The plan, launched in March and underwritten by Etiqa Insurance, also comes with a free concierge service that picks up the damaged phone from a customer and sends it back after repair. It is available on Synagie’s lifestyle insurance app, which targets “threats and hazards in the digital lifestyle”.

“Many people live with cracked screens simply because screen repairs can be costly. But if you were to repair it at a non-authorised shop, you might get your warranty void,” said chief executive Clement Lee.

“We think this is a pain point.”

A screenshot from Synagie’s lifestyle insurance website.

OTHER LIFESTYLE PAIN POINTS

Bigger industry players have also jumped on the lifestyle insurance bandwagon.

Etiqa Insurance, for instance, rolled out cyber insurance for individuals last year. With annual premiums of S$107, the policy offers coverage of up to S$25,000 for four main cyber threats, namely cyber fraud, cyber extortion, restoration costs and identity theft.

Head of direct business Jazzreal Wong said this is a timely product, given trends like increased Internet usage and Singapore’s Smart Nation push. Existing cybersecurity insurance are also mainly targeted at businesses.

“There is growing awareness about protection against cyber risks, and companies have by and large started focusing on this,” said Ms Wong.

“But there is definitely a big gap when it comes to emulating a similar protection for individuals who are very much on their own.”

At NTUC Income, emerging lifestyle pain points that have been identified include surges in ride-hailing fares on rainy days.

It rolled out Droplet in October 2018, offering a payout of up to 60 per cent of a passenger’s trip fare or cancellation fee if it is raining at the point of pick-up. Coverage under the insurance policy has since been extended from rides on Grab to include those booked on Gojek and Ryde.

READ: New insurance plan to cover surge pricing for Grab rides on rainy days

NTUC Income then followed up with Pinfare in March, which allows customers to insure against price fluctuations on flight booking sites.

“Droplet and Pinfare are examples of how we offer customers innovative insurance solutions that are embedded into routine lifestyle activities,” said chief digital officer Peter Tay.

The insurer also embarked on a partnership with China insurtech pioneer ZhongAn in April, to enhance its operational agility and technological capabilities. This has thus far resulted in a micro-insurance plan that allows Grab drivers to slowly build up insurance coverage by paying premiums of between 10 and 50 cents with each trip they complete, as well as a usage-based motor insurance with car marketplace start-up Carro.

“Innovation is agile and iterative and to serve our customers well, we must be ready to tap on the right opportunities at the right time,” Mr Tay added.

Commenting on the trend, National University of Singapore’s (NUS) associate professor Lawrence Loh said insurance has traditionally been “very lumpy and involving big purchases”.

However, the rise of new technology, such as data analytics, has paved the way for changes.

“Now, its about micro-insurance where risks are broken down into smaller parts so that customers can buy what they need,” he explained.

A competitive landscape also means that insurers are now more willing to dabble with new products. “If you don’t do it, someone else will,” added Assoc Prof Loh.

IS THERE DEMAND?

Replying CNA’s queries, NTUC Income said it has seen “encouraging” response to Droplet and Pinfare, with surges in take-up rates during different times of the year.

For instance, there tends to be more takers for Droplet during rainy seasons like the past couple of months. The take-up rate for Pinfare is also typically higher in weeks preceding long weekends or school holidays, said Mr Tay.

“To date, we have sold close to a thousand policies for Droplet and Pinfare combined, and note that 20 per cent of Droplet policy purchases come from returning customers.”

NTUC Income announced a new insurance plan to provide coverage for surge prices charged on rides booked on rainy days. (Photo: Income)

Its micro-insurance plan for Grab drivers – which it said is Southeast Asia’s first micro-insurance plan to offer protection against critical illnesses – has also been “well-received”. At the moment, there are more than 1,200 drivers holding these policies, said Mr Tay.

Etiqa Insurance would only say that its personal cyber insurance has seen a 50 per cent quarter-on-quarter increase in take-up rates since its launch.

Axinan and Synagie declined to reveal how many policies they have sold, although they noted that responses have been promising despite initial challenges.

Mr Lee, for instance, noted the need to change how people feel about insurance.

“People don’t look at buying insurance unless (it’s) at the point of inflection. For example, you won’t think about buying travel insurance unless you are planning a trip.”

Echoing that, Mr Mehta said: “Insurance, by design, is a very difficult product to sell so it has to be sold in a very seamless fashion.

“Like selling it to you in a telco store and as part of an overall package for your new phone. If somebody tried to sell a mobile phone insurance to you separately, you probably wouldn’t buy it.”

This is why both firms have thus far adopted similar strategies – leveraging digital technology to make insurance simple and directly accessible to its customers, but at the same time work with different partners such as brick-and-mortar mobile shops and telcos.

“It was not a smooth start in the sense that we had to do a lot of market education and training of the sales team … but I think we are finally headed to a more receptive market now,” said Mr Lee.

Awareness for new products will inevitably take time, said Ms Wong. And to do so, Etiqa Insurance had a soft launch which introduced the personal cyber insurance as an add-on to its home insurance policy.

“We knew it would be difficult to talk to individuals purely on cyber insurance so we decided to bring in the element of home and protecting one’s family,” she told CNA, adding that the soft launch saw a “positive reception”.

READ: More buying pet insurance for dogs and cats as vet fees climb

IN THE PIPELINE

Moving forward, NTUC Income is looking to launch a micro-insurance scheme that will allow customers to pay for their premiums through daily activities, such as purchasing a cup of coffee. This is slated for early 2020.

But as negotiations with potential partners are still being finalised, it declined to share more details.

Mr Tay said: “Micro-insurance, in essence, breaks down traditional insurance into parts, allowing the customer to pay for what he or she can afford and build up his or her insurance coverage gradually over time.

“We see the growing popularity of micro-insurance schemes globally as an opportunity for us to make insurance more accessible and affordable for customers by making it a part of their daily lives.”

Others are also looking to expand their lifestyle insurance products.

Offering more consumers protection against loss, damage and delivery delays for their online shopping could be on the cards for Axinan.

The start-up already offers this in Indonesia through a partnership with local e-commerce platform Bukalapak. Merchants can protect their goods against the risk of total loss or damage during transit, while customers can get protection against accidental damage for gadgets and electronics they buy from the Indonesian e-commerce site.

Mr Mehta said Axinan plans to make this available in Singapore after seeing encouraging traction in Indonesia.