SINGAPORE: Consumers suffered about S$2.37 million in prepayment losses in 2019 due to the “sudden and unexpected closure” of businesses, the Consumers Association of Singapore (CASE) said on Monday (Apr 20).

CASE said it received at least 427 complaints last year regarding the loss of consumer prepayments due to the closures.

The bulk of these losses came from the motorcars, beauty, renovation contractors, bridal, and fitness club industries.

“While businesses generally collect some form of prepayment from consumers before the delivery of goods and services, the amounts collected for these industries tend to be substantial as they involve big-ticket items or long-term commitment,” CASE said.

In particular, CASE received 33 complaints regarding the sudden closure of at least 15 motorcar dealers, and/or the non-transfer of car ownership by these dealers.

The total amount of prepayment losses suffered by these consumers is about S$1.15 million.

READ: Bridal studio’s sudden closure leaves couples in the lurch

In one instance, a consumer had made full payment of S$78,000 for a pre-owned car and was informed by the dealer that the car ownership will be transferred to him within 10 days.

However, the car ownership was still not transferred to him four months later and the dealer had become insolvent due to financial difficulties. Subsequently, the bank also repossessed his car as the dealer had not paid off the outstanding loan on the vehicle.

CASE said that it was “very concerned” with the amount of losses suffered by consumers and will intensify efforts to educate consumers on the risks involved when they make prepayments and how they can protect themselves.

It will also engage the relevant industry stakeholders and governmental agencies to consider targeted prepayment protection measures for the key industries.

MAJORITY OF MOTORCAR COMPLAINTS INVOLVED PRE-OWNED VEHICLES

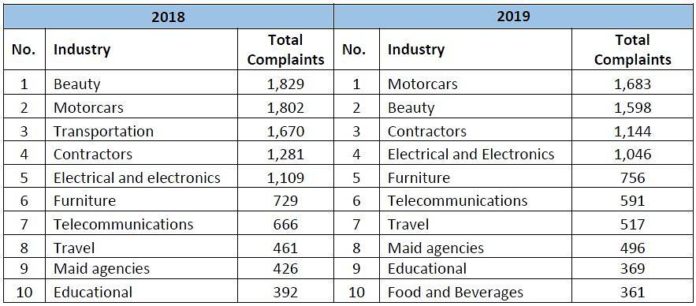

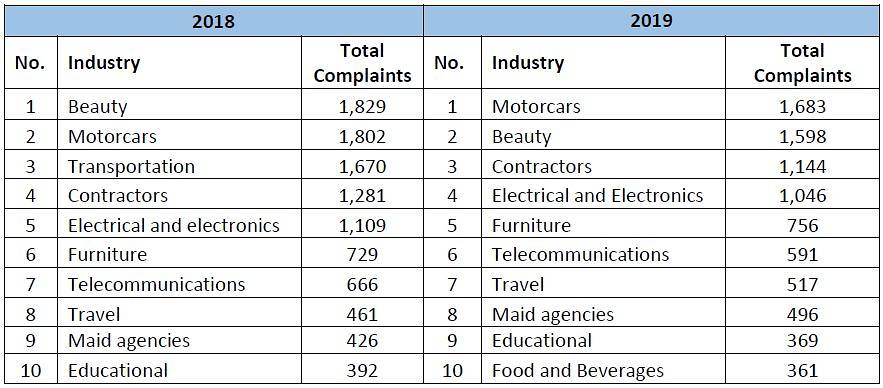

The motorcars and beauty industries received 11.3 per cent and 10.8 per cent of the total complaints respectively.

Breakdown of complaints received for the top 10 industries in 2018 and 2019. (Image: Consumers Association of Singapore)

A total of 42 per cent of the 1,683 complaints regarding the motorcars industry involved defective goods.

Two-thirds of the complaints about defective goods involved pre-owned motorcars.

In one case, a consumer had purchased a pre-owned motorcar for S$39,135. The car broke down four times within two months due to an engine oil leak and other defects.

On the first three occasions, the car dealer agreed to repair the car for free. However, the dealer was unwilling to bear the full repair cost for the fourth time as they had already absorbed the full repair costs on the first three occasions.

After CASE’s intervention, the dealer agreed to absorb the fourth repair cost of S$780 for the vehicle.

Under the law, consumers are entitled to a repair or replacement of goods that do not conform to the contract.

READ: Court order issued against online retailer that misled customers into signing up for recurring subscription

“If a repair or replacement is not possible or if the same cannot be done within a reasonable time and without causing significant inconvenience to the consumer, he can request for a reduction in amount to be paid for the non-conforming good or to rescind the contract,” CASE said.

To address complaints on defective pre-owned motorcars, CASE previously introduced the Standard and Functional Evaluation (SAFE) Checklist in 2017 to guide consumers on the checks they should perform and to encourage them to send the pre-owned car for independent evaluation before they make the purchase.

CASE said it intends to step up its efforts to engage consumers and industry stakeholders to increase the adoption of the SAFE Checklist to help reduce disputes between consumers and car dealers.

PRESSURE SALES TACTICS IN BEAUTY INDUSTRY

About one-third of the 1,598 complaints involving the beauty industry were about salespersons taking advantage of consumers by using pressure sales tactics.

In one instance, a consumer had visited a beauty salon for eyebrow embroidery treatment at a promotional price of S$99.

The consumer complained that the salon staff member proceeded to embroider one side of her eyebrow and then informed her that she had been given a premium eyebrow embroidery treatment costing S$2,280.

READ: 387 complaints on overcharging of face masks, thermometers, hand santisers: CASE

The staff member then allegedly told the consumer that she will not embroider the other eyebrow unless she paid for the premium treatment. The consumer was left with no choice but to pay S$2,280 for the premium treatment.

Under the law, it is an unfair practice for a supplier to take advantage of a consumer by exerting undue pressure or influence on the consumer to enter into a transaction. Consumers have the right to seek recourse against retailers under such a circumstance.

In response to consumer complaints, CASE issued an advisory in July 2019 to alert consumers to aggressive pressure sales tactics used by the industry and to remind consumers who do not wish to enter into a purchase transaction of their right to decline and walk away.

CASE added that it has been educating consumers on their rights and will continue to do so through various communication channels.

S$2.6 MILLION RECOVERED

CASE received a total of 14,867 complaints last year. Of these, 85 per cent of the complaints were instances when consumers were given advice on how to follow up directly with the businesses.

The remaining 15 per cent were filed with CASE, which meant that CASE negotiated and/or mediated the complaints on behalf of consumers.

About 70 per cent of the filed cases were resolved, with nearly S$2.6 million in-cash and in-kind recovered for consumers.

READ: CASE launches new app to compare prices of groceries, household items and hawker food

“We are deeply concerned about the amount of losses suffered by consumers due to sudden business closures. In view of the current economic landscape and as more businesses are affected, it is likely that this issue will remain a pressing concern for consumers,” said the president of CASE Lim Biow Chuan.

“We would like to call on consumers to be vigilant and exercise caution when they make advance payments. CASE will engage industry stakeholders and governmental agencies to consider targeted prepayment protection measures to protect consumers.”