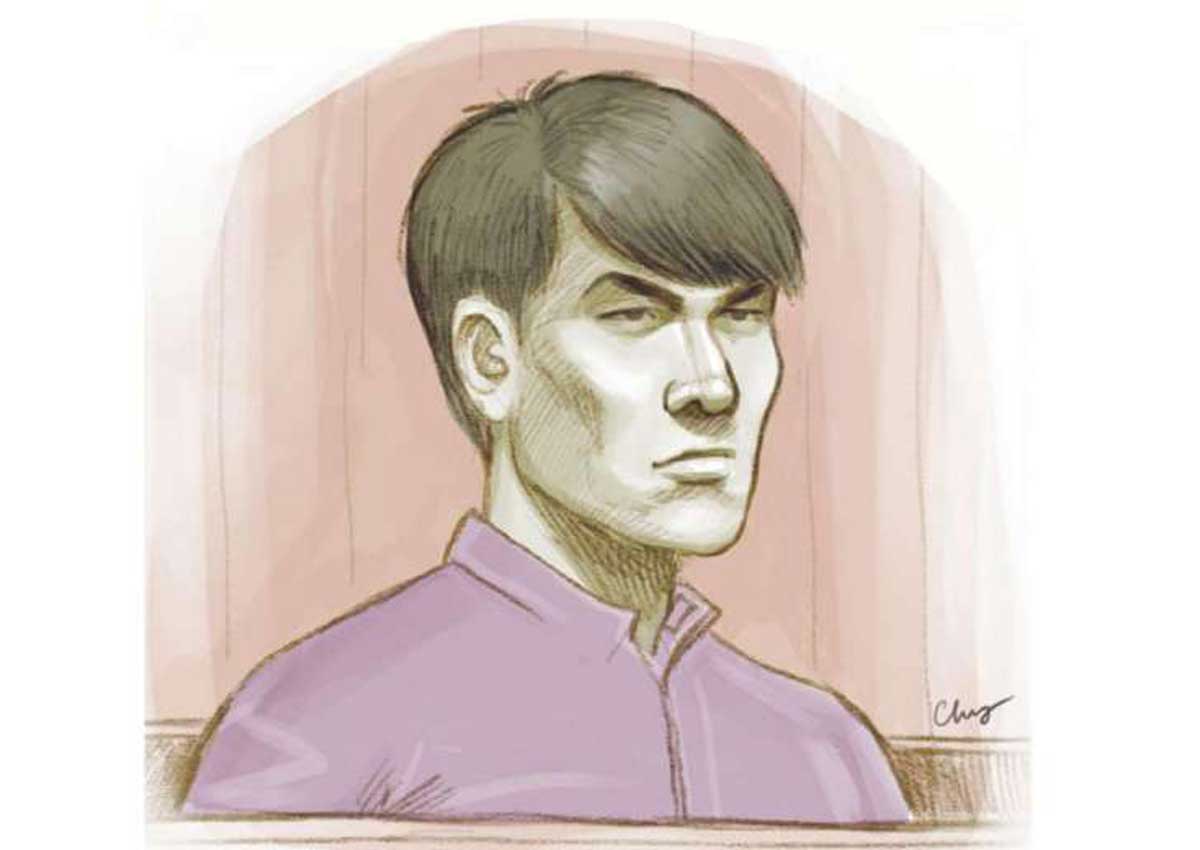

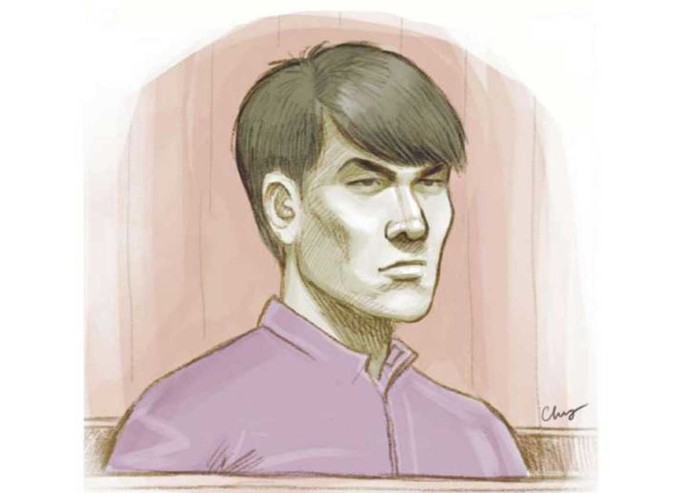

Former BSI banker Yeo Jiawei was so paranoid about secrecy he urged his former supervisor to get a “Bangla” phone so they could hold untraceable conversations, a court heard yesterday.

“Bangla” phones belonged to construction workers who had left Singapore and so would not be traceable.

Kevin Swampillai, Yeo’s supervisor at BSI, told the court: “In fact, I asked him if he could get me one, to which he replied it would be difficult and he suggested that I get my own”, to keep his communications with Yeo secret.

The pair also used encrypted texts on the online messaging service Telegram to avoid detection after investigations by the Commercial Affairs Department into their dealings with scandal-hit state fund 1Malaysia Development Berhad (1MDB) intensified in October last year.

Details on how they tried to avoid detection arose on day three of Yeo’s trial on four charges of perverting the course of justice by allegedly urging witnesses to lie to police and destroy evidence.

Counts of money laundering, cheating and forgery will be dealt with in a separate trial next year.

Mr Swampillai also testified that Yeo, 33, left Swiss private bank BSI to join infamous Malaysian tycoon Jho Low after getting a salary offer of $500,000 a year.

The testimony contradicted claims by Yeo’s lawyer that his client did not get a job offer from Mr Low.

Mr Swampillai, 52, was head of BSI’s wealth management services before being suspended. He is now unemployed.

He told the court that he devised a plan to leave BSI and make “big management fees” from setting up a fund company that would manage the proceeds from a deal with Brazen Sky, a wholly-owned unit of 1MDB.

“The idea may have come from me but Yeo was (an) enthusiastic supporter of the idea and had participated actively with me in that discussion,” said Mr Swampillai.

Yeo’s lawyer, Philip Fong, asked Mr Swampillai if he had put the idea in Yeo’s head for the fund management business.

“The fund company would be managing a portfolio value of more than US$2.3 billion (S$3.2 billion). Did you tell Yeo this?” Mr Fong asked.

Mr Swampillai denied it, saying Yeo “recognised the potential of that business” without him having to say so.

Mr Swampillai said he and Yeo made millions in “secret profits” from their 1MDB dealings. The pair set up shell companies to receive the profits, which were then channelled to companies they controlled.

In September 2012, 1MDB sold its shares in a venture for US$2.32 billion and received units in a shell company called Bridge Partners International Management (BPIM).

1MDB earlier said the units were owned by Brazen Sky and held through BSI in Singapore as custodian.

The “referral fees” arrangement involved a portion of the management fees paid by Brazen Sky to BPIM going to firms controlled by Mr Swampillai and Yeo.

gleong@sph.com.sg