A man has been put in a quandary after his purchase of a resale flat for $270,000 from a dementia-ridden owner was not legally recognised.

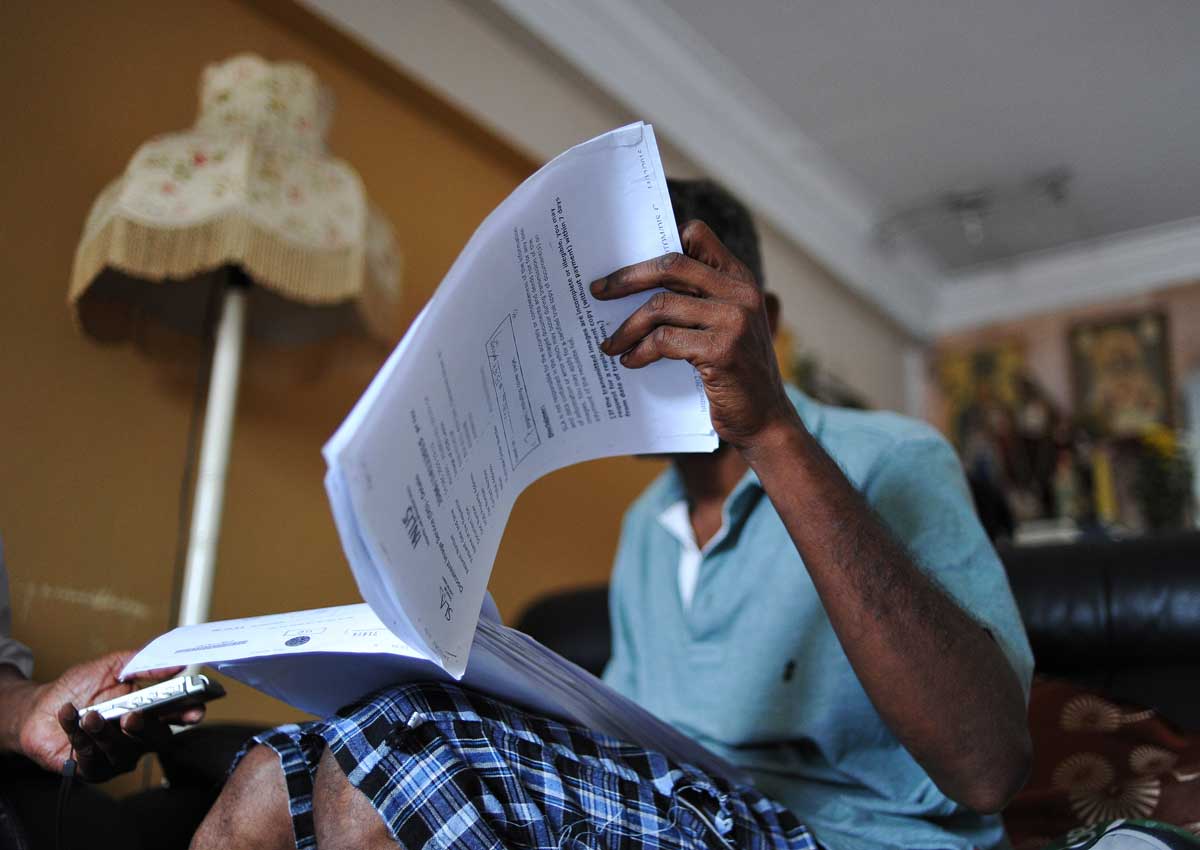

Mr Peter Nathan, 55, who failed to obtain legal ownership of the Tampines flat after the High Court turned down his application last month, told The Straits Times he had been paying the flat’s annual property tax since the sale in 2010. He has also been paying its monthly town council conservancy charges since 2012, he added.

In 2010, Mr Nathan, an oil surveyor, bought the flat from Mr Arthur De Silva Petiyaga, 75, whose late daughter Millicent had acted on his behalf. She had applied to the court to act on his behalf in 2010 but did not actually have the authority to sell the flat on her father’s behalf.

But Mr Nathan came to know of this only in 2014, after Ms De Silva died two years earlier and his relationship with her father soured. Mr Nathan’s father and Mr De Silva had been childhood friends.

Mr Nathan then applied to take possession of the flat and the Singapore Land Authority refused to register the transfer. The High Court also rejected his bid.

Judicial Commissioner Aedit Abdullah said in judgment grounds last month that the case had shown up problems that can arise when a person appointed to act for someone lacking mental capacity dies and is not automatically replaced.

Mr Nathan, who is now lodging at his sister’s Yishun flat, is appealing against the ruling.

A check with the Tampines Town Council showed that the council had billed the owner based on HDB-supplied records which had listed Mr Nathan as the owner of the three-room flat since 2010.

HDB told ST the transaction was completed by lawyers for the buyer and seller in September 2010.

“HDB had granted approval for the resale based on our assessment of the sellers’ and buyer’s eligibility, for instance, whether the sellers have fulfilled the Minimum Occupation Period and whether the buyer has met the requirements for purchase of the flat. As HDB did not act for both the sellers and buyer, we are unable to comment on their legal status,” said a spokesman.

Meanwhile, the family of Mr De Silva has made clear that he had not received any money from the sale of the flat in 2010.

In court papers filed by their lawyer Noor Mohamed Marican for the case heard by Justice Abdullah, Mr De Silva’s grandson Jordan Christopher said when his grandparents were divorced in the Syariah Court in 2008, it was decreed that their matrimonial flat in Tampines was to be sold on the open market.

The proceeds of the flat was to be used to settle the HDB loan and return the money used from the CPF account of his grandmother.

From the net proceeds after the above deductions, 60 per cent was to be given to his grandmother and 40 per cent to Mr De Silva.

Mr De Silva never received a cent of the proceeds after the purported sale, said his grandson in his testimony.

Since his daughter’s death, Mr De Silva has been living alone in the flat, and the flat was regarded by all parties as his property, he added.

He alleged that Mr Nathan’s application was done in bad faith to dispossess an elderly man without mental capacity of his own property. He added that family members are taking steps to apply for a court order to empower them to manage Mr De Silva’s affairs.

vijayan@sph.com.sg

chiaytr@sph.com.sg

This article was first published on May 23, 2016.

Get a copy of The Straits Times or go to straitstimes.com for more stories.