SINGAPORE: After the cooling measures slapped on in July 2018, many have wondered whether Singapore property remains a good investment bet.

To be sure, the measures targeted speculators and hot foreign money, and aimed to cool speculative sentiments.

Investing in overseas real estate is not traditionally a popular option for investors because managing foreign properties is costly and time-intensive, not to mention the risks of dealing with exchange rate fluctuations.

This explains the “home bias” characteristic of property investments and why investors tend to invest repeatedly in local markets they are familiar with overtime. Hefty transaction costs including stamp duties, legal fees and inspections may deter many from entering into foreign markets.

In recent years, Singapore Government introduced cooling measures to tame the demand for property (File photo: TODAY)

READ: The Big Read — Property cooling measures — examining the case for a ‘sledgehammer’

However, there are upsides to investing in real estate, which usually appreciates in tandem with the country’s economic growth that can hedge against inflation at the very least.

Residential property, as a key pillar of Singapore’s social compact that gives a home-owning population a stake in the country, is also seen as stable and less volatile. It is also a familiar asset class that appeal to different investors from institutional buyers to individuals.

The attractiveness of the Singapore property market also in turn attracts foreign developers wanting a slice of the “pie”.

THE CURIOUS CASE OF CHINESE DEVELOPERS IN SINGAPORE

News over the past few months have raised questions about the role of Chinese developers and investors who have been active in the Singapore property market. On the back of the Hong Kong protests, there are also anecdotal accounts of Hong Kongers exploring new homes and offices in Singapore.

READ: Who’s buying private property after last year’s cooling measures? A commentary

China developers have made in-roads into Singapore’s residential property market as early as 2009, on the back of the economic recovery in the aftermath of the global financial crisis.

In more recent years, the spotlight has been shone on this group, especially after a plot of land at Stirling Road got snapped up for S$1.003 billion in May 2017, in a joint bid by Logan Property, a Hong Kong listed developer founded in Shantou, Guangdong, and the Nanshan Group, a conglomerate headquartered in Longkou, Shandong.

Location of the Stirling Road site. (Photo: URA)

They outbid the second-highest bidder, MCL Land, by S$77 million for the 21,109.5 sq m site. The final price also turned out to be an unusual S$289 million (about 29 per cent) higher than the lowest bid price.

Most recently, another Chinese developer Kingsford Hurray Development acquired Normanton Park in an en bloc sale deal, also at a record-breaking S$830.1 million (excluding the estimated S$231.1 million upgrading premium to top up the lease to 99 years).

Kingsford was later slapped with a “no-sale” restriction on the acquired site by the URA’s Controller of Housing in April. They can commence construction but will not be able to sell units before obtaining a Temporary Occupation Permit (TOP). Concerns about construction quality might have afoot.

This greater interest in Singapore from Chinese developers is in keeping with larger trends of outbound foreign investments from China into local real estate markets. Many Chinese firms are enthusiastic to expand overseas amid a hotly competitive domestic market.

Capital flows by China (inclusive of Hong Kong) into global commercial real estate were estimated at US$31.3 billion in 2017 according to Real Capital Analytics. These investments dipped by 27 per cent in 2018, but remained substantial at US$22.8 billion.

Still, questions about whether aggressive land bidding strategies of Chinese developers will crowd out local developers and push up private residential housing market prices in Singapore remain.

AGGRESSIVE ACQUIRING OF LAND

Chinese developers have been assertive in this recent land bank race, acquiring many government sale sites and en bloc sites.

Normanton Park was sold to Kingsford Huray Development for S$830.1 million, on Oct 5, 2017. (Photo: Knight Frank)

Their forays into Singapore’s property market have no doubt intensified competition in the local residential property market, but it’s useful to keep in mind this highly oligopolistic market that has been dominated by few big developers even before their entry.

The top 10 largest developers took up more than 76 per cent of the market share by the private property sales between 1995 and 2009, estimated in our earlier studies with the University of Irvine’s Edward Coulson and University of Auckland’s Dong Zhi.

The question is a balance. On one hand, healthy competition improves efficiency in price discovery, curbs potential collusion in land sales and encourages competitive land bids. On the other hand, excessive speculation is undesirable, causing unsustainable upward price spirals in the private property market.

As the former President of the Real Estate Developers’ Association of Singapore (REDAS) Augustine Tan said in 2017:

Every piece of land sold sets a benchmark for the next piece of land sale. That is the concern. I fear that land prices will run to a situation that may not be healthy. We may not see it now but in few years’ times we will.

There is evidence of such a dynamic at play.

Based on Government Land Sales and en bloc data from 2009 to 2018, Chinese developers have been found to have bought land at a significant premium of 12.5 per cent relative to local developers, holding other factors such as site attributes and location characteristics constant.

A view of private residential homes and executive condominiums in Singapore. (File photo: Reuters)

Facing intense pressure, local developers have counteracted with similarly aggressive acquisitions in order to retain a firm foothold in the home market.

Fears of fewer land plots on the back of a bullish en bloc market may have driven local developers, such as Sim Lian, to acquire Tampines Court for S$970 million in 2017, and GuocoLand and Hong Leong Group to purchase Pacific Mansion for S$980 million in 2018.

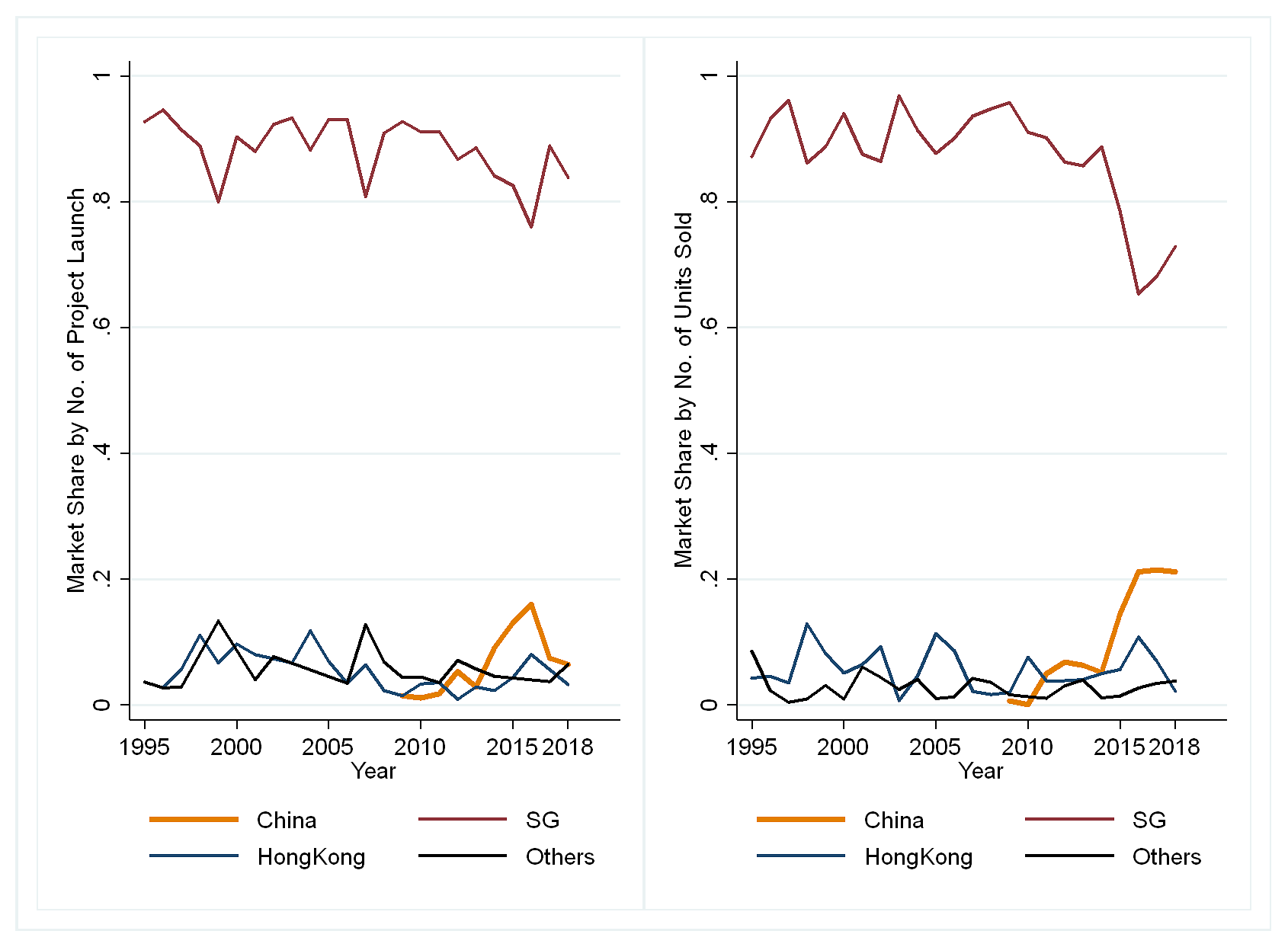

But the high-profile nature of launches by Chinese developers may have obscured a more nuanced picture. The market share of local developers has been hovering around 80 per cent based on market launches – so there is little sign that cash-rich Chinese developers are crowding out local developers.

This is notwithstanding that the number of condominium units sold by Chinese developers in the primary market has seen a surge in the share from 5 per cent in 2011 to 20 per cent since 2015, signifying their expanding influence in recent years.

FOREIGN COMPETITIONS

Two hypotheses may explain the high price premium paid by the Chinese developers.

First, Chinese developers pay higher prices because of information asymmetry, due to the lack of local market knowledge. However, learning through repeated acquisitions may narrow their information disadvantages over time.

Figures of developers’ market share in the Singapore private residential market over the years. The graph on the left shows developer’s market share by number of condominium project launch; while graph on the right is based on the number of units sold in the primary market. (Graphic: Sing Tien Foo, Chia Liu Ee. Source: URA)

Second, Chinese developers are able to keep their construction costs low, such that their profit margin remains intact after paying for high land costs.

In a study with Coulson and Dong, we have found that the most experienced developers can reduce construction costs by harnessing technology and economics of scale. Material and labour costs can be kept low by reducing wastage through effective project management, and by buying material in bulk directly from source countries at lower costs.

While some may have accused Chinese developers of driving up property prices, because they have been purchasing land at a premium, we have found that their new residential property launches sell at 3 per cent lower than those by local developers, controlling for property characteristics, spatial attributes and the timing of property sale.

If these lower prices are the results of competition and increased development efficiency, then the entry of foreign developers into the local property market brings more good than harm to local homeowners.

READ: The Pulse: The outlook for the Singapore private property

However, if lower prices correlate with lower housing quality, then the keen competition in prices may have led to undesirable outcomes. Developers risk damaging their reputation if they resort to lowering construction costs at the expense of shoddy workmanship and cheap material.

ARE FOREIGN INVESTORS PUSHING UP PRICES?

Recent news has also reported the influx of wealthy foreign investors, especially those from China, flocking to Singapore and buying up units in the luxury segment.

READ: Why residential property prices won’t be coming down despite cooling measures, a commentary

Still, these anecdotes seem to be less representative when the data shows that the share of Chinese buyers in foreign buyer transactions in the local property market has been constantly below 4 per cent throughout the years.

There was a small uptick in 2006, but this share reverted in 2013 and 2017 respectively.

Prospective buyers at a condominium showroom. (Photo: TODAY)

Additionally, foreign buyers pay a 2.7 per cent price premium relative to comparable transactions by local buyers. Aside from information disadvantage, the price differential can be explained by the greater liquidity well-heeled foreign investors have.

The uptick in demand for residential property by foreign investors meanwhile have been curbed by the slew of cooling measures since December 2011, and have come under control especially after the Additional Buyers’ Stamp Duty revisions in 2013.

A POSITIVE OUTLOOK AHEAD

Despite foreign competition ramping up prices in the GLS and en bloc markets, there is no evidence showing that high land costs have translated into higher prices in the private property market.

As competition in Singapore’s property market heats up, more local developers are also extending their wings and diversifying their real estate businesses to other foreign markets. Overseas investments by Singapore-based developers have almost doubled from 2013 to 2015 compared to 2010 to 2012.

The entry of foreign developers into the Singapore residential property market may have benefitted average Singaporean private homeowners. The outlook remains positive if innovation and efficiency gains, through the introduction of new smart technologies and fresh housing concepts, can be further realised.

Chia Liu Ee is a researcher and Associate Professor Sing Tien Foo is the Dean’s Chair and the Director of Institute of Real Estate and Urban Studies, NUS.